Accessible Version of PDF: 401k-disclosure-of-changes.pdf

A Call for Congressional and Department of Labor Action

Office of the Secretary of the Commonwealth Massachusetts Securities Division June 12, 2014

Executive Summary

In the last several decades, employers have moved away from providing traditional defined benefit company pensions and profit sharing agreements. The defined contribution 401(k) plan is now one of the primary ways working families in the Commonwealth and throughout the country can save for retirement needs. In this harsher economic environment, it is crucial that employees and retirees be given the tools and information they need to understand and protect their retirement assets.In the current economy, a company 401(k) plan and the employer’s matching contributions (if provided) are important elements of both compensation and retirement planning. Most employees consider an employer’s 401(k) plan match when choosing and staying with a job.

A potentially growing trend with respect to 401(k) plans is employers changing their voluntary matching contributions from a paycheck-by-paycheck contribution to a yearend lump sum contribution.

However, some employers have changed over to making year-end lump sum contributions as a way to save money and hold onto cash as long as possible. Such delayed, year-end capital contributions create a real financial benefit for these employers due to the time value of money.

Such year-end lump sum contributions can create serious financial consequences for employees. The first detriment arises because the funds contributed by the employer to the 401(k) plan are put to work only at the end of the year, so those funds do not capture any stock market gains during that year. Second, this practice creates significant risks for employees: if an employee leaves employment (or is laid off), she may not receive any employer contribution to her 401(k) plan even though she has worked a partial year.

Even under very conservative financial assumptions, the impact of an employer delaying its 401(k) contributions until year-end is meaningful. One recent article states, in a given year, “[a]ssuming a 7% return on investments, the matching account would be about 3.3% less that [sic] it would have been if the matching contribution was made on a biweekly basis.”1

The impact on employees over time can be very significant with repeated year-end employer lump sum contributions and the impact of compounding. Based on conservative financial assumptions, a recent New York Times article estimates that a change from a paycheck-to-paycheck employer contribution to a year-end lump sum contribution would result in an employee having $47,661 less in his or her retirement account at the end of the employee's career.

1 Amy Fontinelle, An Unwelcome Twist to Employer 401(k) Matches, Jan. 26, 2013, http://www.interest.com/savings/advice/an-unwelcome-twist-to-employer-401k-matches/ (quoting retirement planning expert Rich Rausser).

About this Report

While federal regulations govern the basic administration and safeguarding of employerprovided retirement accounts, companies have the ability to freely alter their plans in ways that can expose employees to potentially greater financial risk and long-term consequences.This report examines whether there is a discernible trend in employers shifting their employees’ benefits by no longer paying periodic match contributions, but rather an annual lump sum. This paper also looks at the adequacy of the disclosures plan participants receive concerning the costs and potential risks associated with companies changing over to year-end 401(k) plan contributions. Finally, this report is a call to action for improved disclosure of changes to 401(k) plans.

Massachusetts Securities Division Survey of 401(k) Plan Disclosures

Earlier this year, AOL, Inc. shifted from a per-pay-period 401(k) 401(k) employer contribution to a year-end contribution; but in response to negative reaction from its employees the company reversed its decision. Although AOL changed its position to switch to a year-end 401(k) contribution policy following backlash from the public and its employees, other companies such as Deutsche Bank, and IBM have shifted their employees’ benefits by paying matches in an annual lump sum.Based on these developments and complaints from employees of companies that changed from making a periodic match payment to a year-end lump sum contribution to the company 401(k) plan, the Massachusetts Securities Division (MSD) conducted an inquiry to determine what, if any, disclosures are provided to employees concerning the potential risks associated with ending paycheck-by-paycheck matching contributions to 401(k) plans.

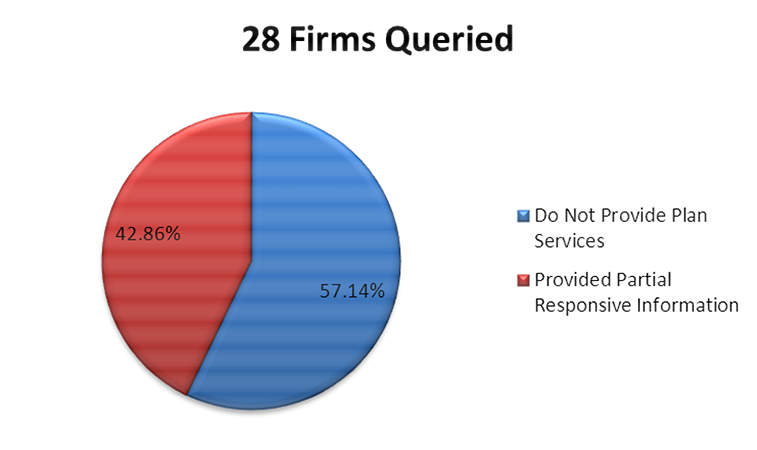

The MSD asked some of the largest 401(k) providers for information on the number of employers whose plans have shifted to year-end lump sum matches and the date of the change. For the purposes of its inquiry, the Division identified twenty-eight 401(k) service providers and requested information on the number of 401(k) plans for which those companies provided services and with respect to those plans, how many have switched from a periodic match employer contribution to a year-end contribution. In addition, the MSD sought to determine specifically what disclosure is required to be provided to plan participants concerning the impact of these changes and who is required to make such disclosures.

2 See Ron Lieber, Beware of the End-of-Year 401(k) Match, N.Y.TIMES, Feb. 14, 2014, http://www.nytimes.com/2014/02/15/your-money/beware-of-the-end-of-year-401-k-match.html.

Key Findings

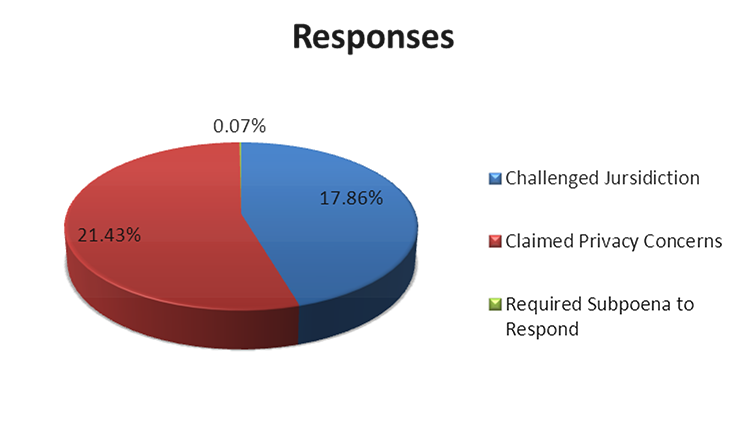

Twelve of the firms contacted did provide 401(k) recordkeeping or plan administration services. Sixteen responded that while they provided other services, they did not provide recordkeeping or plan administration services. In addition, many firms challenged the jurisdiction of the MSD in connection with requesting information regarding its services as a record keeper to retirement plans. Other firms indicated that providing information and records would violate the confidentiality terms of the various agreements between the firm and its plan fiduciary clients and noted privacy concerns. Two firms would not provide information absent a subpoena.As a result of the inquiry, the MSD found with those firms that voluntarily responded, each claimed that it was not the 401(k) record keeper’s obligation to know about the content and implementation of any amendments to a 401(k) plan. Moreover, none of the firms stated that they had any fiduciary duties to independently develop or issue disclosures to employees in the 401(k) plan regarding risks related to the employers’ annual match of employee contributions. Further, most of the firms were not involved in communications to participants regarding changes to plan features.

It became clear from the MSD’s survey that the only party who has a duty to disclose plan changes is the employer or plan sponsor. The Employee Retirement Income Security Act of 1974 (ERISA) requires that the employer provide participants with information about plan features and funding as part of its fiduciary obligations. Under the existing ERISA rules, employers are required to notify employees of any changes to the retirement plan, including match contributions. Overall, it became patently clear that current rules do not mandate that employees receive meaningful and timely disclosure of such changes.

Current disclosure obligations under ERISA only require the employer to inform the employee that a change occurred. Employees will receive a brief and non-explanatory notice that the timing of the employer’s contribution will be changing. There is no obligation to go beyond that. For example, when a company switches from paycheck-topaycheck to end-of-year match contributions, the employee is not informed as to how that change might detrimentally impact her overall retirement plans. Employees are not informed if they leave the company or are laid off before the end of the year, they may lose out completely on the matching contribution. Moreover, what disclosure that is given is more often than not drafted in impenetrable verbiage and virtually hidden within a legal document.

The disclosure provided to employees can be slow to arrive. Employers have up 210 days after the end of the plan year in which the change is made to make the disclosure. Giving this material information to employees months after the change has occurred renders the disclosure totally ineffectual. Most importantly, plan participants would benefit from more immediate and transparent disclosure of changes to 401(k) plans.

Conclusion and Recommendations

The survey revealed that plan participants need meaningful disclosure concerning the potential risks associated with material changes to disbursement of matching contributions. Moreover, this notification must be provided well in advance of the change in order for employees to make an informed decision concerning their retirement planning. These changes are necessary for the protection of employees. Congress, the Department of Labor (DOL), and other regulators must move on these changes expeditiously.401(k) Plans

For many American workers, employers no longer provide defined benefit plans and have shifted to defined contribution plans, such as 401(k) plans. The income that 401(k) plan accounts are expected to provide in retirement depends, in part, on the contributions that plan participants and employers make throughout the plan participant’s wage-earning years. Contributions by plan participants and employers to 401(k) accounts play a crucial role in how much income individuals can expect to receive at retirement and depend on a variety of factors, including the regulatory framework under which 401(k) plans operate, matching contributions, and the plan’s overall structure. These plans have enjoyed enormous appeal in part because they offer a combination of federal and state tax benefits and low costs.Employees may elect, as an alternative to receiving taxable cash in the form of compensation or a bonus, to contribute pre-tax dollars to a qualified tax-deferred retirement 401(k) plan. To encourage employee participation in the plan, many companies match employee contributions anywhere from 3% to 100% annually. All employee contributions and employer matching funds can be invested in several options, usually including stock mutual funds, bond mutual funds, money market funds and company stock. Employees select among various asset classes chosen by the employer or “plan sponsor” and determine how the assets are allocated among those classes. 401(k) plans have become increasingly popular in recent years; in many cases supplanting traditional defined benefit pension plans. Employees favor them because they cut their tax bills in the year of contribution and their savings grow tax deferred until retirement. Companies favor these plans because they are less expensive than traditional pension plans and also shift the responsibility of asset allocation to employees. While employers are free to structure the plan or make changes to meet their business judgment – the impact of those changes falls upon the plan participants.

The administration of 401(k) plans has been subject to criticism due to excessive fees and inadequate disclosure. 3 Recent instances of employers changing from making paycheckby- paycheck 401(k) match contributions to year-end lump sum contributions has highlighted the inadequacy of the disclosures many employees receive. While this issue affects workers of all ages, it will have a particular impact on senior employees who are close to retirement. The following discussion briefly sets forth some of the issues relating to 401(k) match contributions and proposes recommendations to improve the quality and timeliness of the disclosure that employees receive when their 401(k) plans have changed.

Plan Design

Employer-sponsored 401(k) plans allow employees to contribute a portion of their cash wages into individual accounts as a means of saving for retirement. Employers balance numerous considerations in determining when and whether to offer a plan, and in making plan design decisions for the plans they elect to sponsor. Employers are not required to offer 401(k) plans and employers that opt to offer such a plan are not obligated to provide employer matching contributions. Each employer that maintains a retirement plan must decide how to allocate its resources between a voluntary retirement program and competing financial demands of its business.If an employer chooses to offer its employees a retirement plan, that employer has the authority to design the terms of its 401(k) plan freely within the applicable federal regulatory framework. The plan’s terms are established by the employer or “plan sponsor” and are set forth in the plan documents. The plan sponsor is responsible for updating plan documents or providing certain disclosures to participants if and when an employer decides to amend or alter the plan terms.

The employers or plan sponsors of a 401(k) plan also often engage a third-party service provider to perform recordkeeping and plan administrative services. The plan record keeper is responsible for the general day-to-day plan operations and administration which may include, for example, maintaining plan records, processing participant requests, fielding phone calls and distributing notices, statements and reports at the direction of the plan sponsor. Directed record keepers do not independently develop or issue disclosures to 401(k) plan participants regarding the risks associated with an employer’s timing of match employee contributions.

Discretionary Matching Contribution

Since the advent of the 401(k) plan, federal regulations have given full discretion to the employer or plan sponsor regarding whether or not to offer company matching contributions and these regulations have provided significant flexibility on how to structure the funding and timing of such voluntary contributions. While some 401(k) plans are designed with a periodic matching contribution (e.g., paycheck-by-paycheck, monthly, or quarterly), others are designed with an annual matching contribution. An annual matching contribution may require a participant to be employed on the last day of the plan year to be eligible to receive such contribution. To the extent an employer elects to include a company match provision in the 401(k) plan terms, such provision is discretionary.The plan document controls the calculation and timing of employer matching contributions. Some plans specify that employers make contributions every pay period, while others have contributions once a year. Typically, many employers reserve the right to change the timing of funding the company match or may suspend offering the company match altogether in the initial plan documents provided to plan participants. Record keepers are not required to track changes by the plan sponsor for how the plan sponsor calculates a match contribution or when the employer makes a match contribution. The plan sponsor structures the plan and determines the timing and calculation of any matching contribution.

ERISA Landscape and Regulatory Framework

Federal law, including the Internal Revenue Code (IRC) and the Employee Retirement Income Security Act of 1974 (ERISA), 29 U.S.C. §§ 1001-1461 (2014), provides the regulatory framework which governs the design, allocation strategies and operational processes permitted in connection with 401(k) retirement plans. “ERISA is a comprehensive statute designed to promote the interests of employees and their beneficiaries in employee benefit plans.” Shaw v. Delta Air Lines, Inc., 463 U.S. 85, 90 (1983). This framework provides plan sponsors with significant latitude to create plans that suit their needs while at the same time containing a complex set of rules designed to protect plan participant’s interests. These federal laws broadly preempt state laws as to the regulation of such plans and include specific provisions regulating the availability, the level and timing of company contributions, the length and structure of vesting schedules, allocation of contributions among participants and disclosure to participants.Under this regulatory framework, employers are also free to alter the structure of their retirement plans – including the amount, calculation, structure and timing of match contributions. However, ERISA requires fiduciaries to discharge their duties “in accordance with the documents and instruments governing the plan,” 29 U.S.C. § 1104(a)(1)(D), and ERISA’s disclosure provisions require that plan sponsors disclose material changes to the plan through a summary of material modifications, which could include changes to plan provisions regarding the timing of matching contributions. 29 C.F.R. § 2520.104b-3 (2014).

Summary Plan Description

The Summary Plan Description (SPD) is the primary means of disclosing how a 401(k) retirement plan operates including the source of contributions for employees and the company as well as the formula for the contribution (match percentage). ERISA requires initial and periodic disclosure of a summary of the entire plan in the form of a SPD. The SPD follows the applicable federal regulations and is a summary of all the plan information contained in the more detailed plan document. The plan sponsor is responsible for outlining the contours of the retirement plan to employees, including, if applicable, the company’s match contribution terms. The SPD does not contain any language regarding any potential risk associated with the timing of the deposit of an employer match. In fact, a common disclosure example states:Contribution timing. Except as described in Section X, regarding Safe Harbor 401(k) Plan, the time period that the Employer elects for computing its Matching Contributions does not require that the Employer actually contribute the Matching Contribution at any particular time.

It is an industry practice to provide a similar blanket disclosure to plan participants in the initial SPD. Plans may utilize prototype plan documents made available to plan sponsors by the record keepers or more often develop their own revised SPD or Summary of Material Modifications (SMM) when plan features, such as match contributions, are modified. Record keepers are usually not involved in the communications to participants regarding the changes to plan features other than receiving copies of participant communications issued by plan sponsors.

From a plan participant perspective, there is no uniformity in disclosure of changes to employer match contributions. There are differences in the terminology, specificity, length and placement of these types of disclosures.

Summary of Material Modifications

If an employer decides to alter its provision of company 401(k) matching contributions, the plan sponsor will determine whether and how to communicate such changes to the plan participants. ERISA provides for the plan administrator with the fiduciary duty4 to furnish either an amended or revised SPD or SMM to describe a material change, but does not go beyond that to require disclosure of the potential risks associated with that changeThe SMM requirements include provisions on the timing of the disclosure, the method of distribution and the form of the information. First, an SMM must be filed with the DOL and furnished to each participant covered under the plan and each beneficiary receiving benefits under the plan no later than 210 days after the plan year in which a material modification is adopted. 29 C.F.R. § 2520.104b-3. Second, plan administrators, as fiduciaries, must distribute all ERISA disclosure materials (including SMMs, SPDs and updated SPDs) using “measures reasonably calculated to ensure actual receipt of the material by plan participants and beneficiaries” and “must be sent by a method of delivery likely to result in full distribution.” 29 C.F.R. § 2520.104b-1(b). Third, an SMM must be written in a manner calculated to be understood by the average plan participant. 29 C.F.R. § 2520.104b-3. The statute does not specify what information other than the material modifications should be included in the SMM.

Thus, there is no guidance requiring plan sponsors to make any other risk disclosure related to a change to year-end lump sum matching contributions to 401(k) plan participants. While plan sponsors may comply with the technical notice requirements governing a material change or modification of a 401(k) plan, this disclosure loses its effectiveness when hidden in small print or embedded in lengthy SPD plan documents or the SMM. In addition, this disclosure of information amounts to a mere notification of the change itself, without any meaningful disclosure about the potential risks or consequences associated with the change. Ultimately, employees would benefit from greater transparency and full disclosure of the risks associated with a change in the timing of company match contribution.

Employer Matching Contribution Frequency Findings

The MSD sought to determine if recent high profile companies, that have moved from 401(k) pay-period employer match contributions to year-end lump sum match contributions, are an indicia of a growing trend. For the purposes of its inquiry, the Division identified twenty-eight 401(k) service providers and requested information on the number of 401(k) plans for which certain companies provided services and for those plans, how many have switched from a periodic match employer contribution to a yearend contribution. Specifically, the MSD sought to determine what disclosure is required to be provided to plan participants concerning the impact of these changes and by whom.

The Division received responses from all firms that received the inquiry letter. Sixteen of the firms contacted did not provide 401(k) recordkeeping or plan administration services. Five firms challenged the jurisdiction of the MSD in connection with requesting information regarding its services as a record keeper to retirement plans. Six firms claimed that contractual agreements imposed limits on the ability to disclose confidential information identifiable to a particular client. Two firms would not provide information 10 absent a subpoena. Two did not have access to participant level and employer contribution information.

For those record keepers that provided certain 401(k) plan design information and frequency of employer matching contributions, all noted the plan sponsor is responsible for updating the plan document or providing disclosure to participants if and when an employer or plan sponsor amends or alters the plan terms. It is clear that the decision to make a match and on what terms is solely the discretionary decision of the employer or plan sponsor. The record keepers are not required to maintain aggregate data regarding specific timing of match contributions, whether the timing of a match contribution changed over time, or the content of disclosures provided by plan sponsors in connection with such a change.

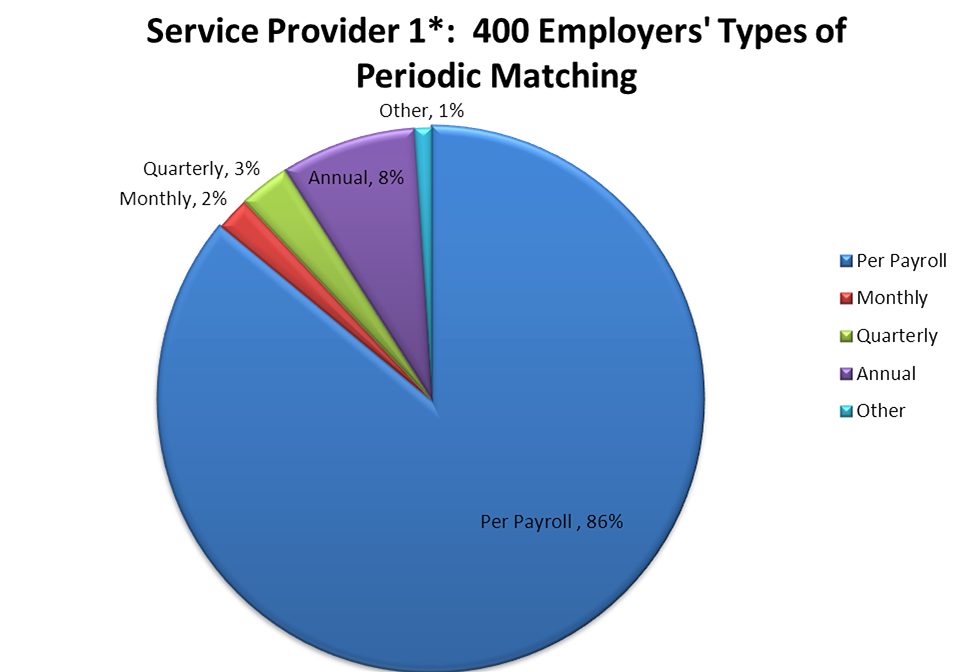

*Data provided by one benefits administration provider as a result of a 2013 survey related to retirement

plan offerings, design and investments.

In a 2013 survey of more than 400 employers, 8% of employers surveyed above provided an annual 401(k) match and 86% made a per-payroll period distribution. The remainder of employers contributed on either a quarterly, monthly or other time period basis.

Frequency of Matching/Changes to Frequency

Service Providers |

Employer Matching Data |

|---|---|

1* |

64.42% Employers Match; 9.2% match annually (no changes); 26% not tracked |

2** |

.2% changed from periodic, monthly, or quarterly to annual; .02% changed from annually to periodic |

3 |

approx. 6% match on annual basis; .00005% changed from periodic to annual |

4 |

.01% changed from periodic to annual |

5** |

.0037% have changed frequency of .06% periodic to annual matching; |

6 |

Data not available |

7 |

Does not track changes to matching frequency |

8 |

.92% changed from periodic to annual |

9 |

No changes from periodic to annual |

10 |

.3% reduced frequency of matching |

11 |

MData not available |

12 |

Data not available |

While the responses received provided limited data, what was established is that if there is a trend, it is moving from periodic match employer contributions to a year-end lump sum contribution. This may become more widespread as employers are attracted to the cost savings that such a change can provide.

Recommendations

As a result of the foregoing findings, prompt congressional and DOL action is necessary to ensure that material changes to 401(k) plans, specifically the timing of match contributions, are required to be disclosed in a full, understandable, standardized disclosure (beyond mere notification to plan participants). Meaningful disclosure, at a minimum, should be mandated before more companies move to year-end match contribution and specifically provided prior to that change occurring. As a part of this recommendation, the following are also suggested for plan changes:

- Prominently disclosed relative to other information about the plan

- Presented as a material change to the plan

- Clearly explained in plain, easily understood language

- Standardized, in both the language and the manner of disclosure

- Explanation of how the plan could impact the employee both negatively and positively

- Requirement to disclose potential risks associated with the change

- Total costs of the change for the plan participant

- Available in an easily accessible format on the plan administrator website

- Separate disclosure document

- Disclosure provided in substantial time before the change

The goal of any new statute or rule is that employees should receive clear and actionable disclosure regarding changes to their 401(k) plans. To accomplish this goal, Congress and the DOL should ensure that material change disclosure rules for 401(k) plans are strengthened and that the rules are energetically enforced.