Accessible Version of PDF: Mass-Fid-Duty-6-27-2013.pdf

June 27, 2013: Addressed To

The Mary Jo White Chairman

U.S. Securities and Exchange Commission

100 F Street NE Washington, D.C. 20549

The Honorable Blisse B. Walter

U.S. Securities and Exchange Commission

100 F Street NE Washington, D.C. 20549

The Honorable Luis A. Aguilar

U.S. Securities and Exchange Commission

100 F Street NE Washington, D.C. 20549

The Honorable Troy A. Paredes

U.S. Securities and Exchange Commission

100 F Street NE Washington, D.C. 20549

The Honorable Daniel M. Gallagher

U.S. Securities and Exchange Commission

100 F Street NE Washington, D.C. 20549

Re: Duties of Brokers, Dealers and Investment Advisers: Request for Data and "Other Information; File No. 4-606; Release No. 34-69013; IA-3558 (the "Release")

Dear Chairman White, Commissioner Walter, Commissioner Aguilar, Commissioner Paredes and Commissioner Gallagher:

As the chief securities regulator for Massachusetts, through the Massachusetts Securities Division (the "Division"), I write in response to the Securities and Exchange Commission's request for data and information relating to potential rulemaking under Section 913 of the Dodd-Frank Wall Street Reform and Consumer Protection Act (the "Dodd-Frank Act").

I urge the Commission not to capitulate to industry advocates and the courts that would relegate investor protection to a "bean counter" analysis concerned with the quantification of industry costs to the exclusion of the harmed warm-blooded investor. While you cannot put a price on investor protection, you can gauge the price paid by investors from the losses they suffer under the current system, where brokers make recommendations under a "suitable investment" standard.

This letter includes detailed discussion of a 2010 enforcement case involving sales of a note fraud in which Massachusetts investors lost over $5.7 million. My Office has also prepared a survey and report 1 of Massachusetts advisers on the potential introduction of a uniform standard of care. The information obtained should help the Commission as it considers rulemaking under Section 913.

The Release focuses on gathering information to help the Commission carry out a cost-benefit analysis of any potential rulemaking. The information we are providing indicates the costs, and indeed the harm, that retail investors suffer under the current system, which permits broker-dealer firms to provide investment advice to customers without any fiduciary duty to them. I urge the SEC to obtain similar data from every regulator in order to fend off the rising tide of cost-benefit rule destruction.

The Securities Division's 2013 survey of Massachusetts-registered investment advisers, and the accompanying report, demonstrate that Massachusetts investment advisers are overwhelmingly against any changes to the current high fiduciary standard that applies when they make recommendations and provide advice to clients. In particular, I urge the SEC to read the comments provided by Massachusetts advisers to see how adamantly opposed they are to any watering down of the fiduciary standard now applicable under the Investment Advisers Act.

Background/Introduction

Section 913 of the Dodd-Frank Act empowers the SEC to adopt a uniform fiduciary standard of conduct for investment advisers and broker-dealers when providing personalized investment advice to retail investors.2 Key requirements of Section 913 are

Dated: July 24, 2012

1 Report on the Impact to Massachusetts Investment Advisers of the Potential Introduction of a Uniform Fiduciary Standard, Massachusetts Securities Division, June 27, 2013.

2 Section 913 g) of the Dodd-Frank Act states, in pertinent part: STANDARD OF CONDUCT.-

"(1) IN GENERAL-The Commission may promulgate rules to provide that the standard of conduct for all brokers, dealers, and investment advisers, when providing personalized investment advice about securities to retail customers (and such other customers as the Commission may by rule provide), shall be to act in the best interest of the customer without regard to the financial or other interest of the broker, dealer, or investment adviser providing the advice. In accordance with such rules, any material conflicts of interest shall be disclosed and may be consented to by the customer. Such rules shall provide that such standard of conduct shall be no less stringent than the standard applicable to investment advisers under section 206(1) and (2) of this Act when providing personalized investment advice about securities, except the Commission shall not ascribe a meaning to the term 'customer' that would include an investor in a private fund managed by an investment adviser, where such private fund has entered into an

that financial professionals providing advice shall act in the best interest of the customer without regard to the financial or other interest of the broker, dealer, or investment adviser giving the advice; and that such rules shall provide that such standard of conduct shall be no less stringent than the standard applicable to investment advisers under Sections 206(1) and (2) of the Investment Advisers Act when providing personalized investment advice about securities. As noted in the Release, the issue of making brokerdealers subject to a fiduciary standard has been the subject of considerable debate and study over several years, including a RAND Corporation study in 2008 and an SEC Staff Report in 2011.

Request for Data and Information

The Release requests data and information, particularly quantitative data and economic analysis, relating to the benefits and costs that could result from various approaches to applying, or not applying, a fiduciary standard of conduct to both investment advisers and broker-dealers. We commend the Commission for addressing this complex and contested issue. Many segments of the securities industry have longstanding interests that would lead them to oppose a strong fiduciary standard. We anticipate that any meaningful rulemaking will spark opposition from at least some groups.

Cost-benefit analysis is an important part of the rulemaking process. Unfortunately, we have seen some courts treat cost-benefit analysis as a reason to override the Commission's past rulemaking. While cost-benefit analysis should inform the Commission's regulatory decision making process, it must never be the beginning and end of that process. We urge the Commission to maintain a big-picture, commonsense approach to the duties that all providers of financial advice should have to retail customers, and to be mindful of the protections that retail investors need. The language of Section 913 focuses on the needs of retail investor and the stringent standards that must apply to all providers of investment advice; we urge the Commission to adopt a commensurately investor-centric view in its rulemaking.

Letter from NASAA and Other Groups on Fiduciary Duty

We are in accord with the June 4, 2013 letter from nine investor protection, accounting and financial planning organizations regarding the Release. 3 Massachusetts participates in the North American Securities Administrators Association, a signatory to the letter, and these comments are intended to support and supplement NASAA's position.

advisory contract with such adviser.

The receipt of compensation based on commission or fees shall not, in and of itself, be considered a violation of

such standard applied to a broker, dealer, or investment adviser.

As the letter notes, the assumptions in the Release fail to include key elements of the fiduciary standard, such as the obligation to act in the best interest of the customer. The Release appears to assume that many significant conflicts of interest that are now inherent in the broker-dealer business model can be resolved by simply disclosing those conflicts to investors. We share the concern voiced in the letter that the Release seems to contemplate little more than the existing broker-dealer suitability standard, supplemented by some conflict of interest disclosures.

The conduct of a national broker-dealer firm and its legal team as shown in a 2010 Securities Division enforcement action gives us a basis to understand what a disclosure-based approach to fiduciary duty might look like and how it would affect investors. This is discussed in greater detail below.

We anticipate that disclosure regarding limitations on the broker-dealer's fiduciary obligations to customers would be included in the pre-printed language of new account statements, subscription agreements, and alternative investment purchase acknowledgement forms. This language in the paperwork often may not be brought to the attention of customers, it may be deemphasized, and its importance may not be explained. We are concerned that this will happen in the future in an environment where brokers will assert that they are fiduciaries for their customers, and that there is no meaningful difference between a broker and an investment adviser, despite the conflicts to which the broker will be subject to.

We believe that disclosures regarding conflicts of interest will not protect retail investors when dealing with broker-dealers, but that such disclosures will be used against them in litigation. With the proliferation of complex alternative investment products, such disclosure will additionally overburden investors who already need help dealing with dense and hard-to-read disclosure materials. In the event of a dispute between the broker and the customer, the customer will be confronted in court or in arbitration with the "conflict of interest disclosures" that he or she was required to sign. In contrast to this legalistic approach of disclosing conflicts, true fiduciary duty is founded on the simple principle that the interests of the customer must come first. We urge the Commission to adhere to this principle in any rulemaking under Section 913 of the DoddFrank Act.

The Current Standards for Broker-Dealer Recommendations are Costly and Harmful to Retail investors

Securities regulators, including the SEC, FINRA, and the states, have seen disturbing examples of how retail investors are disserved by the current system, which treats broker-dealers who provide financial advice to customers as merchants that are subject to an obligation to make "suitable" recommendations, rather than as fiduciaries.

The language of the Release is often tightly focused on gathering data and information that would help the Commission defend even a diluted fiduciary standard against attack on cost-benefit grounds. We urge the Commission in its rulemaking process to recognize the investor protection benefits a strong fiduciary standard would provide, and the genuine savings to investors that it would promote. Unfortunately, the language of the Release often reflects a "bean counter" mentality with respect to costs, and fails to focus on how poorly the current system serves many investors. Too often, the issue of the "costs" of adopting a new regulatory standard focuses on the financial costs that industry will incur if a new system is adopted. We urge the Commission not to get snared in the idea that the only costs to consider are those that might be paid by industry. The Commission must look at all issues of cost, particularly the costs that investors incur when they place their trust in non-fiduciary financial advisers. This is quantifiable data that can be obtained; we urge the Commission to do so.

It is a truism that many of the riskiest investments pay the highest selling compensation. Too often, brokers, who are subject to sharp conflicts of interest, recommend high-commission alternative products that carry inappropriate levels of investment risk, detrimentally high costs, and/or expose investors to factors such as illiquidity or price volatility. A competent investment adviser would warn her customers to avoid such products. The costs borne and the harms suffered by investors who get their advice from broker-dealers under the "suitable recommendation" standard are quantifiable costs. We urge the Commission to gather information about and measure them.

The Release states that the Commission and its staff have extensive experience in the regulation of broker-dealers and investment advisers. We ask the Commission to collect data and information regarding the costs, risks, and losses incurred by retail investors due to recommendations by broker-dealers under the current system. We believe that if these costs are accurately taken into account, the case for adopting a consistent and high fiduciary standard for all providers of investment advice will be overwhelming. Much of this information is in the hands of state securities regulators, FINRA, and the arbitration/litigation bar. We urge the Commission to solicit such information from these and other sources. Moreover, a great deal of information regarding the costs incurred and damage suffered by retail investors in dealing with brokers is in the possession of the Commission; we urge you to take cognizance of it.

The "Suitable Recommendation" Standard for Broker Fails to Protect Investors

As the Release notes, many investors are confused or misinformed about whether their brokers are fiduciaries. This is clearly shown in the Securities Division's survey (see discussion below and attachment). For years, many broker-dealers have blurred the standard they operate under through the use of such nomenclature such as calling a broker-dealer agent a "financial adviser," which makes the agent sound like he or she is an investment adviser. Regulators deserve some of the blame for this misleading practice by allowing the use of these terms without any standards or legal definitions.

The Division has seen repeated instances of brokers cultivating the relationships with customers by portraying themselves as trustworthy advisers. Often, such brokers sell complex and risky financial products to investors based on glowing oral presentations that deemphasize the warnings and risk disclosures in the legally-required offering documents. In many cases, a broker will personally endorse the product, saying I'm in this investment myself," or "I have all my clients in this investment." In the current volatile market and faced with an array of complex investments, many investors are relieved to place their trust in their brokers to select investments, although that trust is often misplaced.

When an investment proves to be excessively volatile, loses money, or collapses due to fraud, brokers fundamentally reverse how they describe their relationship with the customer. A broker will defend itself against its own customer by asserting that the broker is merely a merchant (not a fiduciary) that deals at arms-length with the customer. In conjunction with this defense, the broker will rely on the paperwork the investor signed when he or she purchased an investment the broker had recommended. In such situations, a relationship that formerly had looked to the customer like a fiduciary relationship is treated, at best, as a matter of contract law. Typically, required investor representations included in the subscription materials are used against investors who were sold unsound or inappropriate products. Such required representations include statements that the investor has read all the offering material, understands the offering materials, understands the risks of the investment, and agrees and understands that he or she may not rely on representations about the investment, even those from the broker and agent, but must rely only on the written offering materials.

Facts and Information Gathered in a Massachusetts Securities Division Enforcement Action

In 2010, the Massachusetts Securities Division commenced an administrative hearing in an enforcement action against a registered broker-dealer firm in connection with sales of notes issued by entities affiliated with Medical Capital Partners. The Medical Capital Note enterprise collapsed in 2008, resulting in losses to Massachusetts of over $5.7 million.4 This loss is quantifiable. This cost was borne by investors across the country. The SEC must factor this type of loss, based on bad investment recommendations, into its decision making.

The Division's enforcement action was based on the theory that the broker-dealer failed to conduct adequate due diligence and ignored red flags when recommending Medical Capital Notes and selling the notes to investors.

4 According to a July 16, 2009 Complaint filed by the U.S. Securities and Exchange Commission, Medical Capital entities raised $2.2 billion from over 20,000 investors; and since August 2008, five of the Medical Capital Special Purpose Corporations [the issuers of the notes] have been in default or late in paying principal and/or interest on $992.5 million in notes. SEC v. Medical Capital Partners, Case No. SACV09- 818 DOC(RNBX), U.S. District Court, Central District of California, Southern Division (July 16, 2009).

In its defense against the enforcement action, the brokerage, with the help of its legal team, argued that investors had agreed to purchase these risky and complex investments and that they were responsible for any adverse consequences. In essence, the broker-dealer firm turned the tables on its own customers.

After a lengthy administrative hearing, but before the hearing officer rendered a decision, the Division's enforcement action against broker-dealer was settled on terms beneficial to Massachusetts investors. In the settlement, the Securities Division was able to recover funds from the broker-dealer firm to make whole the Massachusetts investors.

The hearing on sales of Medical Capital Notes revealed facts and patterns of facts that regulators (the SEC, the States, and FINRA) have seen before. These facts and patterns should inform the Commission's consideration of the relationship between broker-dealers and their customers and the standards that should apply to that relationship. Two patterns were clear:

- The investor-witnesses testified with remarkable consistency about how they placed their trust in the broker-dealer agents they dealt with (believing the agents were true fiduciaries) and they testified with similar consistency about how the complex and speculative notes were offered and sold; and

- The broker-dealer and its legal team consistently used tactics to impeach customers who testified at the hearing by placing responsibility for the bad investment on the customers who followed the firm's recommendations.

The administrative hearing in this matter involved 15 investor witness, many of them savers rather than investors, who provided consistent accounts of how Medical Capital Notes were offered and sold to them. Investors described their relationships with their broker and with their selling person as relationships built on trust. Customers expected the firm and the agent to make recommendations in their best interests and to look out for them. Investors believed the investment was at least somewhat safe, based on the fact that the brokerage and its representative recommended it. Written disclosures, including risk disclosure, were not emphasized (they were treated like paperwork) or deemphasized at the point of sale. The accounts of the witnesses show that they purchased offerings of unregistered notes based on their faith in the broker and their individual agents.

Investors' Reliance on their Brokers and Agents

Investors consistently stated that they relied on the broker-dealer to recommend appropriate securities for their needs and to provide trustworthy advice.

As a group, the investor-witnesses were unsophisticated. They largely did not read financial newspapers and they shied away from risky investments. Many were retired or close to retirement age, so they would not be in a position to replace any losses to their savings. Many had health problems that would limit their ability to work and that would likely lead to medical expenses in the future.

Many of the investors had not gone to college or had completed only a portion of their college educations. While many of the investors qualified as accredited investors, in a number of cases they qualified as accredited based on the value of real estate holdings, particularly their homes.

Investors stated that they did not understand what private placement securities were, said they had not heard of Regulation D, and did not know the legal standard for an individual to be an accredited investor.

While a number of the investors could explain some things about how Medical Capital would generate revenue to pay on the notes, as a group the investors stated that they relied on the agent to understand the investment and to make an appropriate recommendation. Over and over again, investors said in simple language that they relied on their broker-dealer agent to take care of them and look out for their best interest when recommending a sophisticated alternative investment to them. In fact, no adviser subject to a fiduciary standard of care or loyalty could have recommended this investment.

Each investor's story is a case study demonstrating the wide gap in knowledge and experience between the customer and his or her agent. It is understandable and foreseeable that customers will trust their brokers and agents as if they are fiduciaries, because markets are so difficult and many investments are so complex that they regard it as a field where most people will need expert advice.

Again, because the broker-dealer firm systematically recommended Medical Capital Notes, investors suffered real costs, real losses. We urge the Commission to consider these costs in the rulemaking process.

The Brokerage Disclaims Responsibility for Its Recommendations and Lays Responsibility at the Feet of Customers

The heart of how the broker-dealer firm defended itself in the Securities Division's enforcement action was to try to discredit the customers by blaming them for the selection of the investment.

Questions directed to customers included:

- Do you recognize your signature on the subscription agreement of several years ago?

- Did you read the language of the subscriptions agreement?

- Did you read the language in the subscription agreement stating that the investor may rely only on the disclosure in the private placement memorandum and may not rely on representations made by anyone else [including the broker-dealer agent]?

- Did you read the language of the Alternative Investment Purchase Acknowledgement Form?

- Did you see the heading, "Statement of Risk" in the Acknowledgement?

- Did you read the representation that says "I understand that non-publicly traded investments, including REITs, limited partnerships, secured notes, Regulation D offerings, ... have certain risks due to the private characteristics and may be considered speculative in nature?"

- Did you read an acknowledgement that refers to the subscription agreement in a couple of places and says, "I have had an opportunity to review and understand the subscription agreement and investment prospectus and I asked my representative questions concerning the product prior to making my decision to invest. I believe this is an appropriate investment for my portfolio."?

- Then lastly the acknowledgement directly above your signature, directly above says, "by signing below, you are agreeing that the risks associated with this product were explained to you and that you have reviewed and understand the unique features associated with this investment," so by signing here, you acknowledged that you did those things, didn't you?

Reading the testimony of the investor-witnesses and the ensuing detailed and lengthy cross-examination of each witness by the lawyers for the broker-dealer firm is a depressing and poignant exercise.

Many witnesses testified that they bought Medical Capital Notes during the course of a meeting with their agent. Many testified that there was not time at the meeting to read lengthy disclosure documents and accompanying subscription agreement and alternative investment purchase acknowledgment. Counsel's question in response to such testimony was, You weren't told by anybody at the meeting not to read any of the documents you were signing were you?

The Securities Division offers to share with the Commission transcripts of the testimony of the 15 investor witnesses in this administrative hearing in order to contribute to the Commission's data gathering for rulemaking under Section 913.

We must be emphatic: Investors are on an unequal playing field when they get advice from broker-dealers. This results in quantifiable harm to investors. We urge the Commission to use its own records and to ask other regulators for information that will document and begin to put a dollar value on this harm. If broker-dealers were held to a

true fiduciary standard and if investors were more easily able to hold their brokers to that standard by bring suits when they are warranted, many of these chronic problems in the brokerage business could not happen.

Survey of Massachusetts State-Registered Investment Advisers

The Massachusetts Securities Division surveyed its state-registered investment advisers on issues posed by the Release and Section 913 of Dodd-Frank Act. 192 advisers responded. Their responses provide a clear picture of how professionals who currently work under a fiduciary standard view their obligations to customers. The overriding view of the advisers is that they are strongly opposed to any "uniform fiduciary standard" that would water down the strong fiduciary standards under which they now conduct their businesses. We urge the Commission to read the results of the survey and the comments of Massachusetts advisers on these issues.

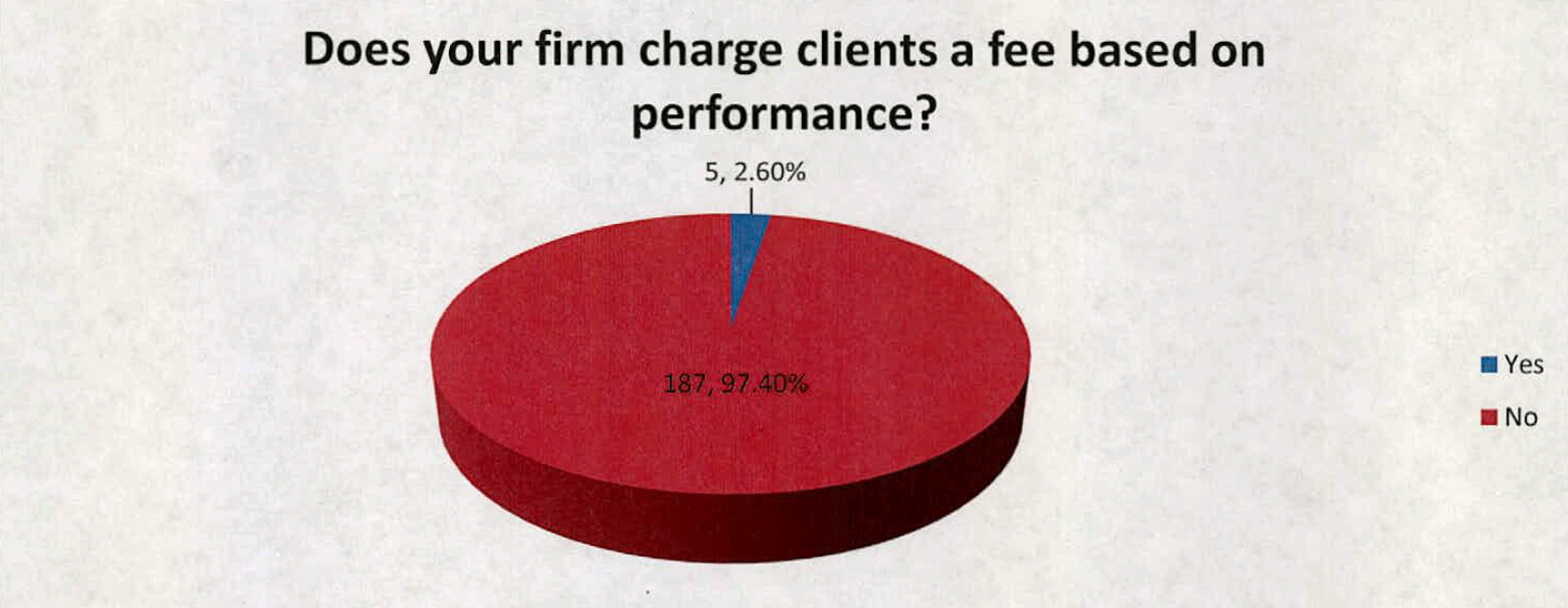

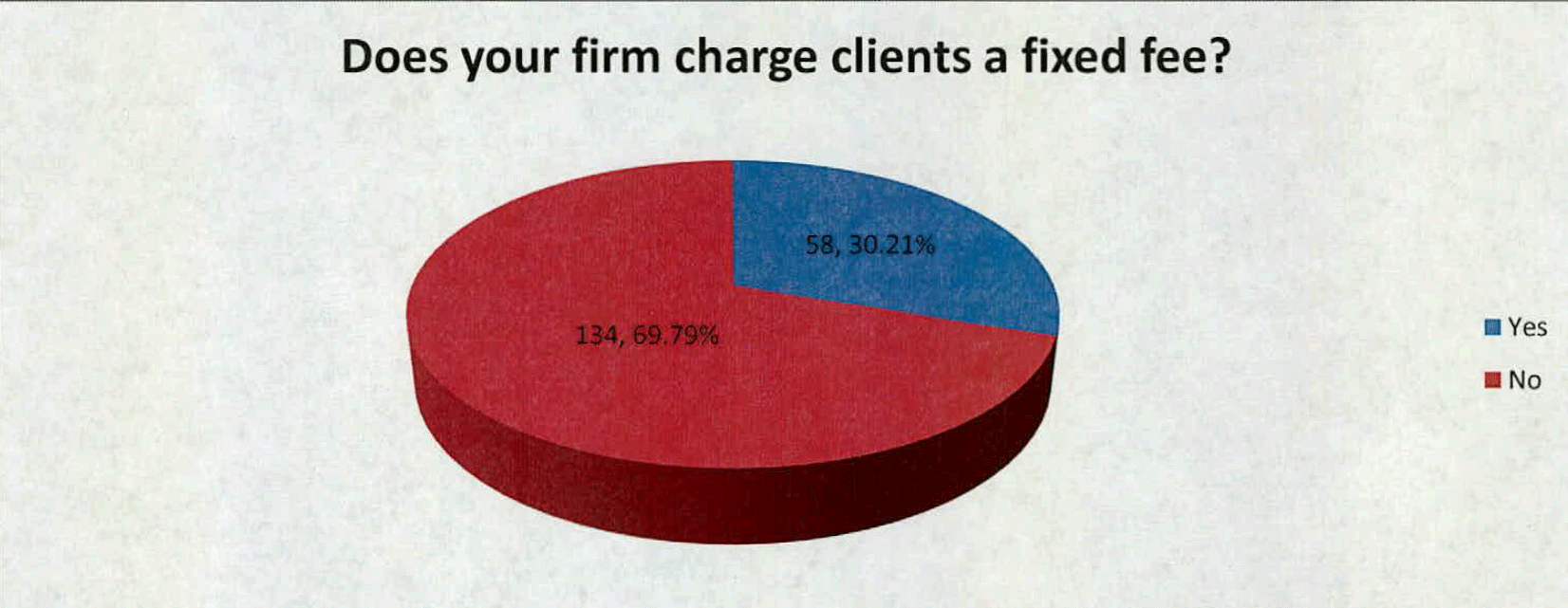

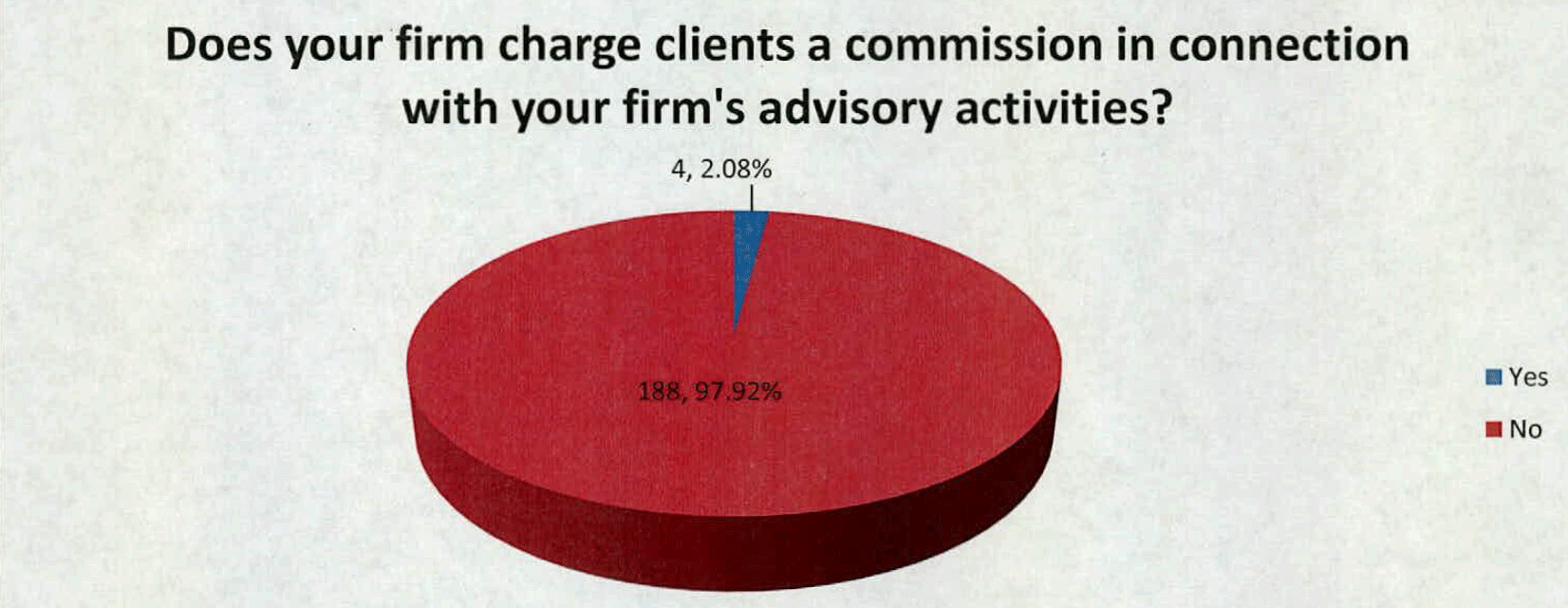

The great majority of the advisers do a fee-based (non-commission) business. In response to questions on whether a high fiduciary standard would increase costs for investors, the advisers said it would lower costs to investors, particularly by keeping inappropriate and overly expensive investments out of investors' portfolios.

A number of the advisers stated in their responses that they were familiar with or had worked in the brokerage industry, and that they were working as advisers because they embraced the standard of always putting the interests of investors first. Also, many advisers stated that the public is inadequately informed about the fiduciary duty issue. Many advisers stated that investors were looking for a source of expert advice and for a firm or person to trust regarding investments; they stated that most investors simply did not understand the fundamental differences between the duties of broker-dealers and investment advisers. The survey results and report are attached.

My office stands ready to assist the Commission with any future study or information gathering it conducts in this important area. Please contact Bryan Lantagne, Director of the Massachusetts Securities Division at (617) 727-3548 if you have questions or if we can assist in any way.

Dated: March 28, 2012

Massachusetts Securities Division

Enforcement Section

By its attorneys,

Secretary of the Commonwealth of Massachusetts" width="638" class="pdf_image maximgsize" title="The Signature of William F. Galvin - Secretary of the Commonwealth of Massachusetts">

Secretary of the Commonwealth of Massachusetts" width="638" class="pdf_image maximgsize" title="The Signature of William F. Galvin - Secretary of the Commonwealth of Massachusetts">

Report on the Impact to Massachusetts Investment Advisers of the Potential Introduction of a Uniform Standard of Care

By the Massachusetts Securities Division Staff

June 27.2013

On March 1, 2013, the Securities and Exchange Commission (the "SEC" or "Commission") issued a "Request for Data and Other Information" regarding the duties of brokers, dealers and investment advisers.l More specifically, the SEC's request seeks information ". . . relating to the benefits and costs that could result from various alternative approaches regarding the standards of conduct and other obligations of broker-dealers and investment advisers.,,2 This information would aid the Commission as it considers the potential implementation of a uniform standard that would apply to all financial professionals, whether that standard would be the current fiduciary standard applicable to investment advisers or another new standard of care blending the current duties owed by investment advisers and broker-dealers.

In an effort to assist the Commission in this matter, the Massachusetts Securities Division (the "Division") of the Office of the Secretary of the Commonwealth William Francis Galvin conducted a voluntary and anonymous survey of investment advisers registered with and operating in the Commonwealth. The purpose of the "Survey Regarding Potential Uniform Fiduciary Standard" (the "Survey") was to gather infonnation on Massachusetts-registered investment advisers' practices and opinions as they pertain to their current fiduciary duties and the impact of any potential changes to those duties as considered by the SEC. The Division mailed the Survey to 704 state-registered investment advisers on Friday, May 10, 2013, and requested that investment advisers postmark their responses by Friday, June 1, 2013. The Division has received 192 responses as of June 24, 2013, representing 27.27% of all state-registered investment advisers located in Massachusetts.

What are the characteristics of Massachusetts-registered investment advisers and their clients?

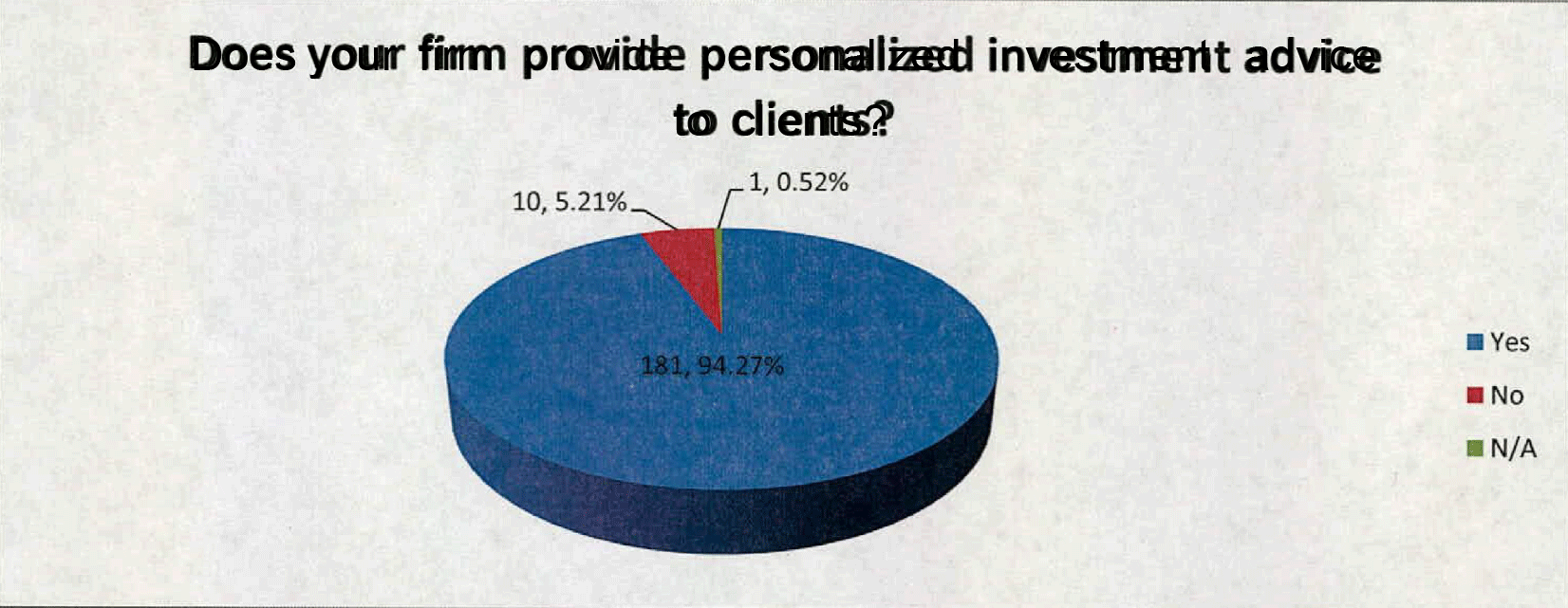

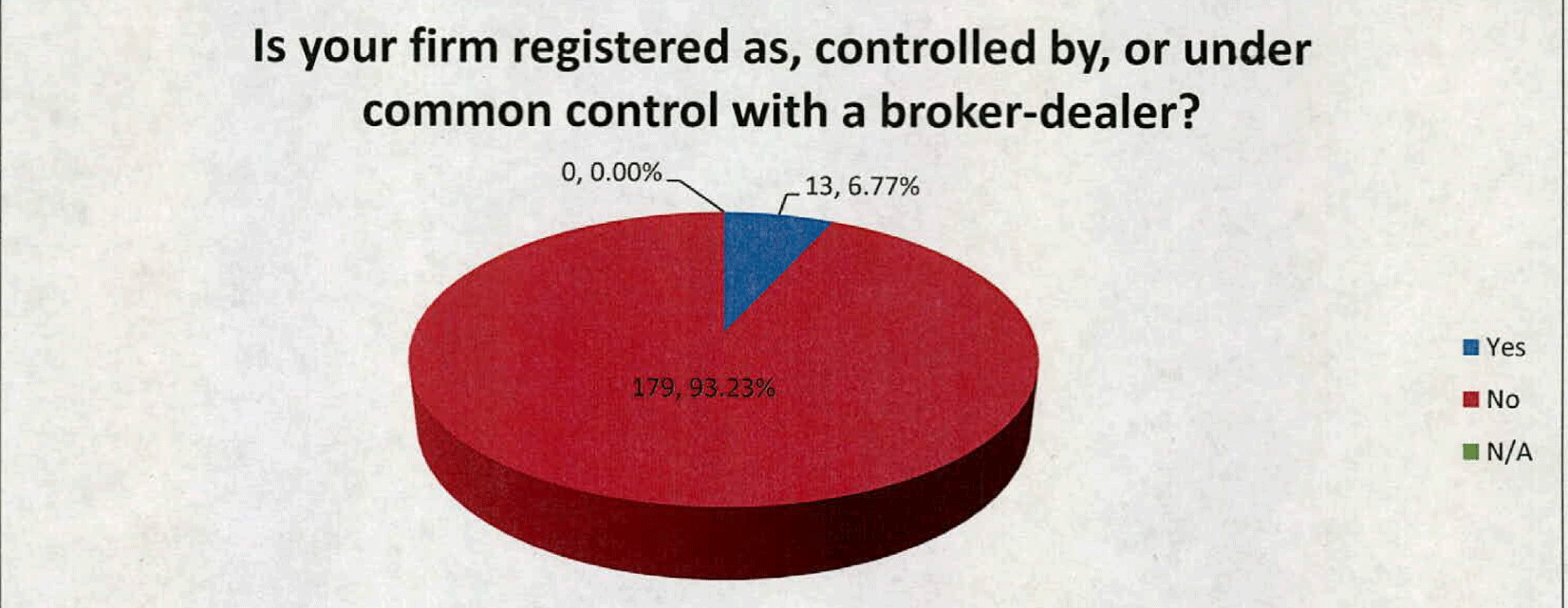

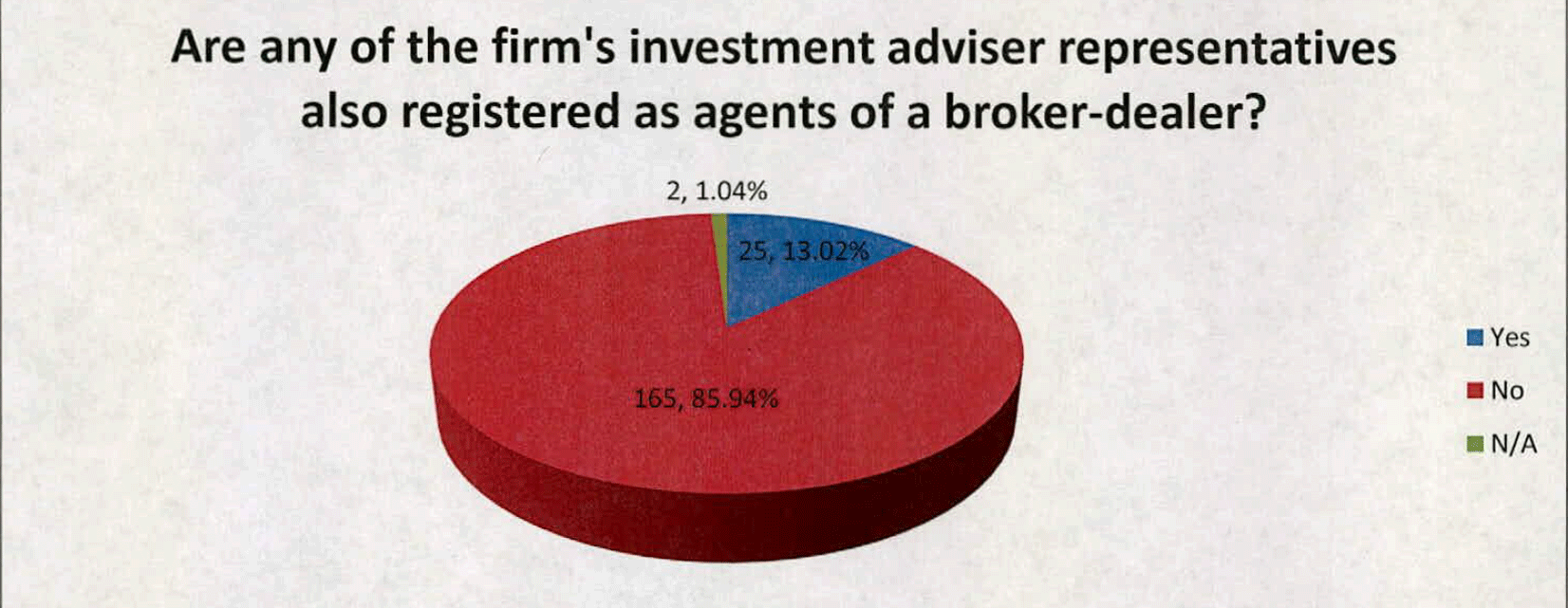

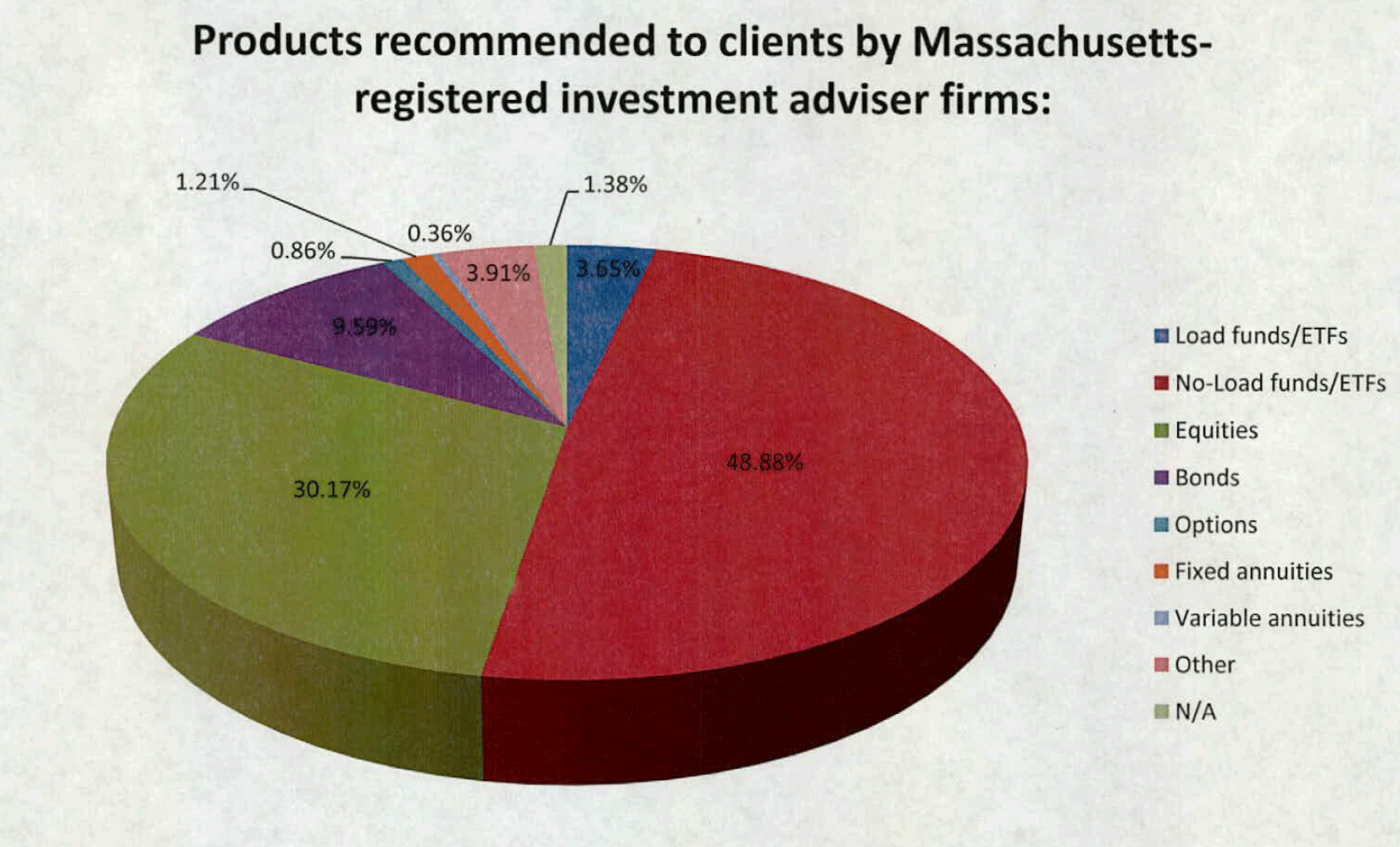

The Massachusetts-registered investment advisers that responded to the Survey generally provide personalized investment advice on a fee-only basis and are unaffiliated with a broker-dealer firm. Of the 192 responses received by the Division, 94.27% (181) of investment advisers responded affirmatively when asked whether their firm provided personalized investment advice to clients. (Copies of the Survey results for selected questions are attached hereto at Exhibit I.) Regarding their and their representatives' affiliations with a broker-dealer, 93.23% (179) of investment advisory firms specified that they were not registered as, controlled by or under common control with a broker-dealer firm, and 85.94% (165) of investment advisers stated that none of their investment adviser representatives were also registered as agents of a broker-dealer.

1 Securities and Exchange Commission Release No. 34-69013.

2 The full text of the SEC's Request for Data aod Other Information can be found at: http://www.sec.gov/rules/other/2013/34-69013.pdf.

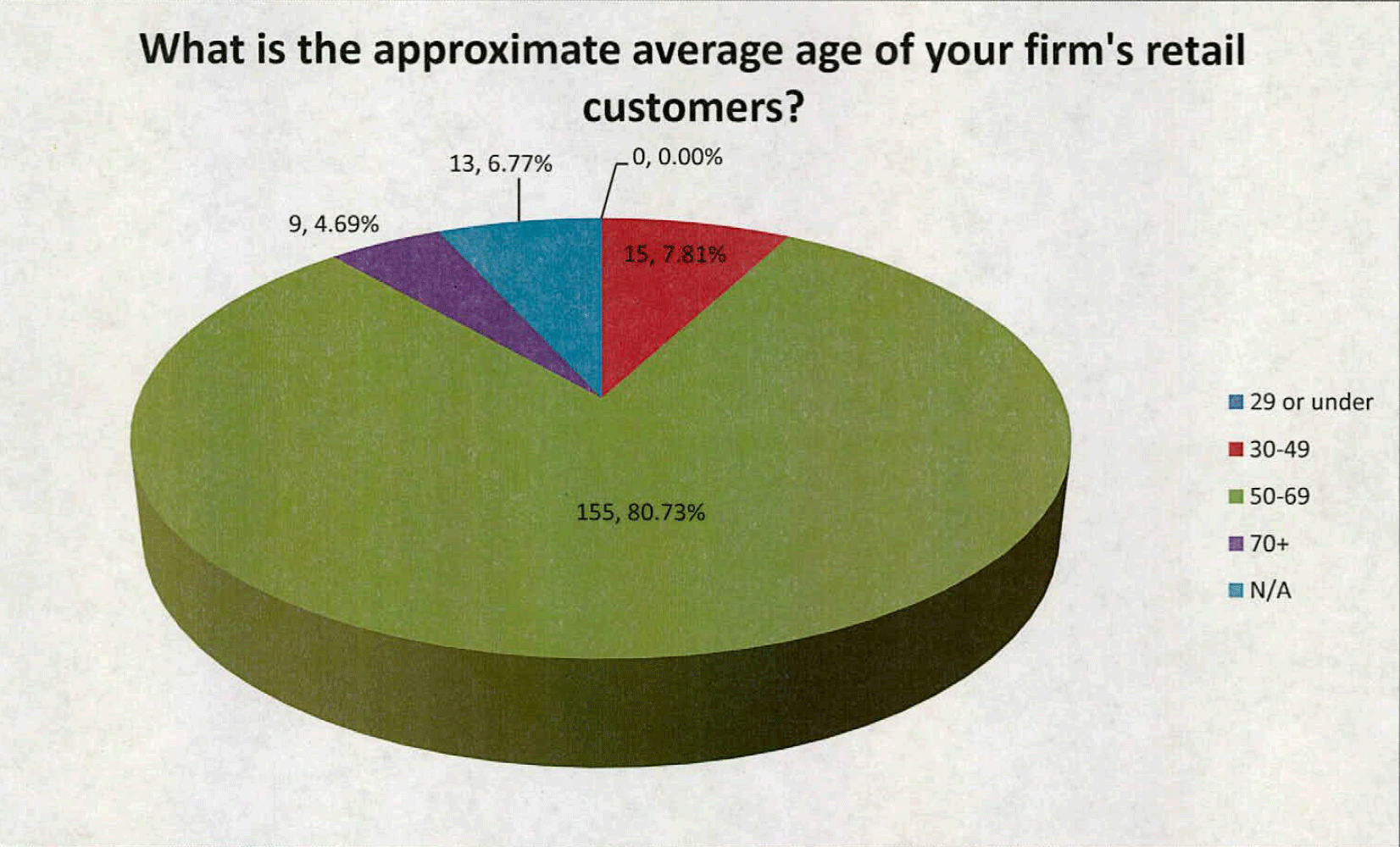

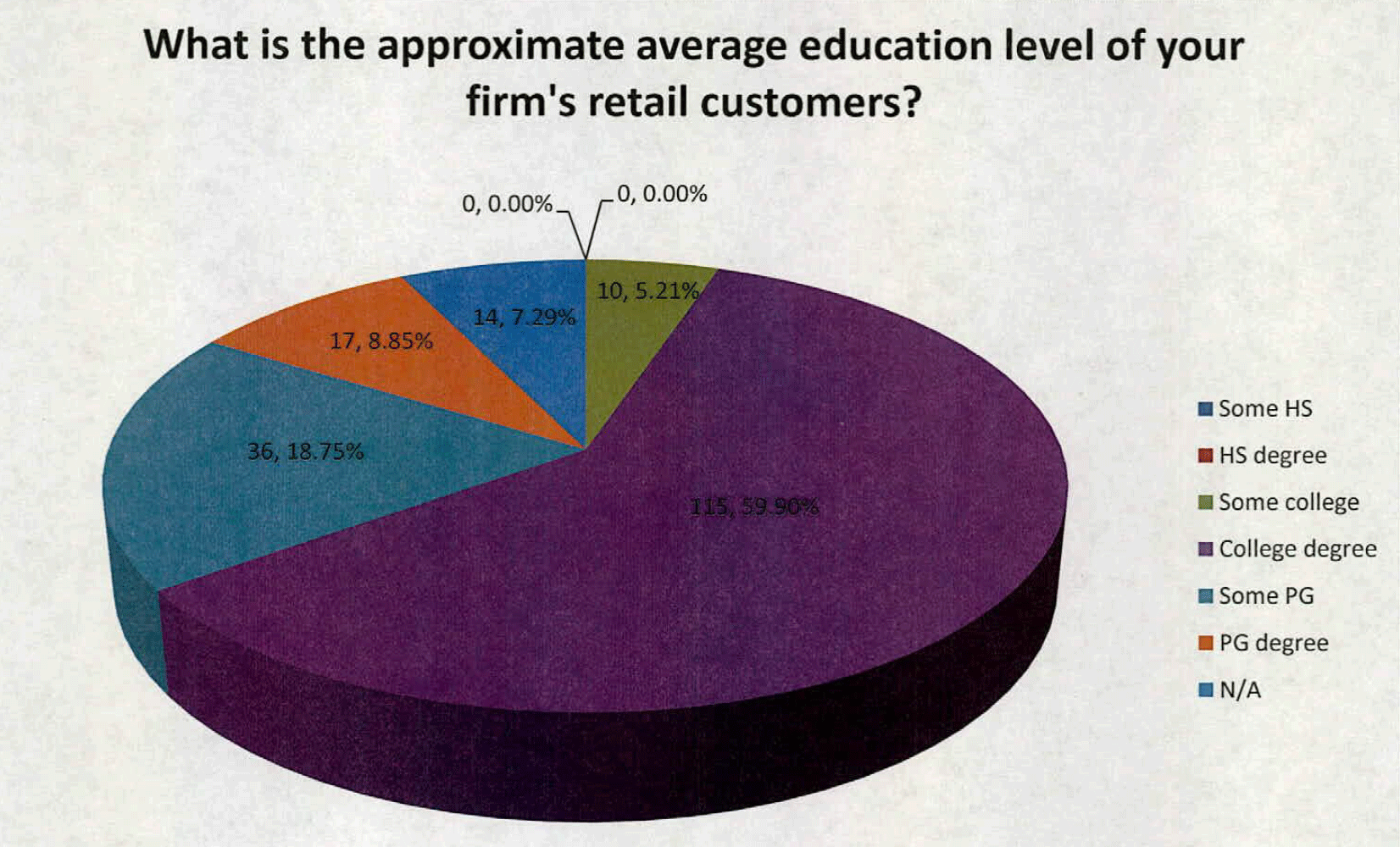

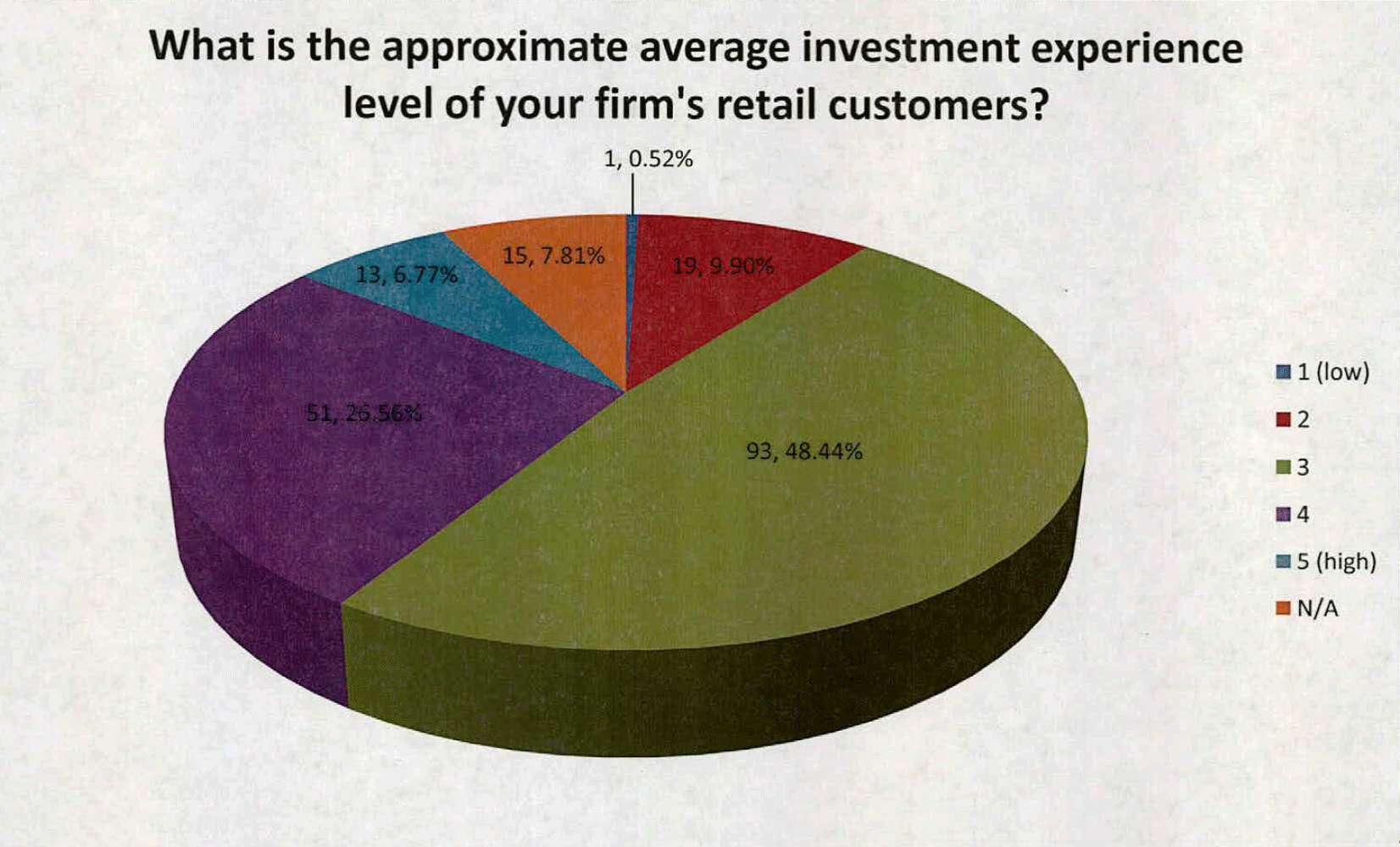

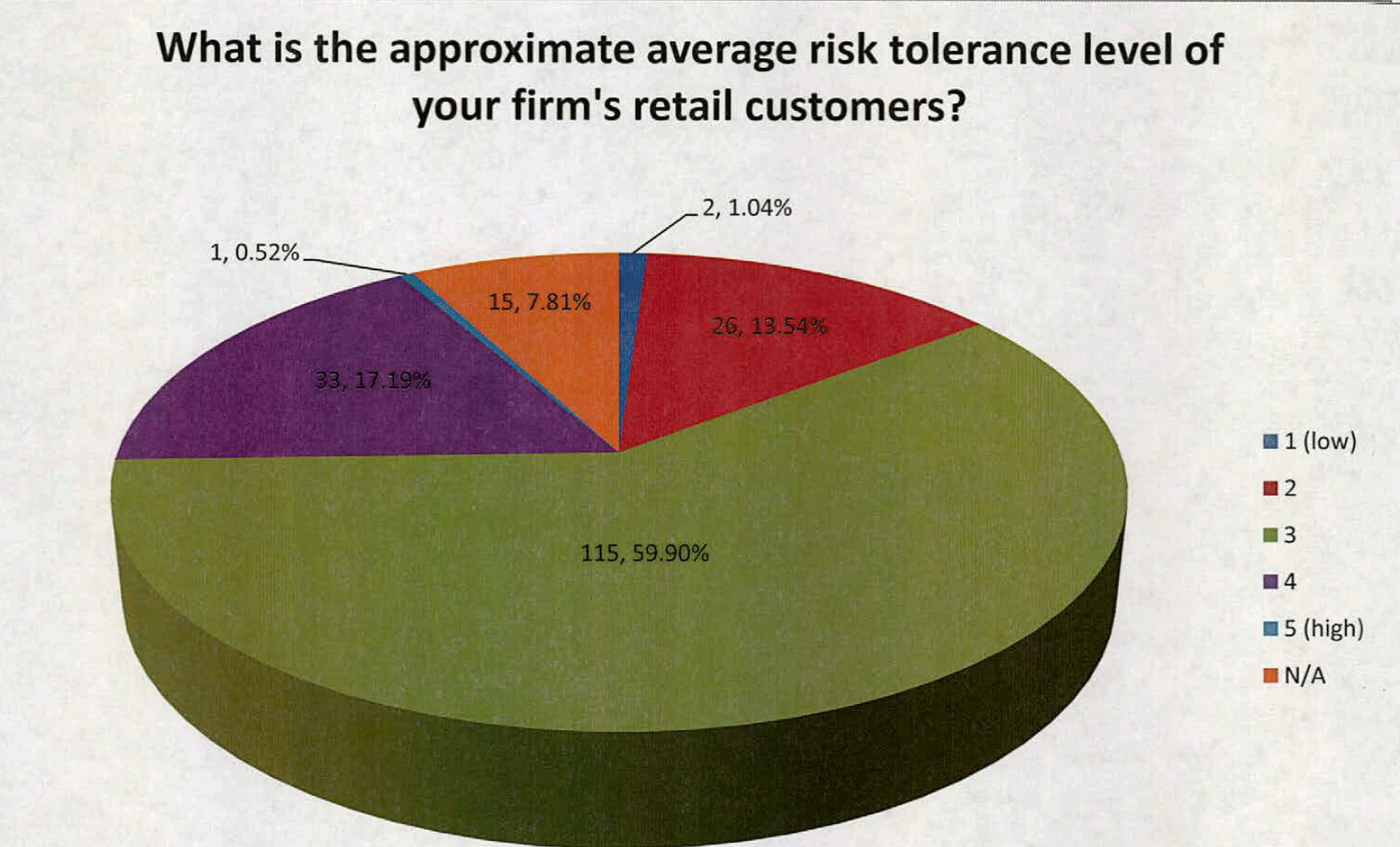

Massachusetts-registered investment advisers also indicated a general consistency in the composition of their clients as well. 85.42% (164) ofinvcstment advisory firms indicated that the age of their approximate average retail client was 50 or older, and 87.5% (168) noted that their approximate average retail client had earned at least a college degree. Additionally, when asked to rate the investment experience and risk tolerance level of their approximate average retail customer on a scale of 1 to 5 (with I indicating a "low" level of investment experience/risk tolerance and 5 indicating a "high" level of investment experience/risk tolerance), 48.44% (93) of investment advisers identified their average client as a 3 in terms of investment experience and 59.9% (115) identified their average client as a 3 in terms of risk tolerance.

Key Findings

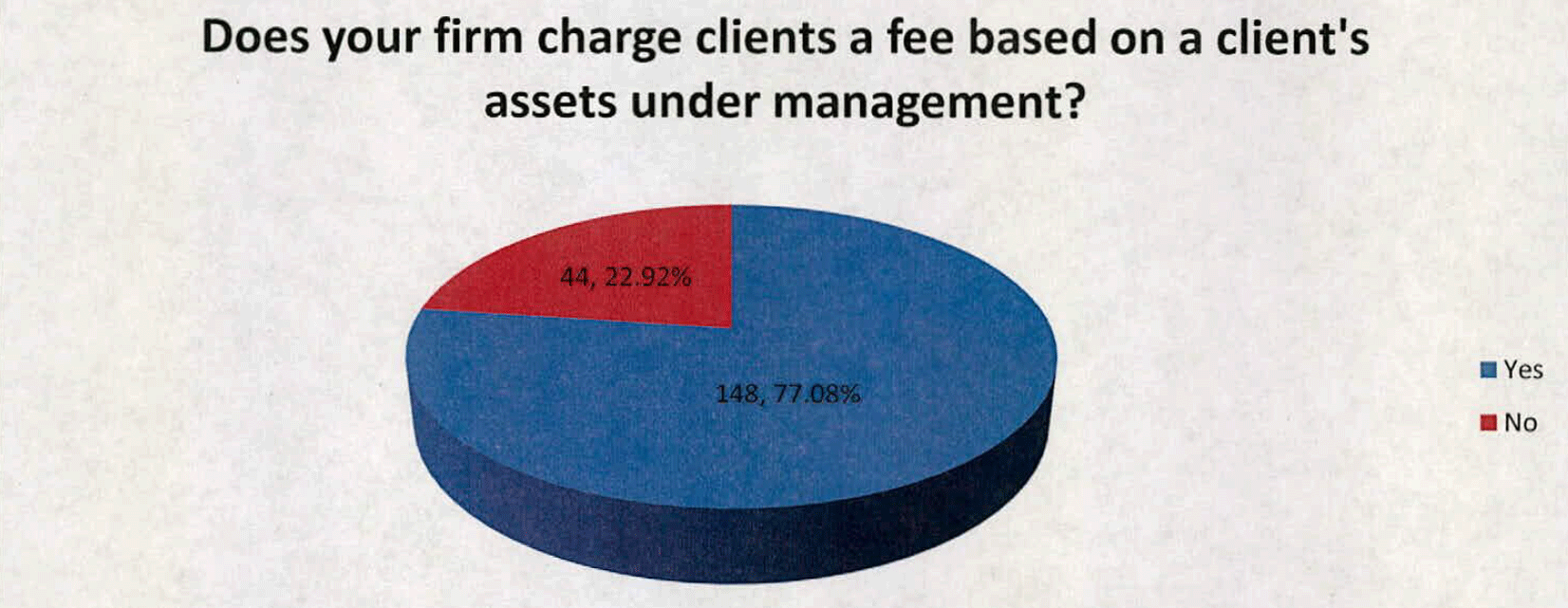

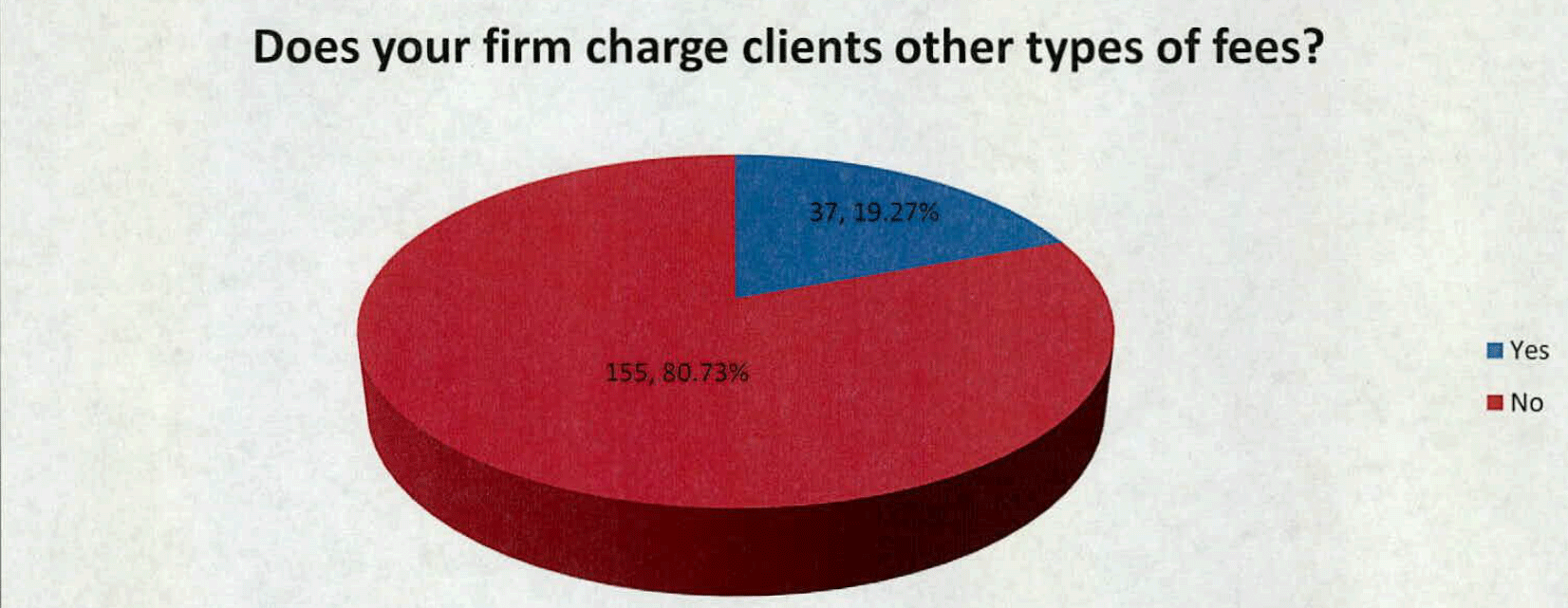

More than three quarters (77.08% or 148 of 192 Survey responses) of Massachusetts registered investment advisers provide asset management services to clients and charge an asset management fec. The averagc asset management fee reported by investment advisers varied between 4 and 250 basis points on an annualized basis, with a nonweighted average response of 90.5 basis points.

Investment advisers differed as to whether a uniform standard of care would increase their compliance costs. A significant percentage of investment advisers independently stated that they would adhere to a fiduciary duty standard even if not required to do so. Other investment advisers indicated that the requirements of the rules-based suitability standard would raise compliance costs vis-a-vis a fiduciary standard. Only a small perccntage of investment advisers « 2%) believed their costs would be lower under a suitability standard.

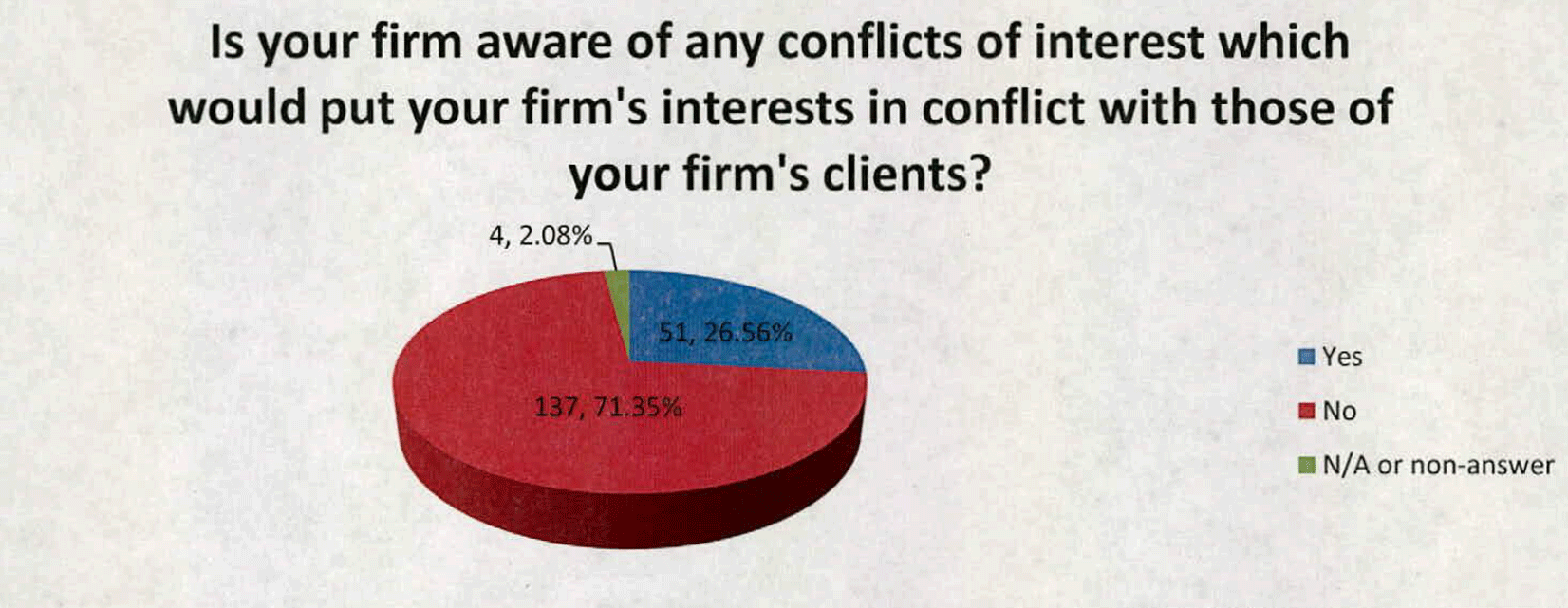

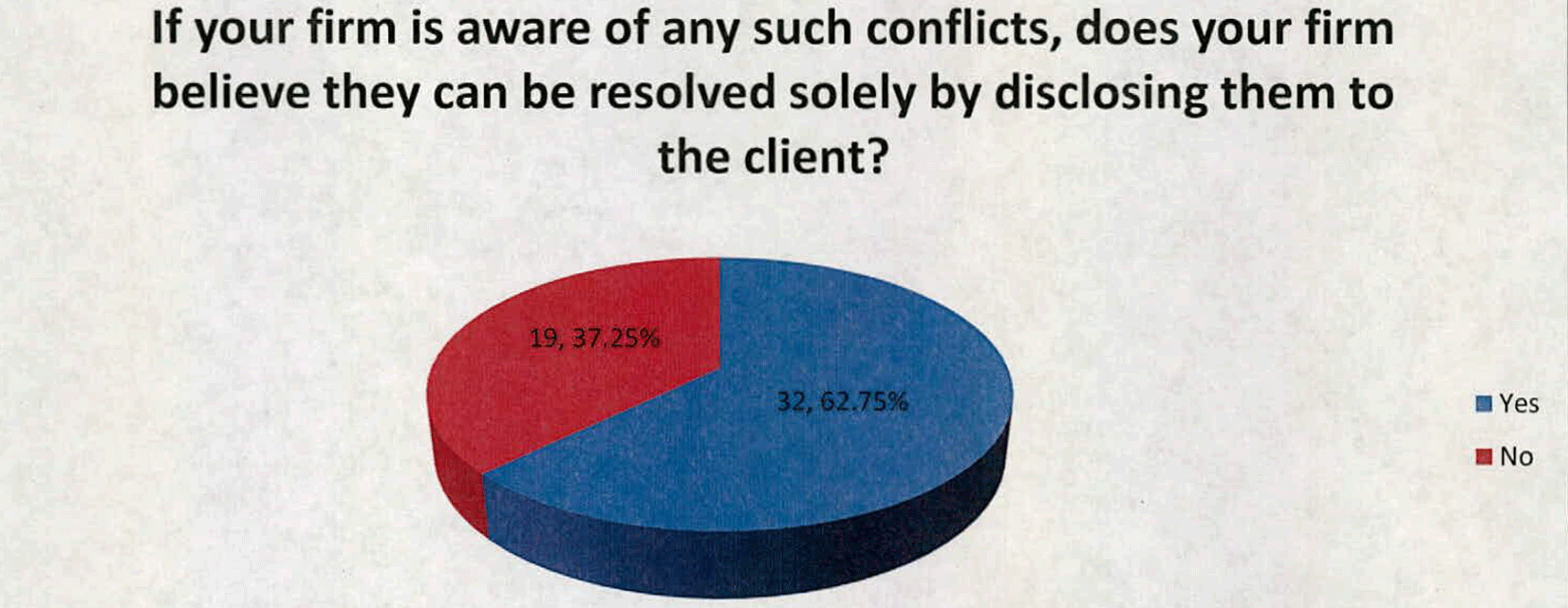

Only 26.56% (51) of investment advisers indicated that they were aware of any conflict of interest that would put their firm's intercsts in conflict with their client's interests. Of those 51 affirmative responses, 62.75% (32) investment advisers believed that the conflicts could be resolved solely through their disclosure to the client.

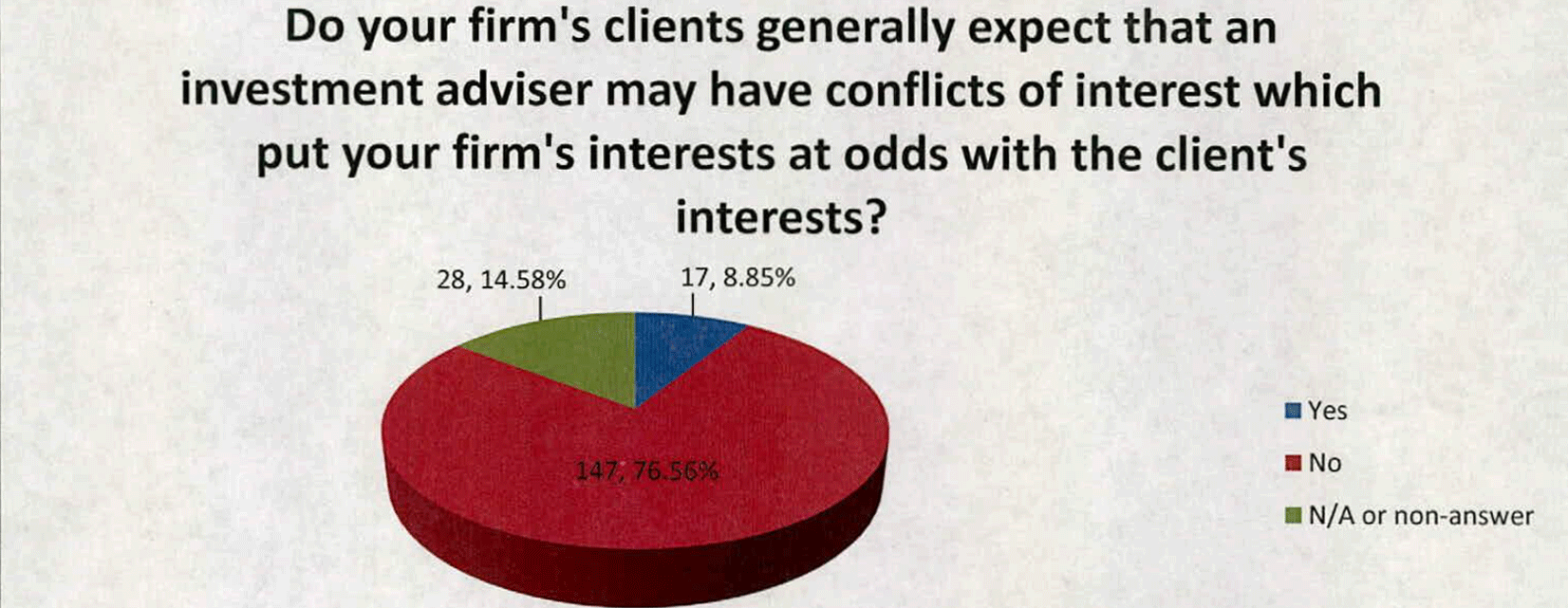

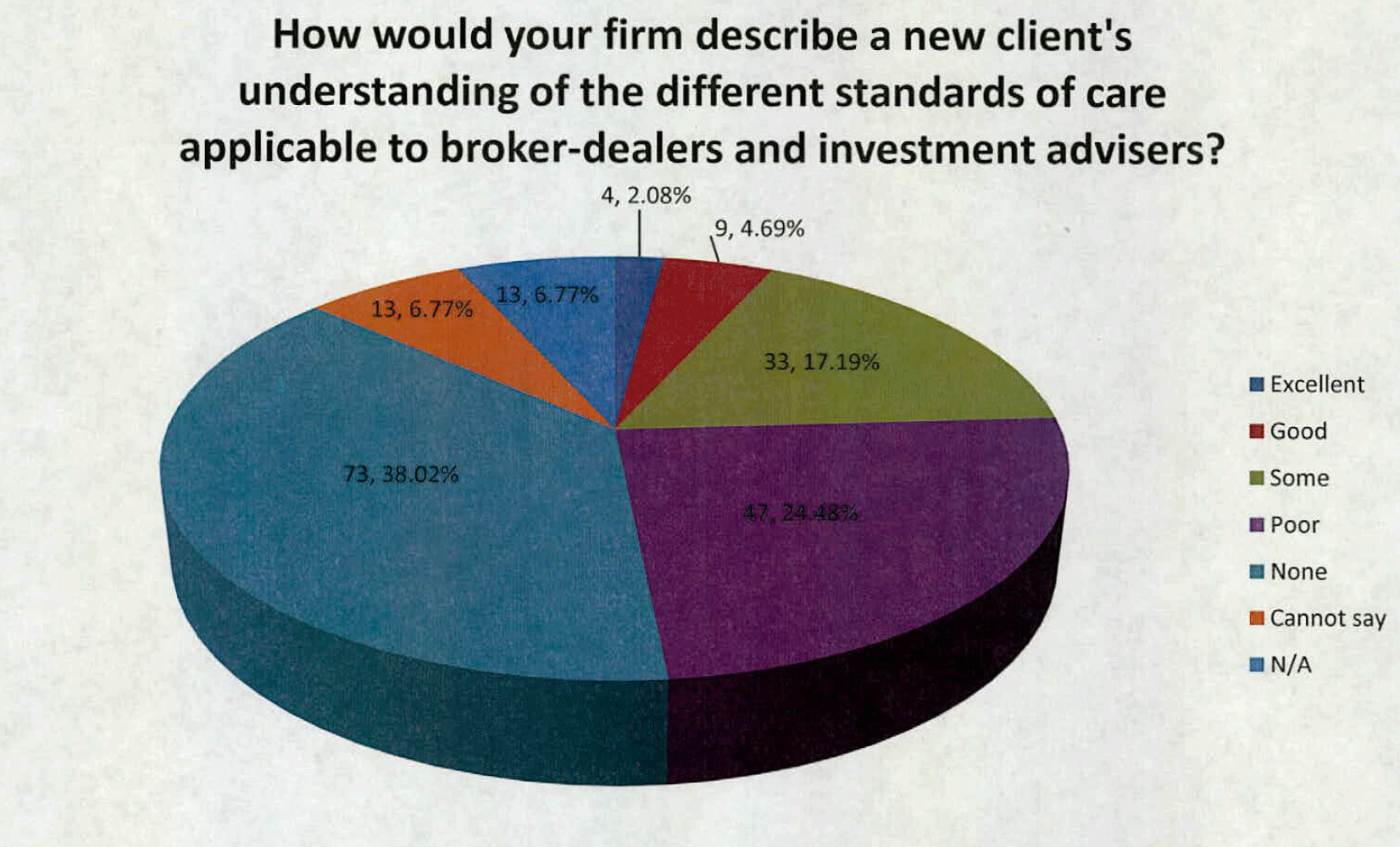

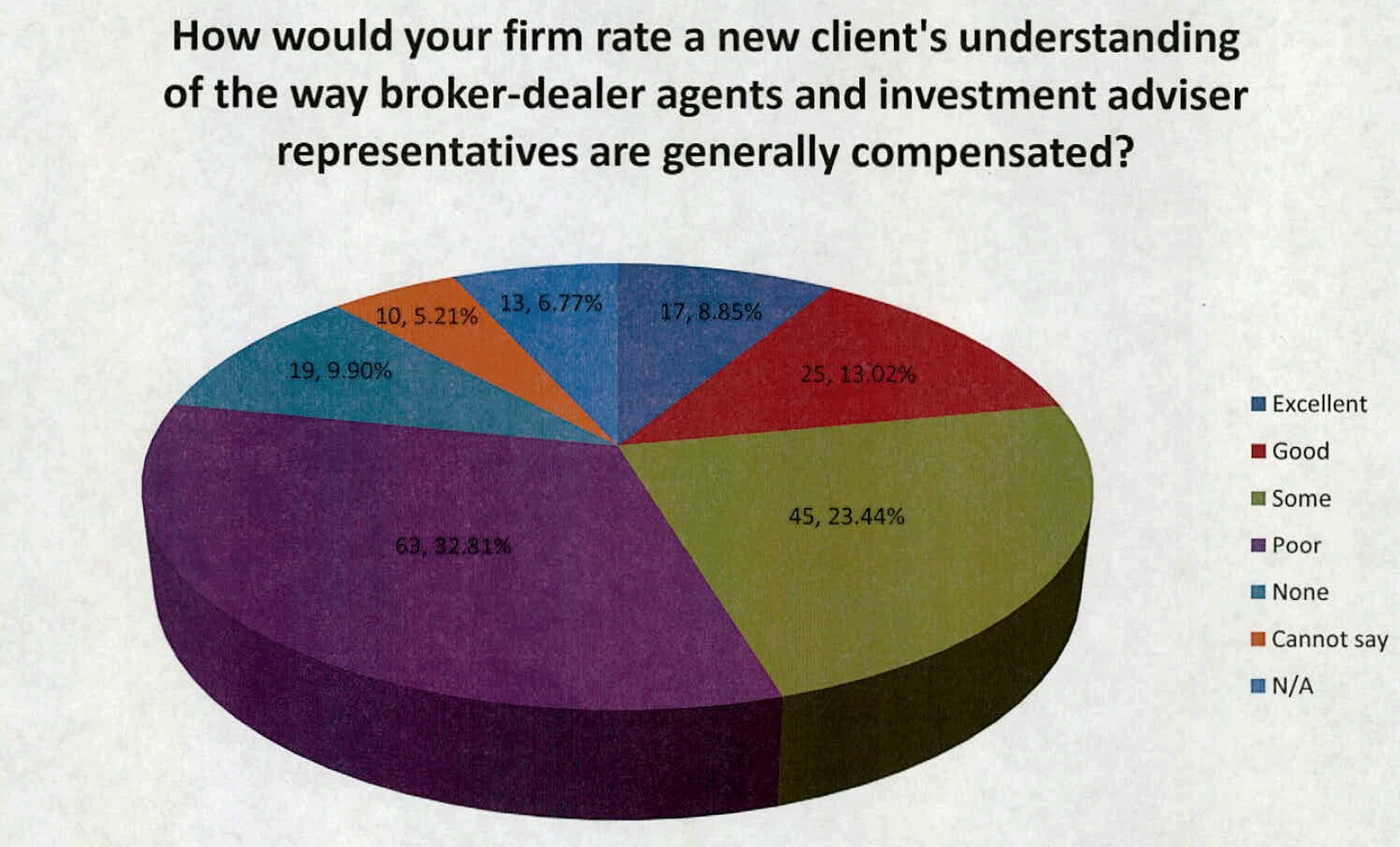

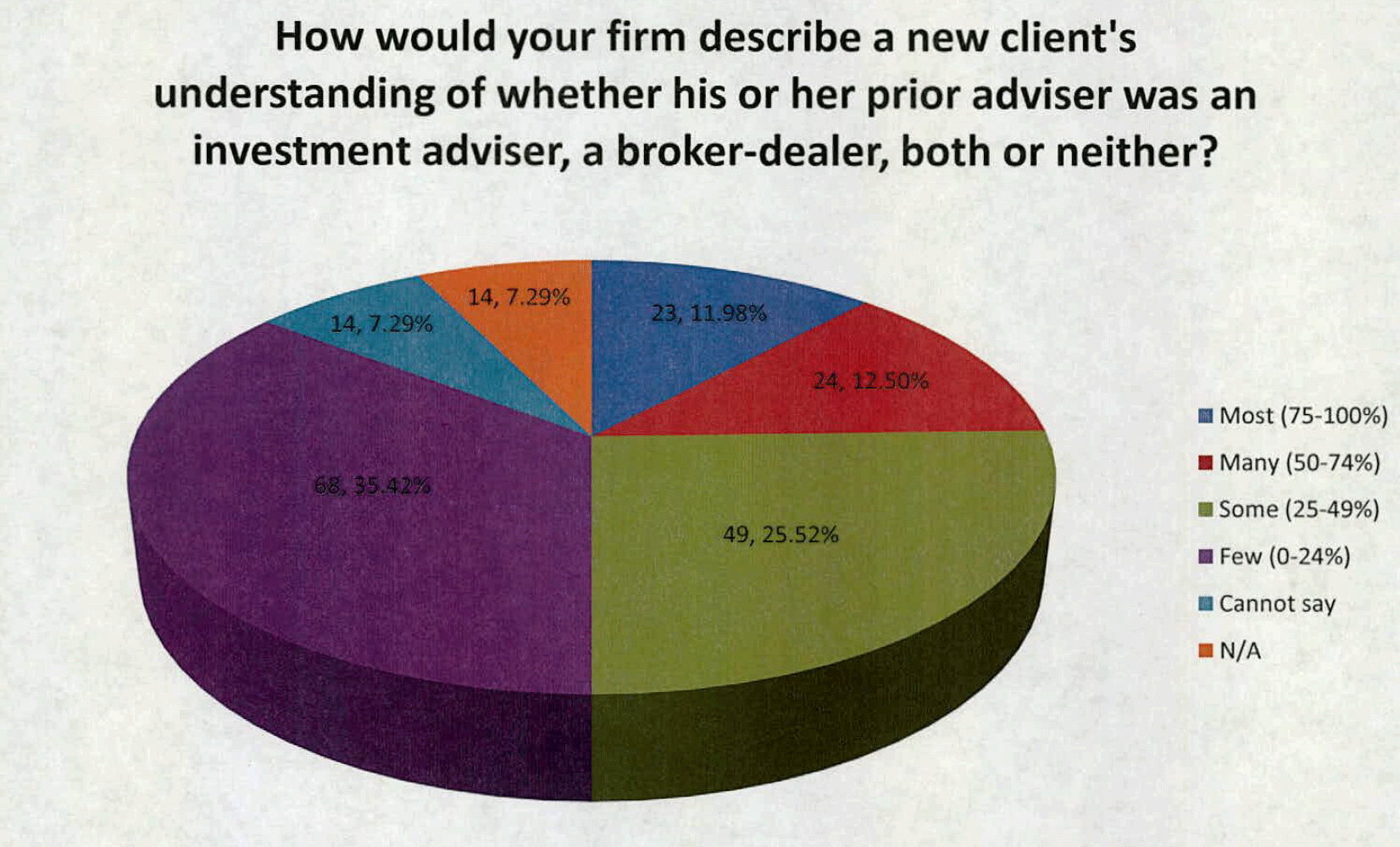

Survey results also suggest that investors may have a poor understanding of conflicts of interest and the duties owed by their financial professional. 76.56% (147) of investment advisers believed that their clients did not generally expect conflicts of interest to arise between themselves and their investment adviser. Furthermore, 62.5% (120) of investment advisers believed that their clients had either a poor or no understanding of the different standards of care applicable to broker-dealers and investment advisers. To that end, 42.71 % (82) of investment advisers believed that their clients had a poor or no understanding of the way broker-dealer agents and investment adviser representatives are compensated, and similarly, 60.94% (117) of investment advisers suggested that only "some" or "few" clients could identify whether the previous financial services professional they had hired was an investment adviser, broker-dealer, both, or neither.

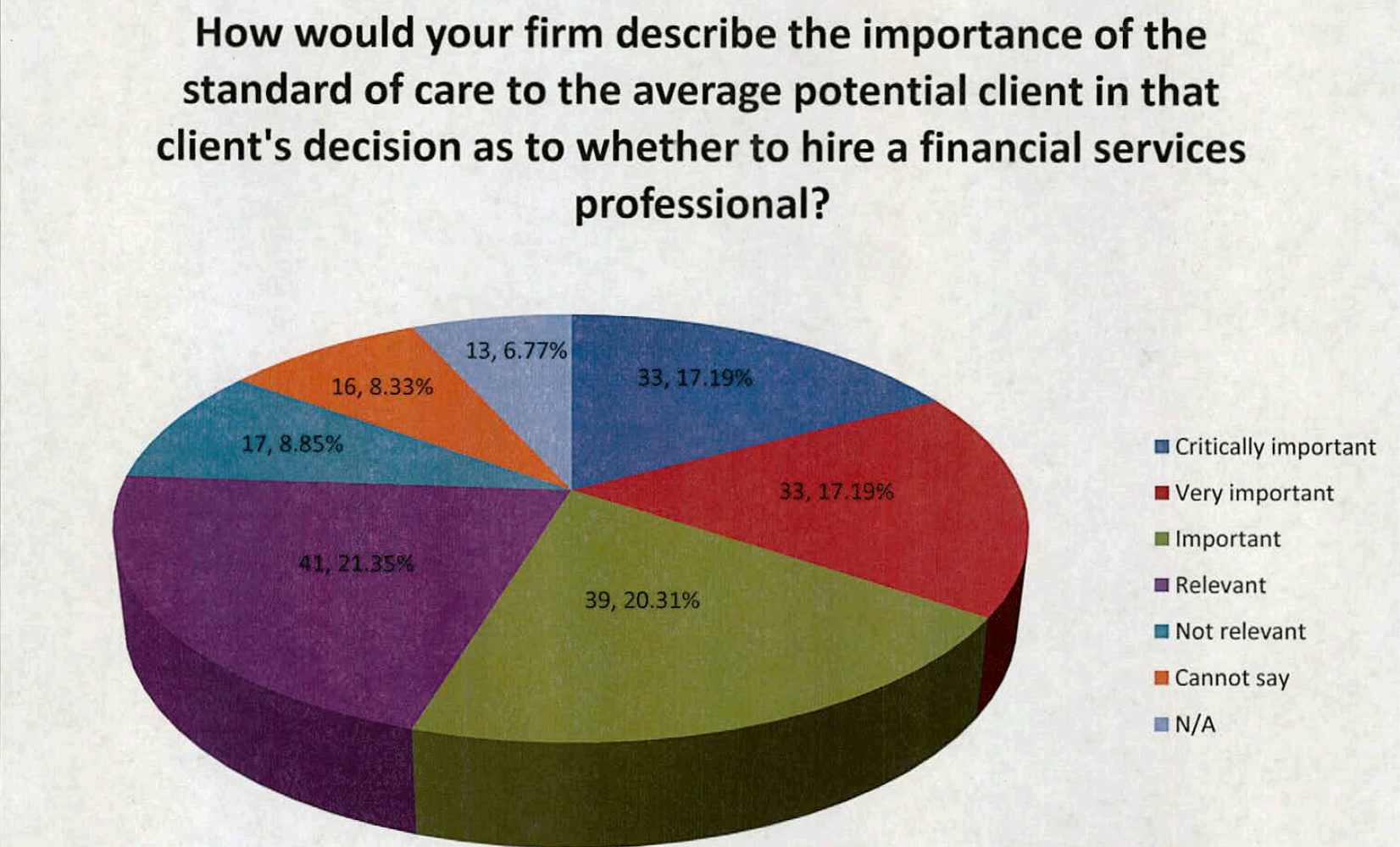

Finally, while investment advisers indicated that a significant number of investors did not understand the relevant standards of conduct, 54.69% (105) of investment advisers believed their clients considered the standard of care to be "important," "very important," or "critically important" in the client's decision as to whether to hire the financial services professional.

The Survey provided investment advisory firms the opportunity to offer narrative responses. The firms' responses varied considerably, but some trends and themes were clearly identifiable. Most significantly, investment advisers generally supported maintaining the fiduciary standard of care and disfavored a uniform standard that would be weaker than the current fiduciary standard required by the Investment Advisers Act of 1940.3 Many investment advisers also indicated experience dealing with both the fiduciary and suitability standards of care, and, as demonstrated by the representative quotation below, virtually all such advisers indicated their preference for a fiduciary standard:

... I was appalled by much of what I witnessed during my short stint [with a broker-dealer firm]. It's not the "suitability standard" but was not even close to what I believe a true fiduciary would do. I can't believe there is even a debate about this. If we are to be respected and trusted like doctors, lawyers and accountants, nothing short of a fiduciary standard will suflice for our industry. (Emphasis in original.)

Survey responses also reflected investment advisers' general concern that the fiduciary duty to which they arc subject may be weakened or changed. A significant number of advisers independently indicated that even if they were subjected to a standard such as the broker-dealer suitability standard, they would continue to hold themselves to the higher fiduciary standard.4 Other investment advisers commented on the value of a fiduciary standard to the services provided by a firm or the firm's decision making, 5 and some investment advisers also remarked that while the type of products emphasized.

3 A sample of representative quotations includes the following:

- "Why would anyone wish to lower the existing standards for [registered investment advisers]?? There is already a crisis of confidence regarding client perceptions of the industry. Better to raise [broker-dealers] and everyone else to the higher standard. Tougher for them but so what? Better for the industry, clients, and the country, period!" (Emphasis in original.)

- "Do not lower the standard for [registered investment advisers:] raise the standard for [registered representatives] to the same fiduciary standard." (Emphasis in original.)

4 representative quotation: " ... I believe in the fiduciary standard and would hold myself to this standard even if it were not legally required. I believe broker-dealers should be held to this standard too as good public policy."

5 A sample of representative quotations includes the following:

- "I believe the fiduciary responsibility is of the greatest importance. Advising a client with their best interest as # 1 priority is critical in establishing trust, then monitoring that trust."

- "Working as a fiduciary, you work to get the best return for the client; anything less than a fiduciary is never going to be in the public interes!.

- "My fiduciary duty to my clients is uppermost in my mind in all decisions concerning purchase & sale of securities in their accounts. It's hard to conceive how removal of a fiduciary duty could not adversely affect the performance of client accounts, generally speaking."

under a suitability standard may be more varied, that larger selection would not necessarily benefit the client.6 A number of investment advisers noted that the brokerdealer focus upon cost and reduced choices was less important than investor protection 7 Issues. The Division encourages readers of this report to examine the more comprehensive sampling of investment adviser commentary from the Survey, which is attached hereto at Exhibit 2.

Conclusion

The Division's Survey of Massachusetts-registered investment advisers paints a clear picture of the entities that would be impacted by any proposed change to the fiduciary standard. The Survey demonstrates that Massachusetts-registered investment advisers generally charge asset management fees and that neither they nor their representatives are also affiliated with a broker-dealer firm. Furthermore, these investment advisers serve a client base that is also consistent: college-educated individuals who are 50 or older with some investment experience and moderate risk tolerance that often do not understand the distinction between investment advisers and broker-dealers, instead believing that all financial professionals owe the same high-level duties to their clients and that their investment advisers will not face conflicts of interest while managing their investments. Through their comments in the Survey, Massachusetts-registered investment advisers universally speak highly of their responsibilities under the Investment Advisers Act of 1940, regularly indicating that the only standard under which they would like to and choose to operate is a fiduciary standard. The Division urges that the SEC strongly consider Massachusetts-registered investment advisers' views as it decides whether to implement any change in the standards applicable to financial professionals.

6 A sample of representative quotations includes the following:

- "My clients would likely have more selection of poor choices [under a broker-dealer], but not a smaller selection of better choices."

- "[The client] would have a greater choice of inferior options. What's the point of additional bad choices?" (Emphasis in original.)

- "There are more 'suitable' investments than those in [the] client's best interest."

7 A representative quotation: "The main concern is that regulators need to be loyal to the highest order cause of protecting the consumer. All the fuss by the [broker-dealer] industry about costs & reduced choices for the consumer that would arise if the suitability standard was removed needs to be analyzed from the point of view of the consumer, not the [broker-dealer] industry .... [D]isclosure does not resolve the conniet of interests issue. Such disclosures are usually lengthy, technical, & very hard for the lay person to understand.

Exhibit 1

Exhibit 2 - Other Selected Survey Quotations

Would your firm's fees be higher, lower or the same if your firm was operating undcr a broker-dealer suitability standard? Why or why not?

- "Lower. Right along with the firm's reputation."

- "I've been a registered investment adviser well before broker-dealers became involved. My fee is very reasonable: if 1 had to use a broker-dealer fcc platform in order for mc to maintain my earnings 1 would need to increase fees with the likely result of forcing me out of business."

Does an investment adviscr's fiduciary duty affect (whether it be positively or negatively) the services thc firm provides to investor accounts? Describe how the fiduciary duty affects or does not affect your firm's decision making and how similar decisions made while not subject to a fiduciary duty mayor may not differ.

- "Of course. Only broker-dealers will argue otherwise."

- "Unquestionably - 1 take utmost care in selecting trades, securities, limit order pricing etc. Suitability is carte blanche to do almost anything you can get away with. When working at a broker-dealer 1saw pcople harm their own grandparents under suitability - no exaggeration."

- "Our recommendations must always be the better or best choices for that client's c.ircumstances. It does not matter how we are paid. Once our compcnsation comes into the picture and alters our advice to pad our pockets, we have violated ethics, trust and common decency."

Can your firm resolve any conflicts of interest solely by disclosing them to the client?

- "Generally ycs as educating the client helps them become aware. However, that is not enough because of the complicated changing nature of the advisory business. Most clients will never understand the subtleties of the business."

- "Yes - but I don't think a client can fully undcrstand all the conflicts of interest inherent in the broker-dealer modeL"

Do your firm's clients generally expect that an investment adviser subject to a fiduciary duty may have conflicts of interest which put your firm's interests at odds with the client's interests?

- "Many of my clients are not that aware of the fiduciary standard."

- "I don't think many are very awarc of the issue."

- "Most clients do not understand 'fiduciary standard' at alL"

Describe any additional costs (administrative, regulatory, or otherwise) to investment advisers of providing personalized investment advice regarding securities to retail customers while subject to a fiduciary standard

- "My net cost is less than if I were going through a broker-dealer and having them take their pound of flesh. This results in a net lower cost to clients also,"

- "It is truly a tragedy that all costs continue increasing at such a rapid rate for advisers, especially small advisors who only provide good services to the average American trying to save for their futures, all while the industry fails to regulate the big guys from raping the system. Both dollars & time spent continue forcing the small producers out of business. After 27 years in business and at 62 years of age I feel like I have a target on my back."

How would your firm describe a client's ability to recover in a dispute based on similar facts and circumstances against either an investment adviser or a broker-dealer based on the different standards of care applicable to investment advisers or broker-dealers?

- "Much easier in my opinion under fiduciary to recover - even though incidence is less. Let's face it - there's a reason pure advisors look askance at the other side of the industry."

- "Has not happened to my firm, but I think it's quite prominently understood that suitability is a far lower bar to clear."

- "Clients can recover from a broker-dealer, so I don't think recovery is too much of an issue but I don't think the burden should be put on clients to pursue the time & money of recovery. Make it so recovery becomes less of an issue by fixing the system up front. 1. These are fiduciaries: (registered investment advisers). 2. These are not: (broker-dealers). 3. Here is what that means to you the client: buyer beware when dealing with broker-dealers!!!"

Would your finn's securities recommendations be the same if your firm was operating under a broker-dealer suitability standard? Why or why not?

- "Recommendations are likely different under a broker-dealer. Securities must first be approved by broker-dealer management and in many cases, such approval is only after "payola" has been given to upper-echelon broker-dealer management. Regardless as to investment suitability, the same management will pressure its reps to sell those investments regardless of suitability or potential risks. All they care about is getting cash/revenue dollars in as fast as possible. The "payola" often comes in from wholesalers whose firms do not have a large sales force at retail level. A few years ago I was affiliated with a broker-dealer that charged certain wholesalers as much as $50,000 in upfront cash to be given status as a "tier one" vendor at the broker-dealer's national convention. Broker-dealer managers in turn applied a lot of pressure on their registered reps to sell the investment products of "tier one" vendors before selling any other investments, If business was submitted for an investment in a security not with a "tier one" vendor, it was often rejected and the rep was told to go back to the client and try and get them to buy that alternative security from the "tier one" vendor instead. Looking back ...the broker-dealer has [had a number of] "tier one" vendors that either went bankrupt in recent years or came close to doing so ... [that were] all highly praised and recommended by the broker-dealer's managers."

- "The same. As an individual rep with a prior broker-dealer relationship, I always put the client's interests first. This is not the case with all broker-dealer reps."

- "If I operated under a broker-dealer, I would not be able to sleep at night. Most broker-dealers require a minimum # of trades in accounts - whether suitable to the client or not."

- "In my judgment no investment services should be exempt from a fiduciary standard. The cost of integrity and duty to client is minimal so all should be subjcct to that standard."

- "[The] broker-dealer would put pressure on me to sell more commission-based products that I don't believe in. This is why I left the broker-dealer world."

- " ...Let's be clear, though, we would never work in the broker-dealer environment because we value the objectivity of the fiduciary standard."

- "Yes, recommendations would be based on pushing certain products to clients to get higher payouts."

- "If compensated by commissions we would likely recommend as many 'suitable' transactions as possible."

- "I don't believe they would. Broker-dealer standard requires you to sell only what the firm approves - who decides that? I'm bombarded with phone calls by hundreds of wholesalers on a yearly basis soliciting my business, all based on commissions. While this may help with my life insurance business, it is a distraction to my advisor business as I will not utilize these products in my investment advisory accounts."

Would your firm's clients have more, less, or the same amount of choice with respect to securities offerings if your firm was operating under a broker-dealer suitability standard? Why or why not?

- "I believe that a client would have more choice to different classes of investments (i.e. UIT or Class B mutual fund shares) but more choice docs not necessarily mean better choice."

- "Less, because of a limited broker-dealer approval process; most often excluding securities that are 'no load' or do not pay hefty commissions."

- "Less, broker-dealers only push products that generate the most revenue to firm and principals of company. "

- "I would think less choice because my broker-dealer would have to approve the funds we used and often that limits the choices, mostly due to remuneration arrangements for the broker-dealer."

- "They may have more access to crappy proprietary products - but I never offered them."

Would your firm's expenses be higher, lower or the same if your firm was operating under a broker-dealer suitability standard? Why or why not?

- "Higher because of the imposed operational fees demanded by broker-dealer management."

- "Expenses would be higher because broker-dealer would want to get paid."

- "Much higher. AsI have said, the additional fees would push me out of the business. Keep things the way they are. You are making it tough for the little guy."

- "I would not go back to the broker-dealer setup since my clients have experienced that for the past 25+ years. Therefore I would leave the industry."

- "Higher because of expenses charged by broker-dealer. Ultimately passed to clients."

- "Higher - more transaction costs, % ofrevenue goes to broker-dealer."

- "Presumably higher because broker-dealers charge brokers for the privilege of licensing and impose substantial documentation requirements not necessary under the fee-only model'''

- "I feel the expenses would probably be higher at a broker-dealer as the investment adviser representatives have quotas to meet and larger overhead to meet."

- "Higher, as a broker-dealer could always raise fees and/or demand higher/more profit."

- "Our expenses would undeniably be higher. Having a broker-dealer suitability standard and rules-based approach will increase our firm's direct and opportunity costs. Processing large amounts of paperwork to demonstrate compliance would take time and money that could otherwise be directed to helping clients make the best financial decisions for them."

- "Probably more because the broker-dealer would most likely charge additional fees to operate."

How would your firm describe a new client's understanding of the different standards of care applicable to broker-dealers and investment advisers?

- "But suspect the average client's understanding of the difference is indistinguishable from zero."

- "Prospects that approach me want fee-only & independent; they don't understand fiduciary vs. suitability."

How would your firm rate a new client's understanding of the way broker-dealer agents and investment adviser representatives are generally compensated?

- "Most probably have little understanding unless they have been around a little."

- "Even if you're in the investment industry, until you actually work as a brokerdealer or investment adviser, it is hard to understand the differences in compensation. The investment industry is overly complex & opaque & ridiculous ... "

How important is the standard of care to the average potential client in that client's decision as to whether to hire a financial services professional?

- "Most clients are oblivious to the difference - they make their choice on 'trust' and sadly in my experience that trust is too often misplaced."

- "Hard to tell, most clients have an inadequate amount of financial education and info basis to assess cost, performance or standards of care."

- "Most clients don't know what a 'standard of care' is."

- "Not all clients are aware of it when they first come in."

- "Because they don't understand it."

- "Most clients do not understand the standard of care - they should be educated about the difference rather than try to blend the two standards."

- "Clients assume that all 'financial advisors' will only do what is best for them. Because of this, they think that this critically important factor is already answered in the affirmative. In fact, they don't have any idea that there are different standards of care."

- "But clients generally do not know about 'best interest' vs. 'suitable.''

Please provide any additional comments or eoncerns you wish to relay to the SEC as it considers the role of the fiduciary standard and applicability to the financial services industry.

- "We believe broker-dealers should be held to a fiduciary standard as we don't believe our clients and prospects understand broker-dealers are held to a lesser standard. Additionally, we believe clients would be better served and thus better off if broker-dealers and investment advisers were held to the same, higher standard."

- "As a registered representative for the past 31 + years, I feel all professionals who hold themselves as financial advisors should be held accountable and should come under the role of any fiduciary standard."

- "I would like to say it's obvious that I have a low opinion of the broker-dealer business - but that would be too complimentary. This business needs an immediate overhaul."

- " .. .I don't believe any advisor working on commission can uphold a fiduciary standard even when disclosing potential conflicts of interest."

- "If you were having a heart transplant, would you want the highest level of care and product or would you rather it just be suitable[?] Clients assume brokerdealers and investment advisers are all fiduciaries. They have no idea there's a difference."

- "I think it is accurate to say that all of my clients have selected me because they have made a judgment that they can trust me. This judgment was likely made in the context of knowing that there is some regulatory oversight, but I rather doubt they made the distinctions you suggest. It would probably be useful for regulators to promulgate a single standard. It should NOT be a safe harbor, however."

- "For individual investors, we should demand the highest standard of care. People just aren't adequately sophisticated to apply a rigorous level of oversight to what are fairly complex areas. Suitability should be applied to clients who demonstrate a much higher level of understanding than that possessed by a typical client."

- "Changes that benefit the broker-dealers at the expense of investment advisers and clients and the public are reprehensible. The considered changes will drive many small investment advisers out of business and broker-dealers will be able to enlarge their practices. The loss of investment advisers will restrict the choices of the public."

- "Most clients have no clue about the 2 different standards and what that means to them or how it works. It should be one set of rules for everyone and it should be a fiduciary standard."

- "I have been in the financial industry since 1979 - with a broker-dealer since 1982 - J found broker-dealer's interest was always on commissions coming in and little, if any, on portfolio management or clients' individual needs. As an investment adviser it is much better for clients and their needs not the firm. That is why the first client I wrote a met policy in J 998 is still with me. I always found brokerdealers and their clearing house placed the client second to their income flow, not the other way around."

- "During my 40+ years of practice, currently as a registered advisor (fee only) and in the past as a registered representative for a broker-dealer, the clients' interest has been best served by the fiduciary standard. It takes all conflicts which could have a negative outcome and unnecessary additional cost because of investment product choice to suit the broker-dealer out of consideration."

- "The present environment which allows brokers to also be investment advisor representatives serves to virtually negate the potential advantage of an investment advisor being perceived by the public as advantageous as compared to a broker. At a minimum any 'advisor, broker, etc.' that is being compensated to sell product should be forced to do that work under a regulatory title other than 'advisor' such that the distinction between product sales and unbiased advice is clear. The retail broker-dealer business model of securities distribution is a dinosaur which should be long extinct. The fact that it is not appears to be due only to lack of regulatory focus to bring about its end. (In our humble opinion.)"

- "Without fiduciary standard clients have very little protection. Disclosure makes little difference as clients don't understand it. Many investors assume a fiduciary approach, and they should receive it."

- "I worry that a new set of rules will not be strong enough to protect the public. A strong and clear fiduciary standard needs to be used to protect the public. Any new standard should not water down the current standard under which investment advisers currently function."

- "If we have to file under a broker-dealer requirement, we will shut down our firm. "

- "I firmly believe all advisors should be held to the fiduciary standard and clearly salespersons should be held to a different standard. Clients need to understand & respect the difference an advisor cannot serve two (2) masters. Personally, as a former broker, I would have not stayed in the business as a broker, as I don't feel I could treat my clients fairly. On the other hand, I understand the need for beginning persons in the industry to have the support of a good firm where they can learn the business."

- My biggest concern is that the current fiduciary duty will be watered down which is not in the best interests of the public. Brokers are already getting around this by farming out management to SMAs & other investment advisers who are subject to the duty. The standard should be strengthened, not weakened. If you lower the standard the consumer will be hurt because people like myself who take the fiduciary duty very seriously would no longer be able to distinguish themselves which would mean consumers would not have a choice in the level of care owed to them. If it's all suitability then it all comes down to greed & the profit motive. Once I educate the prospect on the difference they understand that they should only work with an investment adviser because we are in their corner."

- " ... I think the form of compensation is more important to potential or existing clients than is the standard of care. Most clients see a greater potential for conflicts of interest where compensation is commission/transaction-based as is typically the case in a broker-dealer setting where only a suitability standard applies. Most clients perceive clearly that investment advisers are not motivated by the commission-generating aspect of 'salcs' advice but by thc pursuit of the best results over time, which is an approach under the fiduciary standard that is more likely to be aligned with the client's best interests. Looking broadly at the overall issue of standards, complying with a suitability standard is only one aspect of complying with a fiduciary standard because the latter is more stringent, meaningful, and all-encompassing. A fiduciary standard is a golden rule 'do unto othcrs .. .' approach whereas a suitability standard is closer to a caveat emptor approach, i.e., 'you can sell it if it fits.' I hope a fiduciary standard is applied across the board to govern broker-dealer reps as well as investment advisers, but in doing so I hope that unnecessary additional suitability-standard rules aren't piled on top of the fiduciary standard regulatory regime, making investment adviser compliance muddier and more costly."

- "Don't let the broker-dealers' lobbyists bully or charm you into backing down on the fiduciary standard!!! Yes or no to broker-dealer fiduciary standard but no 'switching hats' with clients. Either one or the other. Broker has to pick one & be that one to all his/her clients."

- "I believe trying to make the same standard of care apply to both fee-only investment advisors/planners and broker-dealer reps will only cloud the issue and confuse the public more. It will water down the standard to a meaningless level. How can someone who can only make money by selling products or gathering assets give truly independent, fiduciary advice? Or provide services that clients necd that are not related to investing?"

- "We would be for allowing the fiduciary standard for investment advisers to stand. We believe it is in the ultimate long-term interest for our clients, and affords them additional protection. It also promotes choice for investors among firms and differentiates approach. We feel this is validated by the trend toward investment advisers and away from broker-dealers for active investment management. Many potential clients are considering our services because they have had below market index returns from mutual funds and other broker-dealer

- favored investment vehicles. I believe the fiduciary standard promotes a higher, more active level of due diligence by investment advisers to benefit investors, and removes the bias they would direct clients to higher compensation investment vehicles."

- "The firm supports applying the fiduciary standard with retail investors regardless of whether they work with an investment adviser or a broker-dealer." "We believe all investment professionals should be held to the fiduciary duty standard. "

- "It is in the best interest of consumers that all financial professionals be subjcct to a fiduciary standard (not just a 'suitability' standard). Consumers today do not understand that there are even two different standards in existence. Their expectation (even if they do not use the industry jargon) is that advice provided should be in their own best intercst. The financial services industry has a bad reputation, in general, due to the low bar of merely 'suitability.'"

- "All should be fiduciaries!" In my experience the general public does not know the difference between the 'suitability standard' of the broker-dealer and the fiduciary standard of the investment adviser. They think both are operating in their interest. I've never received any conflict of interest information from a broker-dealer!!"

- "I think that any reduction of the standard of care for investment advisers would adversely affect clients by making it more difficult to find trusted advisers who will work in their best interests. Most people do not understand the diffcrence in the standards, but when it is explained, it becomes a determining factor in selecting an adviser."

- "Our investment advisory firm was founded by an investment professional who was extremely dissatisfied with the large broker-dealer wirehouse experience and with the value he could provide to his clients while at the wirehouse. The endless processing of large amounts of supervisory paperwork had little, if anything, to do with promoting bettcr investment or financial outcomes for clients. Any 'harmonization' that would bring the onerous reporting and disclosure requirements of broker-dealers to investment advisers would be a major step in the wrong direction and one that our firm, and more importantly, our clients, vehemently oppose."

- "The next financial crisis will involve broker-dealer services that arc fee-based and purport to offer independent investment management services. Investment banking products will be purchased in these portfolios regardless of their suitability. Their investment management accounts will be viewed as a channel of distribution by the broker-dealers."