Accessible Version of PDF: Urban Power Complaint

Document Shortcuts:

Stamped:

2012 MARCH 20 AM 10:27

In the Matter of:

Docket No. E-2012-0003

Respondents:

MORGAN STANLEY SMITH BARNEY LLC,

Administrative Complaint

▲Top of page

I. Preliminary Statement

The Enforcement Section of the Massachusetts Securities Division of the Office of the Secretary of the Commonwealth (the "Enforcement Section" and the "Division," respectively) files this complaint (the "Complaint") in order to commence an adjudicatory proceeding against Urban Power USA, Inc. ("Urban Power") for violations of M.G.L. c. 110A, the Massachusetts Uniform Securities Act (the "Act"), and 950 CMR 10.00 et seq., (the "Regulations"). The complaint is focused on Urban Power's role in the sale ofumegistered securities within Massachusetts.

The Division brings this action as a result of the alleged misconduct by Urban Power and its president & founder Mark Maynard ("Maynard"). Beginning on or around September 2010, Maynard (1) effected general solicitation and sales of unregistered, un-exempt Urban Power securities offerings, (2) authorized agents to do the same, and (3) used materially misleading promotional materials therewith. Urban Power offered $500,000 in over 100,000 shares of equity securities. Urban Power authorized at least six other individuals to solicit these investments without registering with the Division. Urban Power has issued at least 742,400 shares for cash consideration, compensation to employees, legal services, and equipment purchases. These investments were solicited through the Urban Power website, affiliated websites, local newspapers, email, social media such as Facebook, and industry conventions.

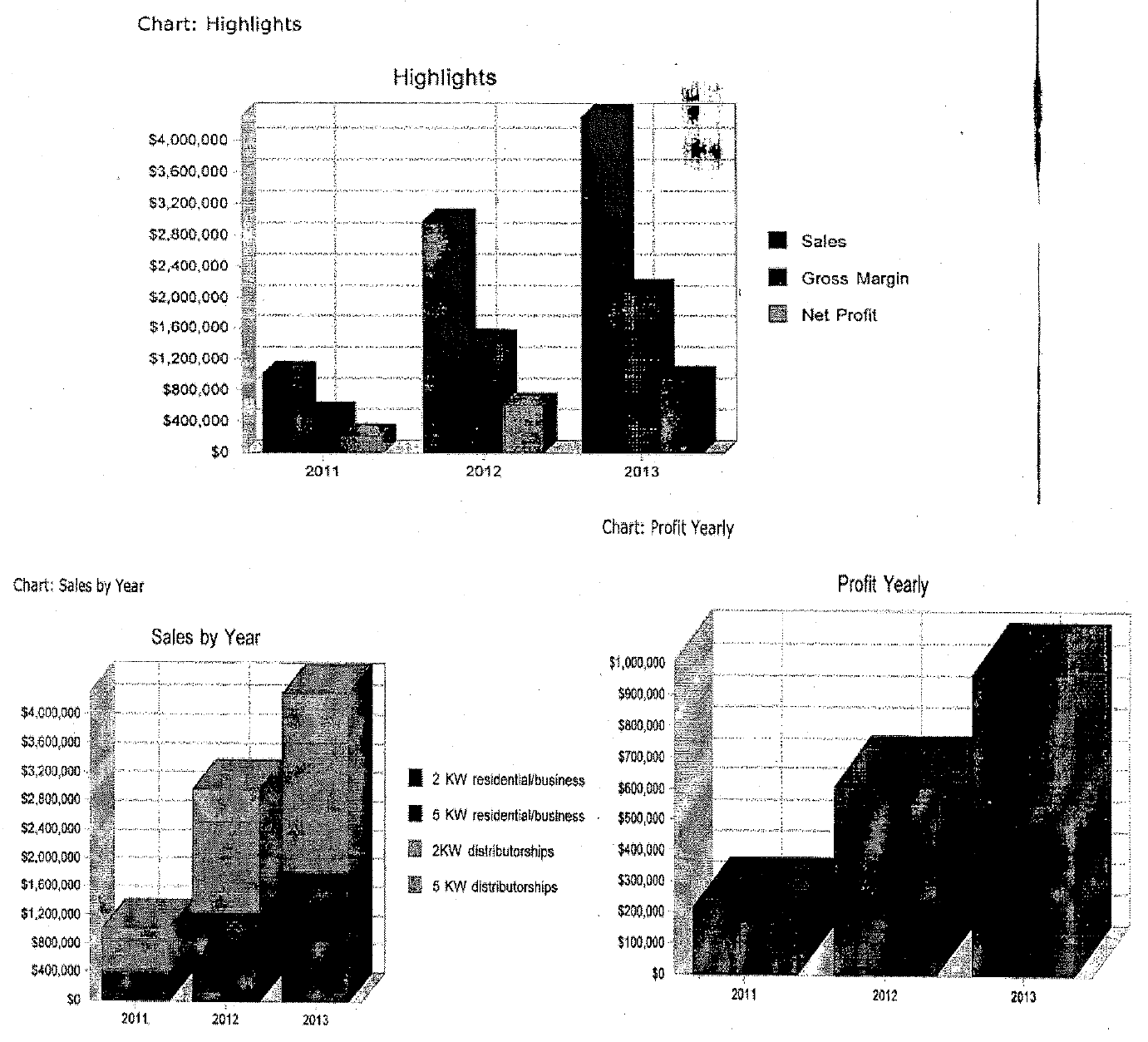

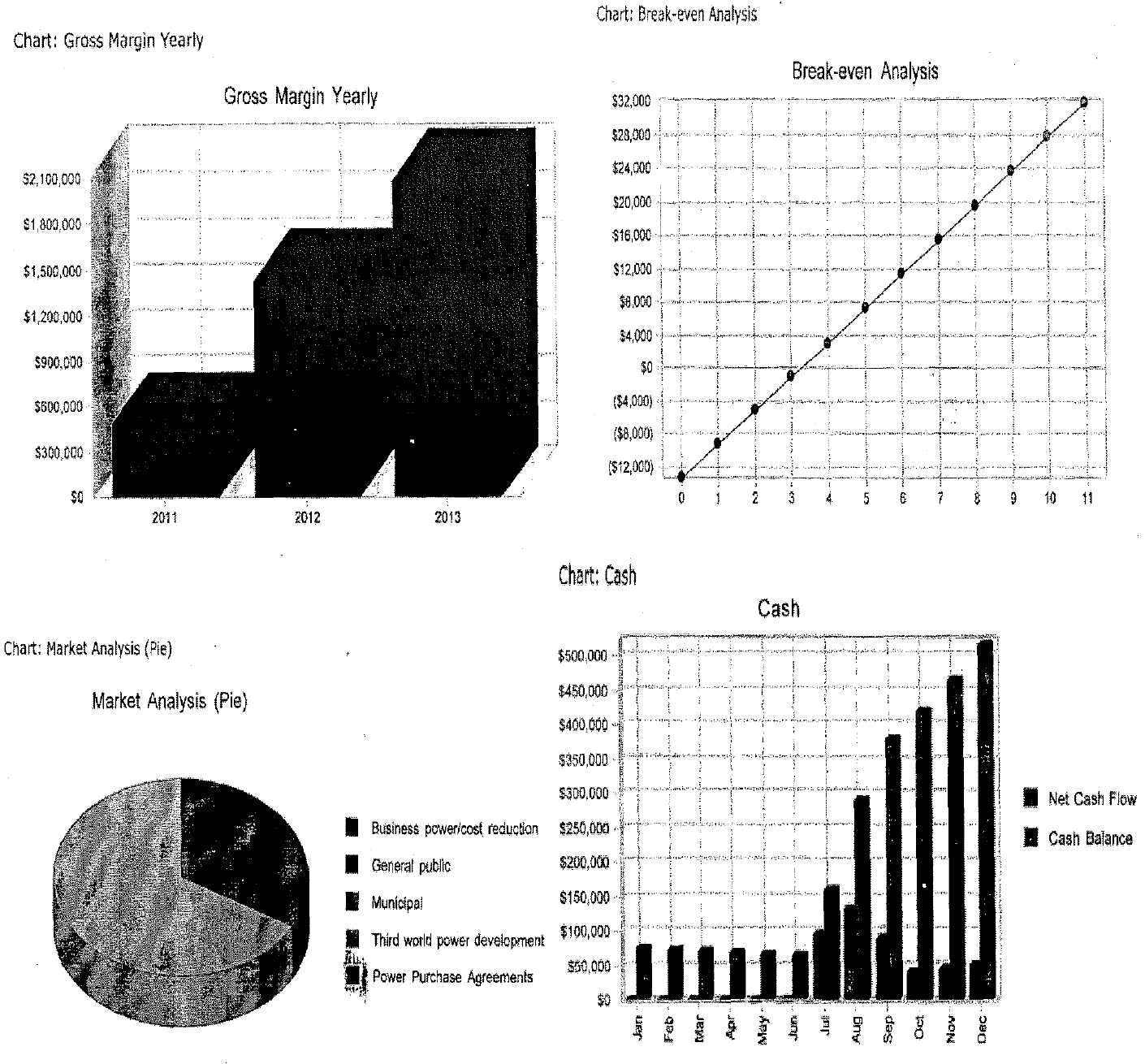

In soliciting these investments, Urban Power touted linearly upward profits and related aggressively optimistic figures without providing any factual support whatsoever. Representations about Urban Power's securities offerings are in large part based on its underlying product, essentially a home-made windmill that generates electricity when mounted on a rooftop. While Urban Power describes its product as low-tech, its promotional materials could lead an investor to believe that these are "revolutionary" alternative green energy products with infinite sales potential and no downsides. As in its Business Plan, "a vibrant, long-term and profitable future exists for any company that can provide a viable wind technology." Forward looking balance sheets and graphical representations show Urban Power as attaining over 162% growth in margins and over $1 million annual profits by 2013. There are no disclaimers or indications that these figures are merely in the hypothetical. There are no citations or references that would substantiate these optimistic representations. Contrary and inconsistent with these representations, Urban Power only sold two wind turbines to date, at a combined price of just $105,000.

The Enforcement Section seeks an order requiring Respondent Urban Power to permanently cease and desist from offering for sale and selling any security in Massachusetts until the security is properly registered or is offered for sale and sold pursuant to an exemption from registration under the Act; requiring Respondent to make rescission offers to all residents of the Commonwealth who purchased securities sold in violation of the Act for each, any and all of the reasons set forth in the complaint; and the Enforcement Section requests that the Director or Hearing Officer take any other necessary action which may be in the public interest and appropriate for the protection of Massachusetts investors.

▲Top of page

II. Jurisdiction

- The Division is a department within the Office of the Secretary of the Commonwealth with jurisdiction over matters relating to securities. The Act authorizes the Division to regulate the offer and sale of securities and those individuals and entities offering and/or selling securities within the Commonwealth of Massachusetts.

- The Division brings this action pursuant to the enforcement authority conferred upon by§ 407 A of the Act and M.G.L. c. 30A, wherein the Division has the authority to conduct adjudicatory proceedings to enforce the provisions of the Act and all Regulations promulgated thereunder.

- This proceeding is brought in accordance with § § 201, 301 and 407 A of the Act and its Regulations. Specifically, the acts and practices constituting violations occurred within the Commonwealth of Massachusetts.

- The Enforcement Section specifically reserves the right to amend this Complaint and/or bring additional administrative complaints to reflect information developed during the current and ongoing investigation.

- Except as otherwise expressly stated, the conduct described herein occurred during the period of September, 2010 up to and including the present.

- Urban Power USA, Inc. ("Urban Power") is a closely held for-profit corporation organized under the laws of the Commonwealth of Massachusetts on September 8, 2010. In its annual reports filed with the Corporations Division of the Secretary of the Commonwealth, Urban Power describes the business of its corporation as "manufacture[ing] alternative energy products." Its principal place of business is identified as 180 Pleasant Street, Easthampton, Massachusetts 01027.

- Mark Maynard ("Maynard") serves as the President, Treasurer, Director, and co-founder of Urban Power. He owns 340,000 shares of Urban Power equity securities, constituting 35% of the shares outstanding. Due to Maynard's controlling interest in Urban Power, "Maynard" and "Urban Power" are at times used interchangeably in this Complaint. Maynard's address is also identified as 180 Pleasant Street, Easthampton, Massachusetts 0 1027.

- Promoter 1 is the co-founder of Urban Power, along with Maynard. Promoter 1 is the wife of Maynard. Promoter 1 serves as the Corporate Secretary and Director of Urban Power. She owns 340,000 shares of Urban Power stock, constituting 35% of the shares outstanding. Webb's business address is identified as 180 Pleasant Street, Easthampton, Massachusetts 01027.

- Promoter 2 is the President of Conservation Solutions Corporation and was retained to perform marketing and promotional services on behalf of Urban Power. Promoter 2's business address is located in Acton, Massachusetts.

- Promoter 3 is the Treasurer of Conservation Solutions Corporation and the wife of Daniel. To Urban Power's knowledge, Promoter 3 assisted Promoter 2 with offering securities of Urban Power. Promoter 3' s business address is located in Acton, Massachusetts.

- Promoter 4 is an entrepreneur and is a neighbor of Maynard. From approximately November 30, 2009 to August 17, 2010, Promoter 4 promoted the services and investments of Urban Power. Promoter 4's address is located in Easthampton, Massachusetts.

- Promoter 5 is the President of Lockwood Solutions and was retained to perform marketing and promotional services on behalf of Urban Power. Promoter S's address is located in Greenfield, Massachusetts.

- Promoter 6 is the President of Human Error Publishing and was retained to perform marketing and promotional services on behalf of Urban Power. Promoter 6's address is located in Wendell, Massachusetts.

- On or about October 20, 2010, the Division was alerted by another state regulator, the Pennsylvania Securities Commission ("PSD"), regarding Maynard and Urban Power. PSD issued a Cease and Desist Order against Maynard and Urban Power on October 19, 2010 for its umegistered, unexempt securities offerings directed at Pennsylvania residents. [Exhibit 1, Penn C&D]

- In Massachusetts, Urban Power never filed an application for the registration of securities to be offered and/or sold, either with the Division or with the United States Securities & Exchange Commission.

- Urban Power never filed a notice of exemption from registration for securities to be offered and/or sold in Massachusetts either with the Division or with the United States Securities & Exchange Commission.

- Notwithstanding the above, Urban Power admits that it has been offering and selling securities within the Commonwealth of Massachusetts.

- Urban Power's website has published an article dated February 10, 2010 stating the

following:

- "Maynard and his business partners, REDACTED and REDACTED, are seeking

investors to fund the production of [Urban Power] turbines. Maynard ... is speaking to

several investors."

[Exhibit 2, http://www.urbanpowerusa.com/News.html (redacted)]

- According to its own website, Urban Power offered securities to the general public.

- On July 6, 2011, Urban Power's website Contact Form generated the following email:

"------- Original Message --------

Subject: Contact Form.

From: wst formmailer@secureserver.net

Date: Tue, July OS, 2011 2:30 pm

To: UrbanpowerUSA@urbanpowerUSA.com

First Name: REDACTED

Last Name: REDACTED

Address Street 1 : REDACTED

Address Street 2 : REDACTED

City: REDACTED

Page 4 of5

1/3/2012

Zip Code: REDACTED

State: REDACTED

Daytime Phone: REDACTED

Evening Phone:

Email: REDACTED

Comments: I saw something about $50k

investment at $5.00 a share. Could you send me

infomration (sic) about this? Thanks."

[Exhibit 3, Emails, at 22 (redacted)]

- The format of the information in said email is an exact match of the fillable fields of the

Contact Form found on Urban Power's website.

- [Exhibit 4, http://www.urbanpowerusa.com/Contact.html]

- Said Contact Form located on Urban Power's website is set out as follows:

[Exhibit 4, http://www.urbanpowerusa.com/Contact.html] Contact Information: Please complete the fields below, fill in comments so we can appropriately respond to your inquiry within three to five business days ..

- A third party website states on behalf of Urban Power:

"For more information on investing, purchasing [Urban Power] wind turbines and/or

becoming a distributor, please be in touch with us through our Contact Us page!."

[Exhibit 5, http://www.pvlocalfirst.org/businesses/urban-power-usa] - Said website directs investors to Urban Power Form page by hyperlinking the "Contact

Us" text to Urban Power's Contact Form webpage.

[See Exhibit 4, http://www.urbanpowerusa.com/ Contact.html] - As such, Urban Power offered securities to the general public through its website.

- On October 24, 2011, Maynard stated in an email to a prospective investor:

- "I have reserved room for ten investors in this offering with about twenty

remaining for a future offering when the stock is worth more. We have six slots still

available in this offering because investors have come in with more than $50,000."

[Exhibit 3, Emails, at 15]

- As such, Urban Power offered securities to the general public through its email.

- On November 7, 2011, Maynard stated in an email to a prospective investor:

- "we are all set for the stock transaction ... on another note we had a booth at the

Sun and Wind Expo last weekend. Urban Power USA did unbelievably well. We

literally have several hundred leads with a large percent of them have already

scheduled an appointment."

[Exhibit 3, Emails, at 17]

- As such, Urban Power offered securities to the general public through its email.

- As such, Urban Power offered securities to the general public at an industry convention.

- On August 17, 2010, an article published on a website by two third parties stated:

"Urban Power USA is actively seeking both investors and a local business with appropriate rooftop space available to further test the potential of its products--offering to 'make significant financial considerations in return for collected data and testimony of performance.' ... For more on Urban Power USA, its products and plans for the future, visit www.urbanpowerusa.com."

- As such, Urban Power offered securities to the general public through affiliated websites.

- Urban Power has not produced any evidence of limiting its solicitations to accredited investors, qualified investors, or sophisticated investors.

- As such, Urban Power did not limit its securities offerings to accredited investors, qualified investors, or sophisticated investors.

- Urban Power has not produced any evidence providing for the investment objectives, risk tolerance, income needs, or loss aversion of investors it solicited.

- As such, Urban Power did not analyze whether its securities offerings were suitable investments for the investors solicited.

- Urban Power admits to using a Facebook account to offer securities, with its last posting dated as 10:33am on April 1, 2011.

- Said Facebook account was located at https://www.facebook.compages/Urban- Power-USA/322054373276.

- Said Facebook account has since been deleted.

- As such, Urban Power offered securities to the general public through a Face book account.

- As of March 14, 2012, Urban Power has maintained an account at "Younoodle," a networking website matching investors to start-up companies, self described as: "On YouNoodle you can plug in to the global grid of entrepreneurs. You can

share your startup, be inspired by others, connect with co-founders, or find the

opportunity of a lifetime."

[Exhibit 7, http://www.younoodle.com/static/about] - Urban Power's Younoodle account profile is as follows:

"Startup type: Company

Status: Active

Stage: Beta

Publicity: Open to speaking to journalists.

Funding: Angel, Debt finance, Institutional investor, Self-funded, Venture capital firm

Industries: Cleantech

Location: Easthampton, MA O 1027

Website: http://urbanpowerusa.com"

[Exhibit 7, http:/ /www.younoodle.com/startups/urban power_ usa] - Said Younoodle account listed Mark Maynard as one of the "Team Members." [Exhibit 7, http://www.younoodle.com/people/mark_maynard]

- As such, Urban Power offered securities to the general public through Y ounoodle, a social media platform matching investors to start-up companies.

- Maynard maintained an account at Go BIG Network, an investment matching website,

self described as:

- "Go BIG helps entrepreneurs through the entire fundraising process from creating

a capital raising strategy to preparing their information to identifying the right capital

sources."

- [Exhibit 8, http://www.gobignetwork.com/info/how-it-works]

- Said Go BIG Network account has been deleted, though the internet address remains at https :/ /www. go bignetwork. com/users/mark-maynard.

- As such, Urban Power offered securities to the general public through Go BIG Network, a social media service matching investors to start-up companies

- According to the "Urban Power USA Business Plan" ("Business Plan") dated July 2011,

the Executive Summary states:

"[t]he company will be seeking to raise approximately $500,000 from private investors for 100,000 shares of common stock to expand operations." [Exhibit 9, Business Plan, at 4]

- On July 6, 2011, Maynard emailed a prospective investor,

"[w]e have a current offering for 10 units of 10,000 shares each, for a total of 100,000 shares of Urban Power USA common stock. Each unit of 10,000 shares is offered @ 5 .00 per share of equity investment for a total of $50,000 per unit. Each unit presents 1 % of the total company stock authorized but not all of the stock has been issued. If you are interested in investing I would be happy to send you a current business plan."

[Exhibit 3, Emails, at 22]

- On August 22, 2011, Maynard emailed another prospective investor,

"We have a current offering for 10 units of 10,000 shares each, for a total of 100,000 shares of Urban Power USA common stock. Each unit of 10,000 shares is offered at $5.00 per share of equity investment for a total of $50,000 per unit."

[Exhibit 3, Emails, at 5]

- The August 22, 2011 email offer was accompanied by the Business Plan.

[Exhibit 3, Emails, at 6]

- The August 22, 2011 offer was accepted and 10,000 shares were sold at $50,000 in

December of 2011.

[Exhibit 10, Stock Agreements, at 9]

- As such, the Business Plan was used as the offering prospectus and disclosure document for Urban Power's offer and sale of common stock.

- On December 14, 2010, Investor 11 purchased 10,000 shares of Urban Power common

stock for $50,000.

[Exhibit 10, Stock Agreements, at 3]

- On April 5, 2011, Investor 2 received 2,000 shares of Urban Power common stock in

exchange for a $10,000 reduction in the price of a plasma cutting table sold to Urban Power.

[Exhibit 10, Stock Agreements, at 7]

- On July 27, 2011, Investor 3 received 1,000 shares of Urban Power common stock as

compensation for "time and effort."

[Exhibit 10, Stock Agreements, at 8]

- On July 27, 2011, Investor 4 received 1,000 shares of Urban Power common stock as

compensation for "time and effort."

[Exhibit 10, Stock Agreements, at 8]

- On July 1, 2011, Urban Power's legal counsel received 38,400 shares of Urban Power

common stock as compensation for legal services rendered or to be rendered in the amount of

$192,000.

[Exhibit 10, Stock Agreements, at 13-16]

- On July 1, 2011, Urban Power's legal counsel received an option to purchase 30,000

shares of Urban Power common stock at $5 per share, good for three years, as compensation for

legal services rendered or to be rendered.

[Exhibit 10, Stock Agreements, at 13-16]

- On July 1, 2011, the firm where legal counsel practices law, received an option to swap

the cost oflegal services at the rate of $250.00 per hour in exchange for up to 25,000 shares of

Urban Power common stock at $5 per share, good for three years, as compensation for legal

services rendered or to be rendered.

[Exhibit 10, Stock Agreements, at 13-16]

- On December 22, 2011, Investor 5 tendered cash consideration on in the amount of

$50,000 for 10,000 shares of Urban Power common stock. However, due to notice to Urban

Power that the Division is investigating its umegistered activities, said consideration has not

been accepted by Urban Power, pending closure of this investigation.

[Exhibit 10, Stock Agreements, at 9-11]

- Urban Power has never filed an application for the registration of statutory agents in Massachusetts.

- Maynard was not regist~red in Massachusetts as a broker-dealer, an agent of a brokerdealer or an issuer agent, an investment adviser or an investment adviser representative, or in any other capacity in the securities business in the Commonwealth during the Relevant Time Period.

- Maynard promoted Urban Power's securities offerings.

- Promoter 1 was not registered in Massachusetts as a broker-dealer, an agent of a brokerdealer or an issuer agent, an investment adviser or an investment adviser representative, or in any other capacity in the securities business in the Commonwealth during the Relevant Time Period.

- According to Urban Power, Promoter 1 manages Urban Power's website.

- Promoter 1 promoted Urban Power's securities offerings.

- Promoter 2 was not registered in Massachusetts as a broker-dealer, an agent of a brokerdealer or an issuer agent, an investment adviser or an investment adviser representative, or in any other capacity in the securities business in the Commonwealth during the Relevant Time Period.

- According to Urban Power, Urban Power plans on compensating Promoter 2 through stock issuances, based on the number of investors he generates.

- Promoter 2 promoted Urban Power's securities offerings.

- Promoter 3 was not registered in Massachusetts as a broker-dealer, an agent of a brokerdealer or an issuer agent, an investment adviser or an investment adviser representative, or in any other capacity in the securities business in the Commonwealth during the Relevant Time Period.

- To the best of Urban Power's knowledge, Promoter 3 assisted Promoter 2 with offering securities of Urban Power.

- Promoter 3 promoted Urban Power's securities offerings.

- Promoter 4 was not registered in Massachusetts as a broker-dealer, an agent of a brokerdealer or an issuer agent, an investment adviser or an investment adviser representative, or in any other capacity in the securities business in the Commonwealth during the Relevant Time Period.

- According to Urban Power, Promoter 4 entered into a written agreement with Urban Power to commercialize its wind turbine, including offering securities of Urban Power.

[Exhibit 10, Stock Agreements, at 2

- As such, Promoter 4 promoted Urban Power's securities offerings.

- Promoter 5 was not registered in Massachusetts as a broker-dealer, an agent of a brokerdealer or an issuer agent, an investment adviser or an investment adviser representative, or in any other capacity in the securities business in the Commonwealth during the Relevant Time Period.

- According to Urban Power, Urban Power plans on compensating Promoter5 through stock issuances, based on the number of investors he generates.

- As such, Promoter 5 promoted·Urban Power's securities offerings.

- Promoter 6 was not registered in Massachusetts as a broker-dealer, an agent of a brokerdealer or an issuer agent, an investment adviser or an investment adviser representative, or in any other capacity in the securities business in the Commonwealth during the Relevant Time Period.

- According to Urban Power, Urban Power plans on compensating Promoter 6 through stock issuances, based on the number of investors he generates.

- As such, Promoter 6 promoted Urban Power's securities offerings.

- As previously outlined, the Business Plan was used as the offering prospectus and disclosure document for Urban Power's offer and sale of common stock.

- As such, the Business Plan is the investor's primary source of information on Urban Power products and profits.

- For instance, Maynard relies on the Business Plan to inform investors about Urban

Power's securities,

"with respect to the projections of value of your stock, the projection is based on the business plan and a $50,000 investment."

[Exhibit 3, Emails, at 18]

- As such, investors rely on the Business Plan for its accuracy, completeness, and truthfulness in its representations.

- The Business Plan contains material representations about Urban Power's wind turbine

capabilities, promising that the turbine, o_nce installed, will generate electricity and can

ultimately save energy or be sold as trade-able credits or cash proceeds.

[See Exhibit 9, Business Plan, at 17]

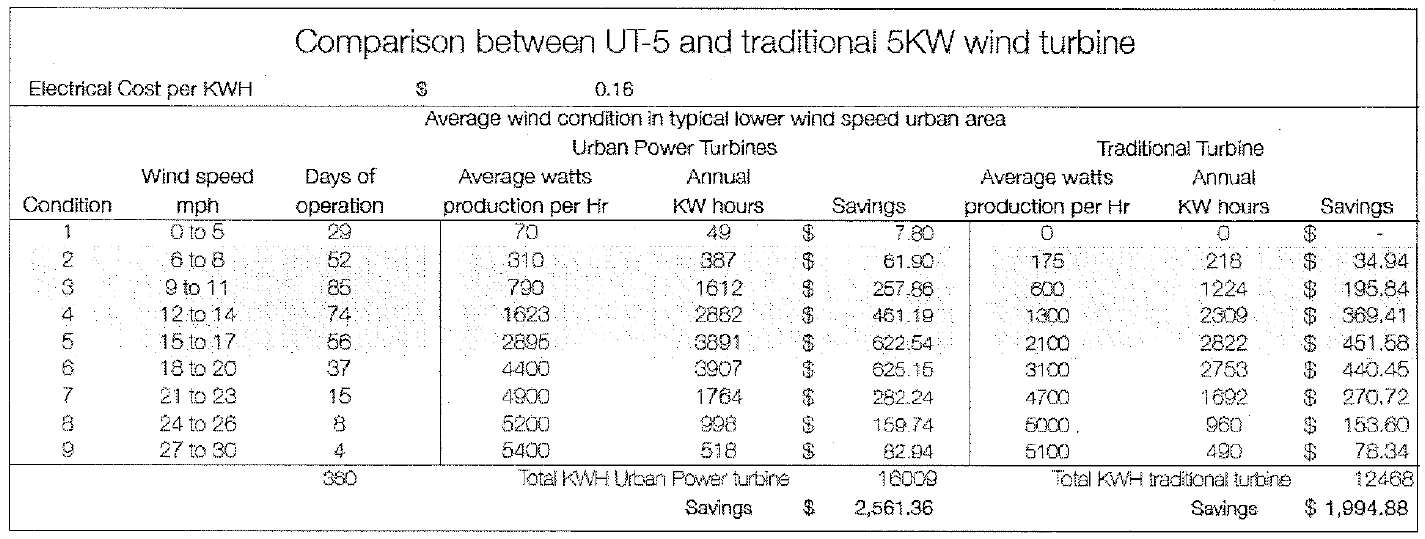

- Based on the turbine's purported ability to generate electricity, the Business Plan promises that the wind turbine will give purchasers "payback in 3 years" and an average of"4 to 7 years return on investment." The following are examples of the representations and projections stated:

- "The turbines have a useful life-span of more than 40 years."

- "In low-wind city environments, our turbines will outperform all traditional turbines of equivalent rated output."

- "we have the most environmentally friendly turbines in the world and one of the fastest paybacks in the industry."

- "Urban Power USA turbines have the longest useful life of all alternative energy products."

- "there is no reason to conduct expensive environmental testing or worry about harming local bird or bat populations because there is no danger to wildlife. Birds can easily see and avoid the turbines."

[Exhibit 9, Business Plan, at 8-10, 14, and 16]

- Wind turbine capabilities are depicted in a detailed and convincing fashion through

various tables, charts, and graphs. Two such tables are reproduced below:

Typical 5kw Wind Energy Project Estimated kWh Produced

22,8361

Estimated Installed Cost

$28,500.00

Estimated State Incentives

$1,000.00

Estimated Federal Incentives $8,550.00 (30%)

$8,550.00

Estimated Net Cost

$18,950.00

Estimated Annual Energy Produced @ $0.16/kWh:

$3,653.76

Renewable Energy Credits (RECS) @ $0.02/kWh/vr

$456

Payback (yrs)

2.51

ROI

39.8%

Estimated 10 Year Cash Flow

$56,408.80

[Exhibit 11, http://issuu.com/highprofile/docs/highprofilemonthlygreen2011/1 ?mode=a_p at page 6]

- These representations are not accompanied by citations of authority or research, any qualifiers, indications of a hypothetical case, or disclaimers on their purported veracity in any way.

- These detailed representations would affect a reasonable investor's decision making process.

- Despite the Division's subpoena request, Urban Power failed to furnish any basis for the material representations about its wind turbine capabilities.

- Additionally, the Business Plan contains material representations about Urban

Power's current and future profitability as a company ("Business Projections"). The

following are examples of such representations:

- Urban Power expects "conservative 45% growth rate across the product line."

- Sales in years 2011, 2012, and 2013 are projected to be $1 million, $2.9 million, and $4.2 million, respectively.

- Profit in years 2011, 2012, and 2013 are projected to be $200,000, $600,000, and $1 million, respectively.

[Exhibit 9, Business Plan, at 17, 18, 23,and 24]

- Inconsistent with the foregoing representations, Urban Power has had only two buyers of its wind turbines since its inception: Buyer 1 and Buyer 2, in sum total of contractual amount owed in $80,500 and $24,500, respectively.

- The Business Projections represents that "Urban Power USA has been very well received in Third World Nations." It projects sales growth in "third world" to be over 162% from 2011 to 2013.

- Inconsistent with the foregoing representation, Urban Power did not produce any evidence of sales to any foreign purchasers.

- The Business Projections state in its proforma cash flow statement that the month of December 2011 Net Cash Flow is $51,622 and 2011 year end Cash Balance is $516,581.

- Inconsistent with the foregoing representation, Urban Power's bank statement at "Bank X" held a total balance of$22,189.16 as of month end December 2011.

- The Business Projections are illustrated variously as tables, charts, and graphs. The following are examples of the representations and projections stated:

- These Turbine and Business Projections are reproduced both in PowerPoint slides shown to potential investors and in PDF presentations available publically on various websites hosted by Urban Power affiliates.2

2 http://www.conservationsolutions.com/assets/files/1-6-l2-UT-5KW-datasheet.pdf;

- http://www.conservationsolutions.com/assets/files/1-3 l -l 2-Urban-Power-UT-2KW-Datasheet-2.pdf;

- http://www.manufacturersmart.com/ c gibin/ newsscript.pl?record=34l;http://issuu.com/highprofile/docs/highprofilemonthlygreen2011/1 ?mode=a _p at page 6; 97;

- http://www.valleyadvocate.com/article.cfin?aid=12208;

- http://www.previewma.com/article.cfm?aid=l2208;

- Regarding the basis in arriving at these Projections, the Division specifically subpoenaed

the following:

- "3. Please describe the basis on which Urban Power has arrived at cost, savings, and

profit projections of its (i) products and services & (ii) financial statements." (emphasis

added)

- Urban Power responded to the above as follows:

"RESPONSE:

Urban Power USA, Inc. has not arrived at a final cost, savings and profit projection determination relative to its products and services and financial statements. Notwithstanding this, Urban Power USA, Inc. expects a five and a half (5½) year time period until profit and/or payback is received, and will at that time receive seventy percent (70%) of any profits. For more information, please refer to the initial test results and business plan of Urban Power USA, Inc., which are attached hereto as Exhibit 'F' ." ( emphasis added).

- As directed, Exhibit F merely refers to a copy of the Business Plan and engages in circular reasoning. As stated, the Business Plan contains no basis for these material representations whatsoever.

- The Business Plan and other Urban Power promotional materials do not contain indications that either its turbine capabilities or its business projections are merely in the hypothetical.

- The Business Plan and other Urban Power promotional materials do not contain risk disclosures or disclaimers that figures used may overestimate actual performance.

- The Business Plan does contain a "Weakness" portion, stating:

"5.1.2 Weaknesses

Urban Power USA is new to manufacturing and lacks the experience and knowledge of years of manufacturing. Having the knowledge of the best current manufacture techniques and technology is critical in being successful.

Urban power USA turbines are not as efficient traditional air foil turbines in higher winds. Because of this our turbines are larger in size to produce the same amount of power. We have a newer design so there is not an established network of user data available to support performance."

-

[Exhibit 9, Business Plan, at 16]

- The said "Weakness" portions as stated above makes material omissions because it fails to address any substantive weakness of Urban Power.

- Throughout the Business Plan, only scant evidence pointing to Urban Power's potential

inadequacies can be found, such as the following:

- "To date lack of funding has prevented this process from going forward."

- "The biggest threat to Urban Power USA is the lack of financing. Because of poor funding, choices have to be made to conserve funds that may not be in the best interest of Urban Power USA."

- "Income from sales and capital funding will be required to accomplish these goals."

- [Exhibit 9, Business Plan, at 15, 17, and 20]

- Inconsistent with these statements, the inadequacies as stated are buried within the remaining 34 pages of sheer optimism, sales pitch language, and linearly upward trajectories. Inundated and contradicted by vast majority of the Business Plan, these statements are insufficient in disclosing material risks to investors.

- Incorporating the inconsistencies pointed out previously, the Business Plan makes material omissions about Urban Power's actual business performance, which would utterly deflate and contradict its baseless projections.

- The only authorities that the Business Plan makes reference to are generic statistics and

blanket statements regarding the wind power industry, for instance asserting the following:

- "The alternative wind energy market is one of the most promising long term markets that exist. Projected growth over the next 5 years is 3000%."

- "The industry projects 30-fold growth within as little as five years, despite a global recession, for a cumulative U.S. installed capacity of 1,700 MW by the end of2013."

- "One of the most persuasive reasons why wind turbines are expected to continue their strong growth rate for decades to come is their cost per kWh of energy produced is expected to be he cheapest source of energy. In 2008, 25,000 megawatts (MW) of turbines were installed bringing world wide capacity to 120,000 MW. Modem large MW size wind turbines are selling for around $1.5 million per MW. At this price, over $100 billion in wind turbine technology is expected to be sold in 2013."

- "For the next twenty years, it is expected to expand at double-digit rates. The US Dept. of Energy, the American Wind Energy Association (A WEA), and the I National Renewable Energy Laboratory believe that 20% of the nation's electricity can come from renewable wind energy within the next twenty years. This would result in cumulative wind turbine sales of over $250 billion."

- "The simplicity of the turbine also lends itself to opportunities in third world nations ... Many third world nations do not have the labor force with specialized skill sets ... The Urban Power USA turbine on the other hand is easily install (sic) and maintained by ordinary skill sets."

- [Exhibit 9, Business Plan, at 10, 13, and 16]

- Without any proven connection to Urban Power, these generic statements are nonsequiturs and baseless puffery, serving to materially mislead investors into believing that Urban Power is destined for success

- Supplemental publications such as PowerPoint slides shown to investors depict the

apparent feasibility of large scale turbines up to the size of airplane hangers, stating "large

Megawatt size turbines will use traditional transmission lines."

Large Megawatt size turbines will use traditional transmission lines - Urban Power USA - The purpose of a feasibility assessment is to reduce the technical, financial, operational, and environmental risks of a potential project.

- A feasibility assessment requires going through a

particular project concept; identifying the technical,

financial, operational, and environmental

uncertainties and impacts; and finally making a

determination regarding the project's viability.

Exhibit 15, PowerPoints, at 38 and 43

- The PowerPoint depictions appear to be created from superimposed photographs. And while contemplating a "feasibility assessment," no evidence of an actual assessment is provided. These depictions do not disclaim or qualify the hypothetical and untested nature of these implementations. Therefore, while generating an appearance or possibility of feasibility, these slides provide no basis in support thereof.

- Inconsistent with Urban Power's representations which appear to be factual on its face, a closer look reveals that Urban Power only alludes to future data collection, experiments, research, or aspirations thereof:

- "Future sales will use the data collected from installed turbines to capitalize on the fast return on investment realized from these turbines."

- "The communication market is already under way with potential trials in the near future. Positive trials should lead to significant orders."

- "We have a newer design so there is not an established network of user data available to support performance."

- "Our goal is to establish test projects in each of our focus market areas and then use the successes to build new sales."

- "There is no reason to conduct expensive environmental testing."

- "It is important we begin aggressively researching the next generation turbine to offer customers."

- "Research and technology will be financed with cash flow."

- As such, Urban Power's representations are built upon supposition and fueled by speculation.

- Incorporating paragraphs 1 through 114, Urban Power used materially misleading promotional materials in connection with the offer and sale of securities.

- Section 301 of the Act provides in pertinent part:It is unlawful for any person to offer or sell any security in the commonwealth unless:

- the security is registered under this chapter;

- the security or transaction is exempted under section 402; or

- the security is a federal covered security.

- The Division herein re-alleges and restates the allegations and facts set forth in paragraphs 1 through 115 above.

- The conduct of Respondent Urban Power, as described above, constitutes a violation of M.G.L. c. 110A, § 301.

- Section 201 of the Act provides in pertinent part:

(a) It is unlawful for any person to transact business in this commonwealth as a broker-dealer or agent unless he is registered under this chapter.

(b) It is unlawful for any broker-dealer or issuer to employ an agent unless the agent is registered.

- The Division herein re-alleges and restates the allegations and facts set forth in paragraphs 1 through 115 above.

- The conduct of Respondent Urban Power, as described above, constitutes a violation of M.G.L. c. 110A, § 201(a).

- Section 201 of the Act provides in pertinent part:

- (b) It is unlawful for any broker-dealer or issuer to employ an agent unless the

agent is registered.

- The Division herein re-alleges and restates the allegations and facts set forth in paragraphs 1 through 115 above.

- The conduct of Respondent Urban Power, as described above, constitutes a violation of M.G.L. c. 110A, § 201(b).

- Violations, Cease and Desist Orders and Costs

- Section 407 A(a) of the Act provides in pertinent part that:

(a) If the secretary determines, after notice and opportunity for a hearing, that any person has engaged in or is about to engage in any act or practice constituting a violation of any provision of this chapter or any rule or order issued thereunder, he may order such person to cease and desist from such unlawful act or practice and may take affirmative action, including the imposition of an administrative fine, the issuance of an order for accounting, disgorgement or rescission or any other relief as in his judgment may be necessary to carry out the purposes of [the Act].

- The Division herein re-alleges and restates the allegations and facts set forth in paragraphs 1 through 114 above.

- Respondent Urban Power directly and indirectly engaged in the acts, practices, and courses of business as set forth in this Complaint above and it is the Division's belief that Respondent will continue to engage in acts and practices similar in subject and purpose which constitute violations if not ordered to cease and desist.

▲Top of page

III. Relevant Time Period

▲Top of page

IV. Respondent

▲Top of page

V. Other Involved and Related Parties

▲Top of page

VI. Allegations of Fact

General Soliciation

Social Media

Offering $500,000 of Common Stock

Securities Sold

1 Investor information has been withheld to preserve the privacy of Massachusetts residents.

Unregistered Solicitors

Baseless Representations

[Exhibit 13, Turbine Purchase Agreements]

[Exhibit 9, Business Plan, at 11, 12, and 15-17]

[Exhibit 9, Business Plan, at 33]

[Exhibit 14, Bank Statement]

1.0 Executive Summary

Urban Power USA is a manufacturing company formed In September of 2010, to a revolutionary wind turbine. Our manufacturing and research facility is located In Easthampton, MA USA. The company will be seeking to raise approximately $500,000 from private Investors for 100,000 shares of common stock to expand operations.

Table: Market Analysis

- |

- |

2011 |

2012 |

2013 |

2014 |

2015 |

- |

|---|---|---|---|---|---|---|---|

- |

Growth |

- |

- |

- |

- |

- |

CAGR |

- |

200% |

500 |

1,500 |

4,500 |

13,500 |

40,500 |

200% |

- |

30% |

1,000 |

1,300 |

1,690 |

2,197 |

2,856 |

30% |

- |

100% |

500 |

1,000 |

2,000 |

4,000 |

8,000 |

100% |

- |

200% |

2,000 |

6,000 |

18,000 |

54,000 |

162,000 |

200% |

- |

20% |

500 |

600 |

720 |

864 |

1037 |

20.01% |

Total |

162.72% |

4,500 |

10,400 |

28,910 |

74,561 |

214,393 |

162.72 |

Table: Sales Forecast

| 2011 | 2012 | 2013 | |

|---|---|---|---|

| Unit Sales | |||

| 2 KW residential/business | 36 | 104 | 151 |

| 5 KW residential/business | 5 | 15 | 21 |

| 2 KW Distributorships | 71 | 206 | 299 |

| 5 KW Distributorships | 11 | 32 | 46 |

| Total Unit Sales | 123 | 357 | 517 |

| Unit Prices | |||

| 2 KW residential/business | $9,000 | $9,000 | $9,000 |

| 5 KW residential/business | $21,500 | $21,500 | $21,500 |

| 2 KW Distributorships | $6,000 | $6,000 | $6,000 |

| 5 KW Distributorships | $15,000 | $15,000 | $15,000 |

| Sales | |||

| 2 KW residential/business | $324,000 | $936,000 | S1,359,000 |

| 5 KW residential/business | $107,500 | $322,500 | $451,500 |

| 2 KW Distributorships | $426,000 | $1,236,000 | $1,794,000 |

| 5 KW Distributorships | $165,000 | $480,000 | $690 |

| Total Unit Sales | $1,022,500 | $2,974,500 | $4,294,500 |

| Direct Unit Cost | |||

| 2 KW residential/business | $3,330 | $3,330 | $3,330 |

| 5 KW residential/business | $10,105 | $10,105 | $10,105 |

| 2 KW Distributorships | $3,330 | $3,330 | $3,330 |

| 5 KW Distributorships | $10,102.50 | $10,102.50 | $10,102.50 |

| Direct Cost of Sales | |||

| 2 KW residential/business | $119,880 | $346,320 | $502,830 |

| 5 KW residential/business | $50,525 | $151,575 | $212,205 |

| 2 KW Distributorships | $236,430 | $685,980 | $995,670 |

| 5 KW Distributorships | $111,128 | $323,280 | $464,715 |

| Subtotal Direct Cost of Sales | $517,963 | $1,507,155 | $2,175,420 |

Table: Cash Flow (Pro Forma Cash Flow)

| 2011 | 2012 | 2013 | |

|---|---|---|---|

| Cash Received | |||

| Cash From Operations | |||

| Cash Sales | $1,022,500 | $2,974,500 | $4,294,500 |

| New Current Borrowing | $1,022,500 | $2,974,500 | $4,294,500 |

| Additional Cash Received | |||

| Sales Tax, VAT, HST/GST Received | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 |

| New Other liabilities (Interest Free) | $0 | $0 | $0 |

| New Long Term Liabilities | $0 | $0 | $0 |

| Sales of Other Current Assets | $0 | $0 | $0 |

| Sales of Long Term Assets | $0 | $0 | $0 |

| New Investment Received | $45,000 | $0 | $0 | Subtotal Cash Received | $1,067,500 | $2,974,500 | $4,294,500 |

| Expenditures | 2011 | 2012 | 2013 |

| Expenditures From Operations | |||

| Cash Spending | $100,944 | $396,000 | $485,000 |

| Bill Payments | $480,299 | $2,934,091 | $2,540,978 |

| Sub-total Spent on Operations | $581,243 | $3,330,091 | $3,025,978 |

| Additional Cash Spent | |||

| Sales Tax VAT HST/GST Paid Out | $0 | $0 | $0 |

| Principal Repayment of Current Borrowing | $0 | $0 | $0 |

| Other Liabilities Principal Repayment | $0 | $0 | $0 |

| Long Term Liabilities Principal Repayment | $0 | $0 | $0 |

| Purchase Other Current Assets | $0 | $0 | $0 |

| Purchase Long-term Assets | $45,000 | $0 | $0 |

| Dividens | $0 | $0 | $0 |

| Subtotal Cash Spent | $626,243 | $3,330,091 | $3,025,978 |

| |

|||

| Net Cash Flow | $441,257 | ($355,591) | $1,266,522 |

| Cash Balance | $516,581 | $160,990 | $1,429,513 |

7.5 Projected Balance Sheet:

As shown in the Balance sheet in the following table, our net worth will grow from approximately $274,000 to more than $1,800,000 by the end of 2013.

Table: Balance Sheet (Pro Forma Balance Sheet)

| 2011 | 2012 | 2013 | |

|---|---|---|---|

| Assets | |||

| Current Assets | |||

| Cash | $516,581 | $160,990 | $1,429,513 |

| Inventory | $110,343 | $1,177,751 | $4,294,500 |

| Other Current Assets | $20,000 | $20,000 | $20,000 |

| Total Current Assets | $646,924 | $1,358,741 | $2,292,778 |

| Long Term Assets | |||

| Long Term Assets | $46,765 | $46,765 | $46,765 |

| Accumulated Depreciation | $3,450 | $10,450 | $22,450 |

| Total Long Term Assets | $43,315 | $36,315 | $24,315 |

| Total Assets | $690,238 | $1,395,055 | $2,317,092 |

| Liabilities and Capital | 2011 | 2012 | 2013 |

| Current Liabilities | |||

| Accounts Payable | $153,865 | $248,993 | $205,252 |

| Current Borrowing | $0 | $0 | $0 |

| Other Current Liabilities | $5,211 | $5,211 | $5,211 |

| Sub-total Current Liabilities | $158,876 | $254,204 | $210,463 |

| Long-term Liabilities | $211.470 | $211,470 | $211,470 |

| Total Liabilities | $370,346 | $465,765 | $421,933 |

| Paid-in-Capital | $101,800 | $101,800 | $101,800 |

| Retained Earnings | $2,346 | $218,092 | $827,581 |

| Earnings | $215,746 | $609,489 | $965,778 |

| Total Capital | $319,892 | $929,381 | $1,895,159 |

| Total Liabilities and Capital | $690,238 | $1,395,055 | $2,317,092 |

| |

|||

| Net Worth | $319,692 | $929,381 | $1,895,159 |

[Exhibit 9, Business Plan at 4, 12, 16-19, 23, 25, 26-34]

Materially Misleading Under The Circumstances

Feasibility Assesment

▲Top of page

VII. Violations of Securities Laws

A. Count I, Violation of §301

B. Count II Violations of §201(a)

C. Count III Violations of §201(b)

▲Top of page

VIII. Statutory Basis for Relief

▲Top of page

IX. Public Interest

For all of the reasons set forth above, it is in the public interest and will protect Massachusetts investors, to provide the relief requested in Section X below.

▲Top of page

X. Relief Requested

WHEREFORE, the Enforcement Section of the Division requests that the Director or Hearing Officer take the following action:

- to enter an order requiring Respondent Urban Power to permanently cease and desist from offering for sale and selling any security in Massachusetts until the security is properly registered or is offered for sale and sold pursuant to an exemption from registration under the Act;

- to order Respondent Urban Power to make rescission offers to all residents of the Commonwealth who purchased securities sold in violation of the Act for each, any and all of the reasons set forth in the complaint; and

- to take any other necessary action which may be in the public interest and appropriate for the protection of Massachusetts investors.

Dated: March 20, 2012

Massachusetts Securities Division

Enforcement Section

By and through its attorneys,