Accessible Version of PDF: HS-White-Paper-12-08-16

REPORT

Massachusetts Securities Division’s Sweep of Select Broker-Dealers that Hire Bad Agents

Executive Summary

The Registration, Inspections, Compliance and Examinations (RICE) Section focuses on the registration and regulation of broker-dealers and broker-dealer agents, investment advisers and investment adviser representatives, and exempt reporting advisers. All firms and individuals offering and selling securities or investment advice on securities for compensation in the Commonwealth must apply for registration with, or provide other notice to, the Massachusetts Securities Division unless an exemption is available.

In March 2016, The Market for Financial Adviser Misconduct study by Mark Egan, Gregor Matvos, and Amit Seru tackled the well-known yet rarely addressed issue of continued employment of broker-dealer agents with histories of misconduct.1 The study focused on both the prevalence of agent misconduct in the industry and the role brokerdealer firms play in facilitating new misconduct by employing these agents.

On June 6, 2016, the RICE Section sent an inquiry (the “Letter”) to 241 Massachusetts registered broker-dealer firms.2 The firms within this pool were selected because each had employed at least ten agents registered in Massachusetts and employed a higherthan- average percentage of Massachusetts-registered agents with at least one current misconduct disclosure (a “Disclosure Incident”) on their records. The average percentage of Massachusetts-registered agents employed with at least one Disclosure Incident at all broker-dealer firms doing business in Massachusetts, regardless of size, was about 15% as of June 2016.

The Letter consisted of three questions requesting information on the broker-dealer’s hiring practices, the broker-dealer’s vetting of candidates, the number of agents hired with Disclosure Incidents, the number of agents with Disclosure Incidents placed on heightened supervision, and the broker-dealer’s written supervisory policy and procedures on hiring agents with Disclosure Incidents.

Key Findings

Broker-dealers are conducting more background checks due to FINRA Rule 3110(e) which became effective on July 1, 2015.3 Every broker-dealer queried confirmed that it conducts background checks on the agents hired. For the most part, the brokerdealers’ background checks consist of searching publicly available data, verifying

1 See Mark Egan, Gregor Matvos & Amit Seru, The Market for Financial Adviser Misconduct (March 1,2016) (available at ssrn.com/abstract=2739170 or dx.doi.org/10.2139/ssrn.2739170).

2 The 241 Massachusetts-registered broker-dealer firms include firms whose main address is not located in Massachusetts.

3 See FINRA Regulatory Notice to Members 15-05, Background Checks (available at: www.finra.org/sites/default/files/notice_doc_file_ref/Notice_Regulatory_15-05.pdf).

information submitted on the agent’s Form U4, conducting credit checks, checking criminal databases, or requesting that candidates fill out a firm questionnaire regarding the agent’s past. In addition, the vast majority of the broker-dealers have written policies and procedures regarding hiring agents with Disclosure Incidents.

Notwithstanding the broker-dealer’s background checks and written policies and procedures, the data from the majority of the broker-dealer firms queried showed that 18.13% of the total agents hired had Disclosure Incidents. More concerning is that the rate at which a subset of the broker-dealers hire agents with Disclosure Incidents has slightly increased. A subset of the broker-dealers responded that in 2014 a total of 12,039 agents were hired, 1,925 of which had a Disclosure Incident (15.99%); in 2015 a total of 13,059 agents were hired, 2,169 of which had a Disclosure Incident (16.61%); and 5,093 agents were hired in the first six months of 2016, 888 of which had a Disclosure Incident (17.44%).

This report’s most troubling finding is that while broker-dealers are continuing to hire agents with Disclosure Incidents, the vast majority of these agents are not placed on heightened supervision. Of the 8,584 agents broker-dealers hired with Disclosure Incidents, only 6.03% were placed on heightened supervision, leaving 93.97% of agents with Disclosure Incidents not subject to heightened scrutiny. A subset of the brokerdealers responded that of the 1,925 of agents hired in 2014 with Disclosure Incidents, only 4.05% were placed on heightened supervision; of the 2,169 agents hired in 2015 with Disclosure Incidents, only 5.21% were placed on heightened supervision; and of the 888 agents hired during the first six months of 2016 with Disclosure Incidents, only 6.42% of those agents were placed on heightened supervision.

Heightened supervision requires a firm to monitor and mitigate the known risks that agents with Disclosure Incidents may pose to investors. Implicit in heightened supervision is the broker-dealer’s willingness to accept the responsibility to monitor and protect investors from harm from potential repeat offenders. While the year to year numbers provided by a subset of the broker-dealers that showed an increase of the number of agents placed on heightened supervision is encouraging, overall the report found a presumption that broker-dealers failed to take on the responsibility to place agents on heightened supervision when hiring agents with Disclosure Incidents.

BROKER-DEALER HIRING PRACTICES FINDINGS

The RICE Section

The Registration, Inspections, Compliance, and Examinations (“RICE”) Section of the Massachusetts Securities Division (“Division”) is tasked with registering those seeking to do securities-related business in Massachusetts, and reviewing their applications for registration. Broker-dealer firms submit thousands of applications to register their agents (also referred to as representatives4) in Massachusetts every year. For example, in the first three-quarters of 2016, over 29,000 applications were submitted by broker-dealers on behalf of agents in Massachusetts.

To apply for registration as a broker-dealer agent in Massachusetts, the employing broker-dealer submits application on the Uniform Application for Securities Industry Registration or Transfer (“Form U4”) with the Financial Industry Regulatory Authority (“FINRA”). On the Form U4, an applicant must answer Section 14, Disclosure Questions, regarding involvement in events such as criminal events, complaints from customers, regulatory actions, and bankruptcies (“Disclosure Incidents”). More often than not, the discovery of a Disclosure Incident on an applicant’s Form U4 will result in an additional review of the applicant’s background by the RICE Section. Form U4 information, among other things, is stored on the Central Registration Depository (the “CRD”). The CRD is FINRA’s registration database, and it is accessible to state securities regulatory agencies for their reviews of agents applying for registration. Disclosure Incidents are categorized as either Current or Historic/Archived 5 on the CRD. Current Disclosure Incidents tend to be comparatively more recent and more serious. Disclosure Incidents are available to the investing public by either contacting a state securities regulator or conducting a search on FINRA’s BrokerCheck.

4 The term “representative” used herein carries the meaning of the term defined in NASD Rule 1031(b) that states:

Persons associated with a member, including assistant officers other than principals, who are engaged in the investment banking or securities business for the member including the functions of supervision, solicitation or conduct of business in securities or who are engaged in the training of persons associated with a member for any of these functions are designated as representatives.

NASD Rule 1031(a) requires that each representative be registered.

5 For example, FINRA Rule 8312(b)(2)(G) defines historic customer complaints as:

Historic Complaints (i.e., the information last reported on Registration Forms relating to customer complaints that are more than two (2) years old and that have not been settled or adjudicated, and customer complaints, arbitrations or litigations that have been settled for an amount less than $10,000 prior to May 18, 2009 or an amount less than $15,000 on or after May 18, 2009 and are no longer reported on a Registration Form), provided that any such matter became a Historic Complaint on or after August 16, 1999;

Prior Study on Broker-dealer Hiring Practices

In March 2016, a study titled The Market for Financial Adviser Misconduct, authored by Mark Egan, Gregor Matvos, and Amit Seru tackled the well-known yet rarely addressed issue of continued employment of broker-dealer agents with histories of misconduct.6 The study identified that agents of broker-dealer firms that have been the subject of misconduct-related disclosures are five times more likely to be involved in another incident alleging misconduct than agents who have never been the subject of a misconduct disclosure. The study also showed that not only do broker-dealers continue to hire agents with Disclosure Incidents; it showed that some broker-dealers specialize in hiring agents having Disclosure Incident histories. The RICE Section undertook an inquiry of select broker-dealers registered in Massachusetts to better understand how these hiring practices impact Massachusetts investors and to determine whether brokerdealers have in place adequate policies and procedures to provide reasonable assurance that Massachusetts investors are protected from recidivist agents.

The RICE Section’s Inquiry Letter

On June 6, 2016, the RICE Section sent out an inquiry letter (the “Letter”) to 241 Massachusetts-registered broker-dealer firms.7 The firms within this pool were selected because each had hired and employed at least ten Massachusetts-registered agents, and had employed a higher-than-average percentage of Massachusetts-registered agents with at least one Disclosure Incident on their Form U4s. The average percentage of Massachusetts-registered agents employed with at least one Disclosure Incident at all broker-dealer firms doing business in Massachusetts, regardless of size, was about 15% as of June 2016.

The Letter required that the broker-dealer firms provide the following information from the time period of January 1, 2014, up to and including the date of the Letter, June 6, 2016 (the “Relevant Time Period”).

- For each year or part thereof of the Relevant Time Period, provide a chart with the following information:

- the number of representatives your firm hired;

- the number of representatives your firm hired with at least one Current Disclosure Incident at the time of the representative’s hire;

- the number of background checks run by your firm on individuals in connection with your firm’s consideration of those individuals’ candidacy for employment as representatives;

- the number of individuals your firm considered for employment who were not offered employment as a representative specifically because of the individual’s Current Disclosure Incident(s);

- the number of representatives terminated by your firm because the representative incurred at least one Current Disclosure Incident during that calendar year; and

- the number of representatives your firm placed on heightened supervision as a condition of a representative’s employment with your firm as the result of a Current Disclosure Incident.

- Provide a detailed description of your firm’s representative hiring process. A complete response shall include, but is not limited to, how a potential representative applies for employment, what documentation your firm reviews in considering a potential representative, the factors your firm uses to evaluate the potential representative, and how the firm makes the determination to hire the potential representative.

- Provide a copy of your firm’s policies and procedures relating to the hiring of representatives with Current Disclosure Incidents.

6See Mark Egan, Gregor Matvos & Amit Seru, The Market for Financial Adviser Misconduct (March 1, 2016) (available at http://ssrn.com/abstract=2739170 or http://dx.doi.org/10.2139/ssrn.2739170).

7The 241 Massachusetts-registered broker-dealer firms include firms whose main address is not located in Massachusetts.

RESPONSES AND RESULTS

All 241 broker-dealers provided a response to the Letter. Some firms, however, provided incomplete or non-responsive information to some or all items in the Letter. Nevertheless, the information collected by the RICE Section provides sufficient data to establish a sound vantage point from which to view and interpret the hiring practices of this critical segment of broker-dealer firms.

This analysis will first address the broker-dealer’s hiring practices with regard to background checks. It will then discuss whether broker-dealers had policies and procedures on hiring agents with current Disclosure Incidents. Finally, it will examine the numerical data received in response to the number of agents hired, number of agents hired with Disclosure Incidents, and number of agents hired with Disclosure Incidents placed on heightened supervision.

Response to Item 2:

Broker-Dealer Background Checks

Every broker-dealer responding to the Letter confirmed that it vets the agents it hires by conducting background checks. For the most part, the broker-dealers queried conduct background checks by searching publicly available data, verifying information submitted on the agent’s Form U4, conducting credit checks, checking criminal databases, or requesting that candidates fill out a firm questionnaire regarding the agent’s past.

On July 1, 2015, FINRA made effective a change to its Rule 3110(e).8 This change stated, in part, that FINRA member firms were required to maintain written procedures to verify information reported on its agent’s Form U4, and that a search of reasonably available public records needed to be included in these procedures.

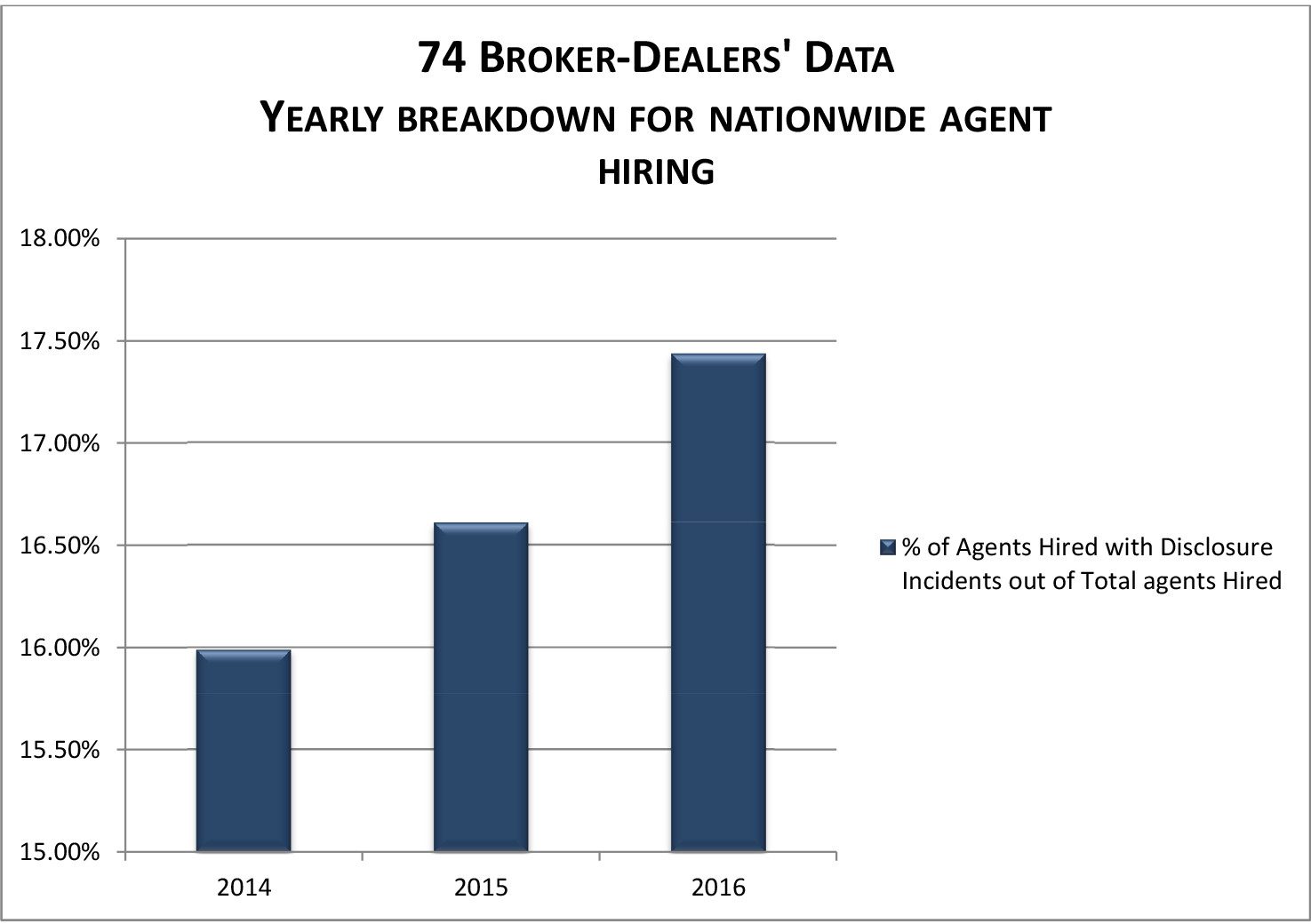

From a subset of the data received in response to Request No. 1c, it appears there was an increase in the number of background checks conducted by broker-dealers on the agents considered for employment during the Relevant Time Period. Despite the increase in background checks allowing broker-dealers to learn more about the agents being hired, especially those with Disclosure Incidents, the number of agents with Disclosure Incidents hired increased at a steady, if not slightly increased, rate. See Figure 4.

8 See FINRA Regulatory Notice to Members 15-05, Background Checks (available at: http://www.finra.org/sites/default/files/notice_doc_file_ref/Notice_Regulatory_15-05.pdf).

Response to Item 3:

Broker-Dealer Written Policies and Procedures Relating to Hiring of Agents with Current Disclosure Incidents

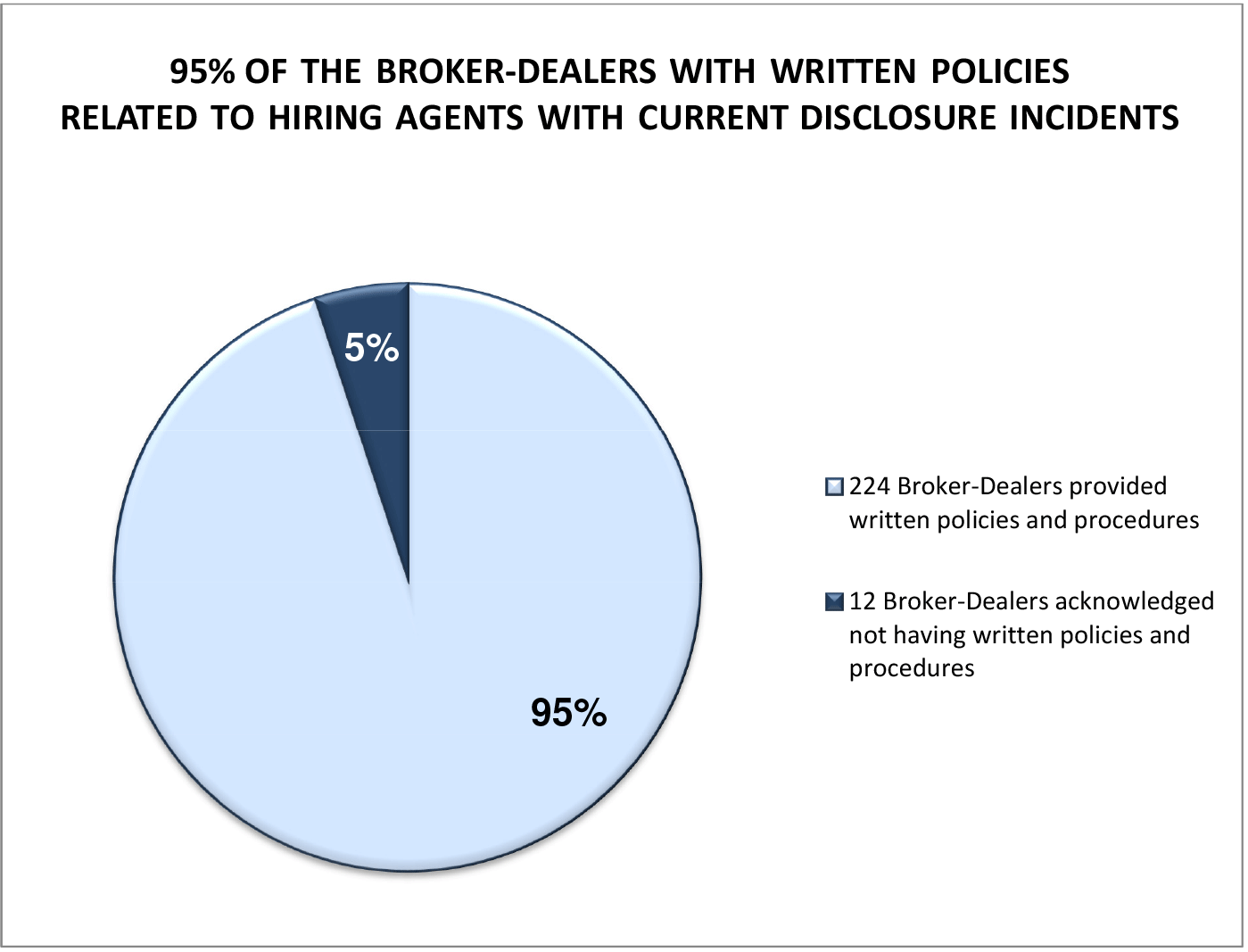

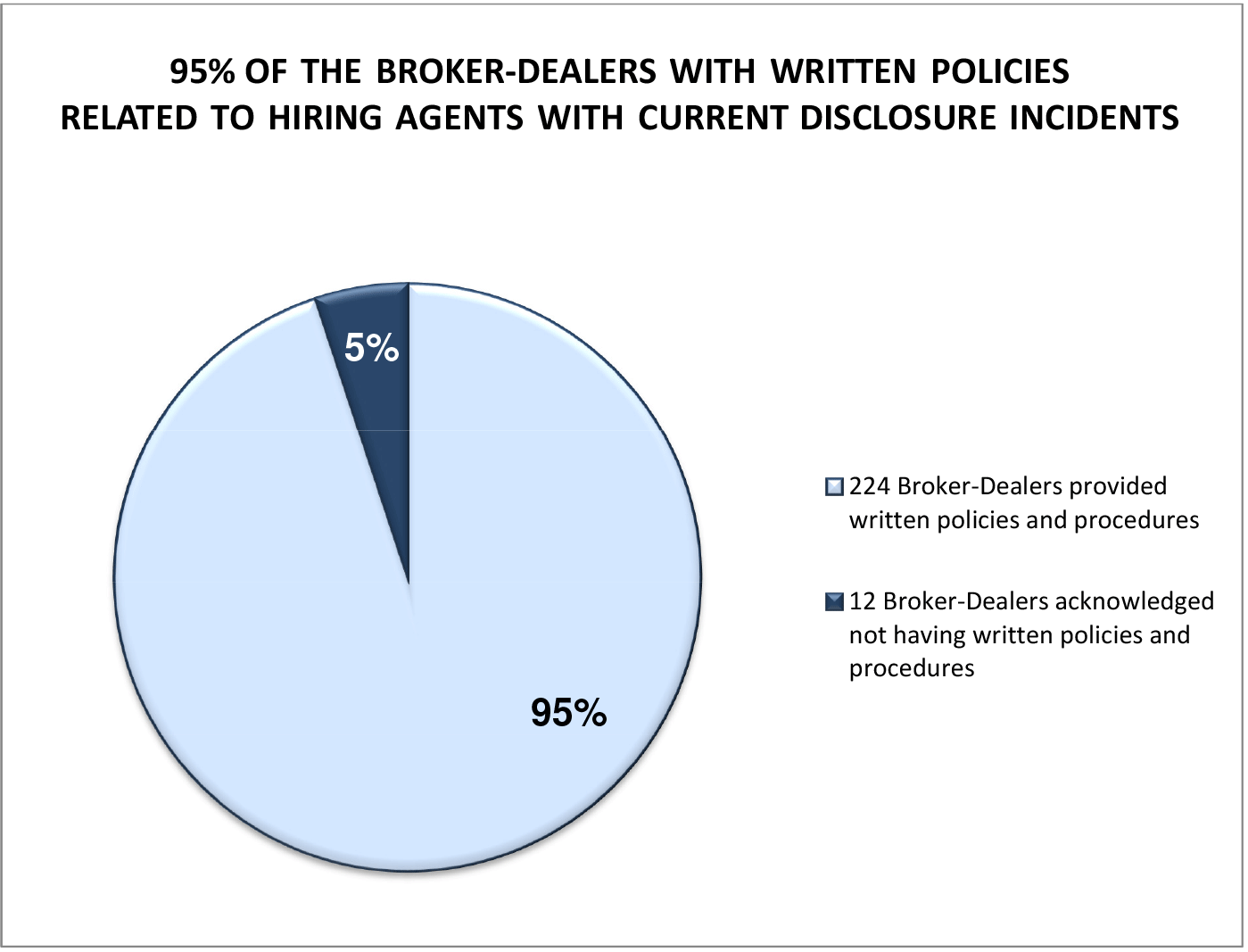

236 of the broker-dealers queried provided a response to Item 3. While nearly all broker-dealers that provided a response provided written policies and procedures, twelve broker-dealers acknowledged not having written policies and procedures with respect to hiring agents with current Disclosure Incidents.

Response to Item 1:

Of the 241 responses received, 183 broker-dealers provided responsive data for all subsections of Item 1 during the Relevant Time Period regarding their nationwide hiring practices.

Broker-Dealers Hiring Agents with Disclosure Incidents

The data collected clearly demonstrates that broker-dealers hire agents with Disclosure Incidents. See Figure 3. Notwithstanding the broker-dealers’ background checks and written policies and procedures, the data from the majority of the broker-dealer firms queried showed that of the 47,340 total agents hired during the Relevant Time Period, 18.13% of those agents had Disclosure Incidents. More concerning is that the rate at which a subset of the broker-dealers hire agents with Disclosure Incidents has slightly increased. See Figure 4.

Of the 183 broker-dealer responses:

- 74 broker-dealers provided data for each calendar year in the Relevant Time Period.

- 109 broker-dealers provided total data for the Relevant Time Period.

It is clear from Figure 4 that for broker-dealers that provided year over year statistics, the percentage of total agents hired with Disclosure Incidents has moderately increased.

- Of the 12,039 agents hired in 2014, 1925 (15.99%) had Disclosure Incidents.

- Of the 13,059 agents hired in 2015, 2,169 (16.61%) had Disclosure Incidents.

- Of the 5,093 agents hired in the first half of 2016, 888 (17.44%) had Disclosure Incidents.

The remaining 109 broker-dealers provided the requested data as one number for the entire Relevant Time Period.

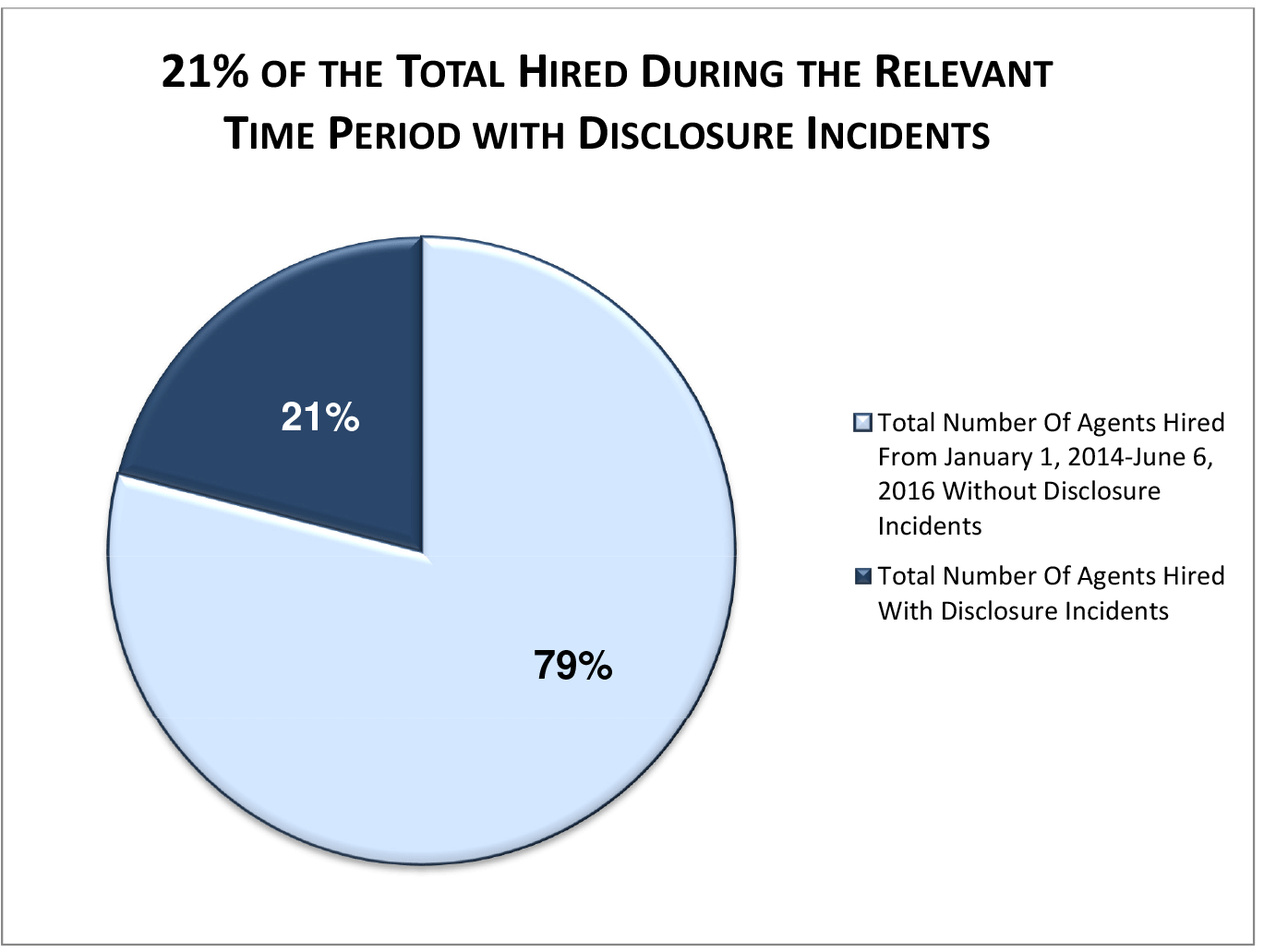

Figure 5 shows that of the 17,149 agents hired during the Relevant Time Period by these 109 broker-dealers, 21% of those agents had Disclosure Incidents.

Agents Hired with Disclosure Incidents Placed on Heightened Supervision

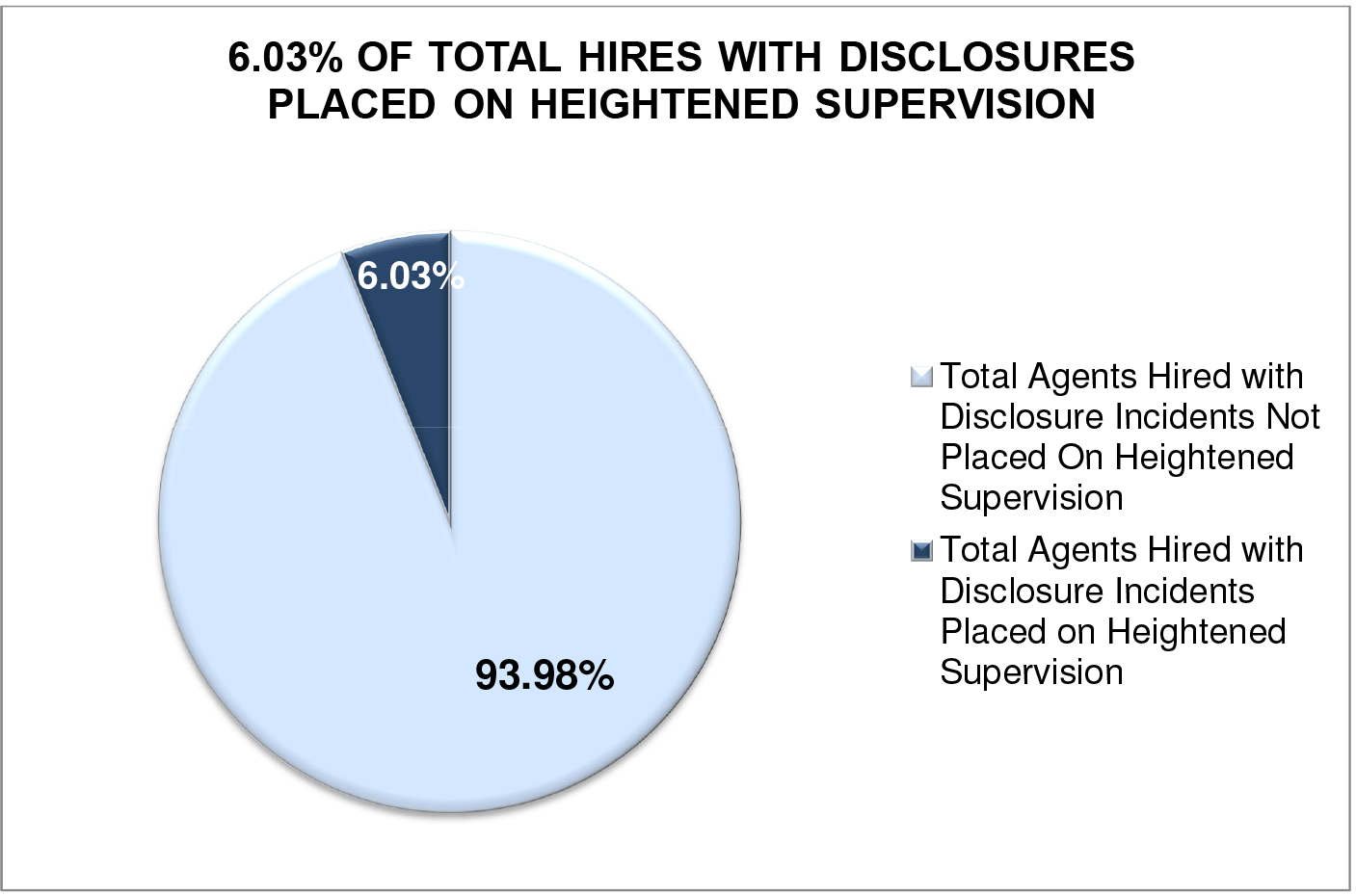

This report’s most troubling finding is that while broker-dealers are continuing to hire agents with Disclosure Incidents, the vast majority of these agents are not placed on heightened supervision. Of the 8,584 agents broker-dealers hired with Disclosure Incidents, only 6.03% were placed on heightened supervision, leaving 93.97% of agents with Disclosure Incidents not subject to heightened scrutiny. See Figure 6.

6.03% of the total agents hired with Disclosure Incidents during the Relevant Time Period were placed on heightened supervision

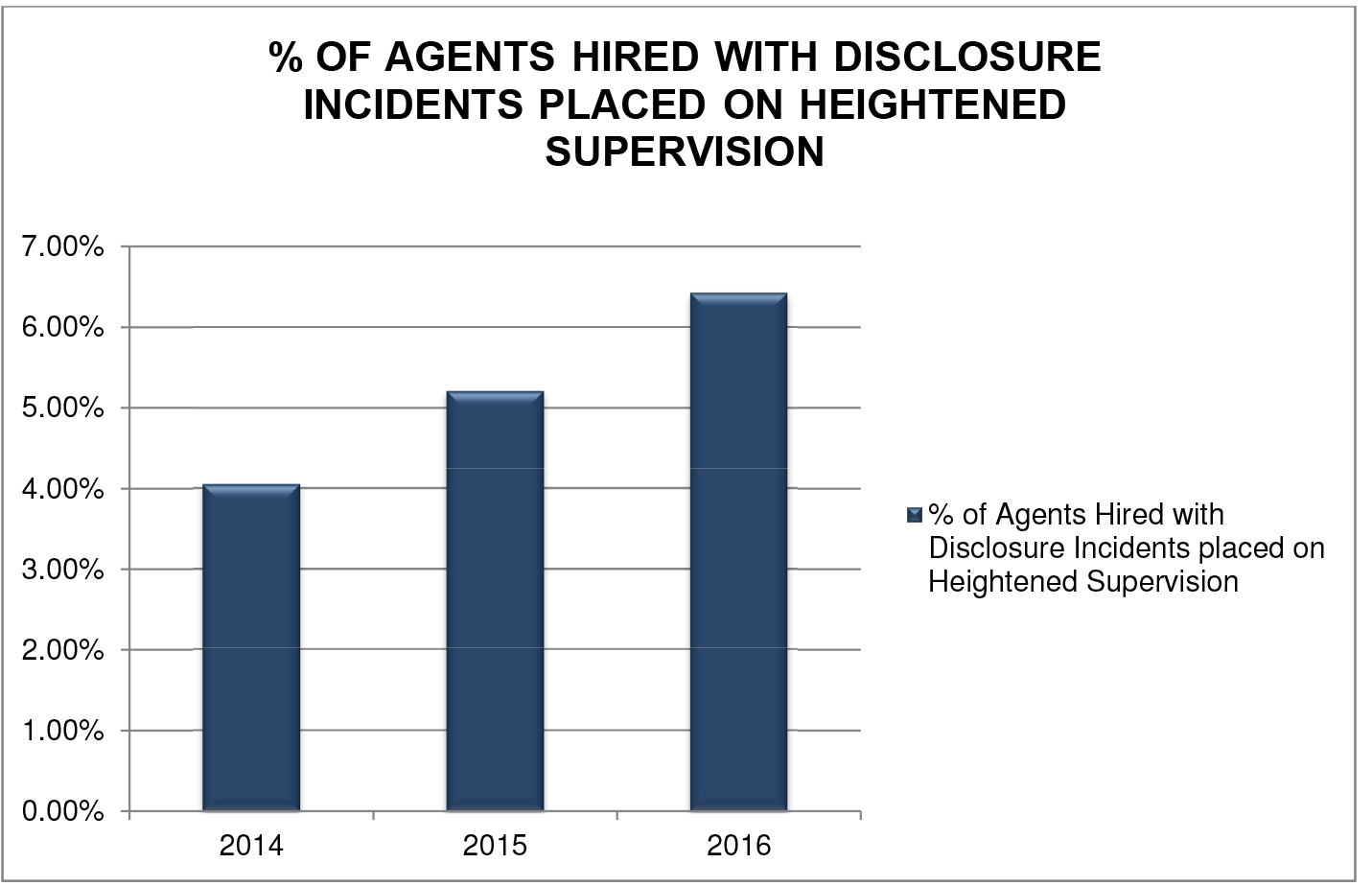

The results from the 74 broker-dealers who provided a year-by-year breakdown shows that:

- Of the 1,925 agents hired in 2014 with Disclosure Incidents, only 4.05% were placed on heightened supervision.

- Of the 2,169 agents hired in 2015 with Disclosure Incidents, only 5.21% were placed on heightened supervision.

- Of the 888 agents hired during the first six months of 2016 with Disclosure Incidents, only 6.42% were placed on heightened supervision.

see Figure 7

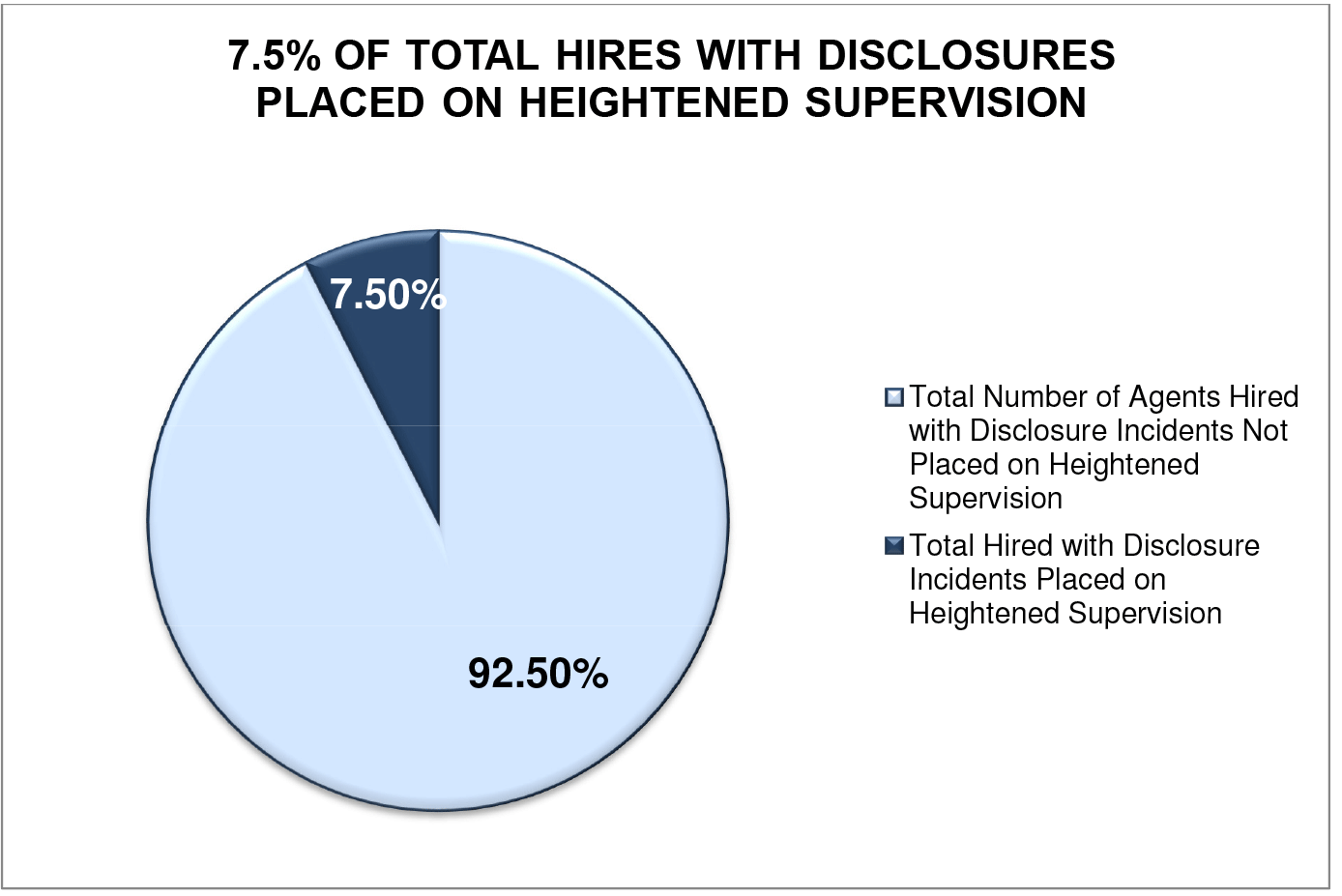

The data for the remaining 109 broker-dealers shows that of the 3,602 agents hired with Disclosure Incidents during the Relevant Time Period, only 7.5% of those agents were placed on heightened supervision, leaving 92.5% of agents with Disclosure Incidents not subject to heightened scrutiny. See Figure 8.

Conclusion

Heightened supervision requires a firm to monitor and mitigate the known risks that agents with Disclosure Incidents may pose to investors. Implicit in heightened supervision is the broker-dealer’s willingness to accept the responsibility to monitor and protect investors from harm from potential repeat offenders. While the year to year numbers provided by a subset of the broker-dealers that showed an increase of the number of agents placed on heightened supervision is encouraging, overall the report found a presumption that broker-dealers failed to take on the responsibility to place agents on heightened supervision when hiring agents with Disclosure Incidents.